In this article, I want to highlight the options available if a client wishes to take less risk and use our various cash options for this year’s ISA allowance, or for some of the money held in their existing ISA.

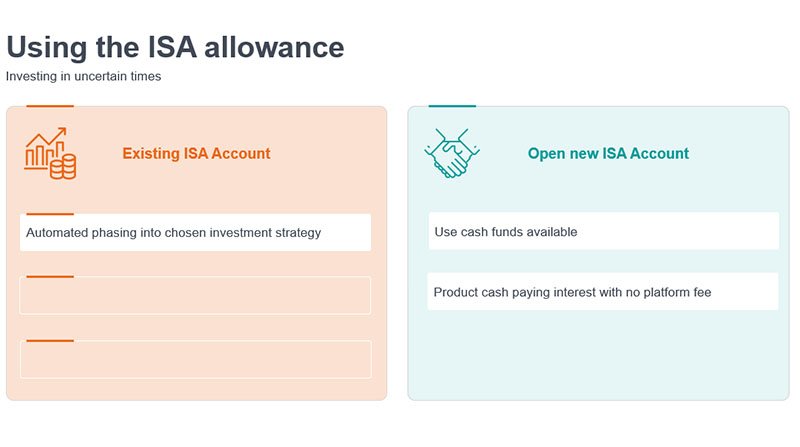

Firstly, for new contributions, you can choose to phase a lump sum into the client’s chosen investment strategy over any time period up to 99 months. The money held back in cash is totally ring-fenced from any transactions such as fee deductions or portfolio rebalances. If circumstances change at any time, you can cancel the phasing instruction and invest the balance.

Alternatively, if the client is looking to lower risk within their portfolio, you may wish to consider one of the many cash funds we have on the platform. Another option is to invest in the wrapper’s cash account. This pays interest and we don’t charge the client a platform fee on the money held in Product Cash, although we still count this when calculating your ongoing fee. The current interest rate can be found within the Cash options section of our website.

Depending on the client’s investment strategy – for example, you may be using model portfolios or outsourcing to a Discretionary Fund Manager – it may not be possible to hold cash funds or Product Cash alongside this arrangement. Therefore, you can simply open a new ISA account for the client, or multiple ISA accounts, in order to use a different investment strategy.

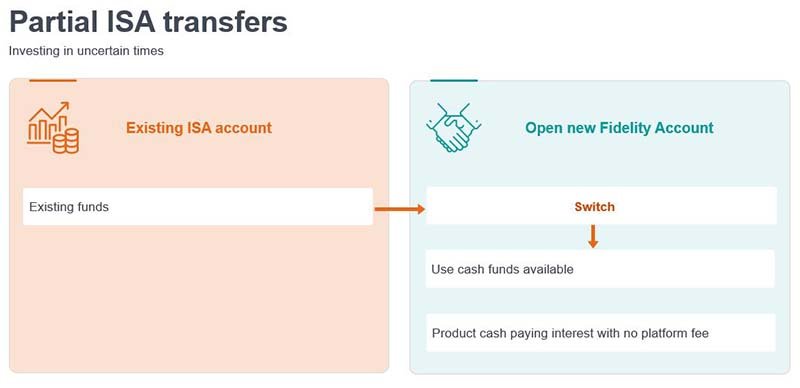

You can also split an ISA, which might be useful if a client wishes to adopt a different investment strategy, such as cash, for some of their existing assets. Moving money into a new ISA will allow you to switch into one or more of the cash funds available on the platform. This approach also ensures you retain your ongoing fee. The other benefit is that, unlike fixed term deposits, the money can easily be switched back into the core investment proposition at any time. Accounts can be merged again if necessary.

Finally, I would just like to mention that we have a dedicated web page on investing in uncertain times. Furthermore, our Cash option hub covers the various options open to your clients if they are considering cash investments for their ISA. In addition, you may find the other articles in this series helpful when administering client accounts – these touch upon practical tips for pension planning, practical capital gains management, tax-efficient fee funding and tax planning using a Bed & ISA.

Important information

The value of investments and the income from them can go down as well as up so your client may get back less than they invest. This article provides information and is only intended to provide an overview of the current law in this area and does not constitute financial advice, tax advice or legal advice, or provide any recommendations. The value of benefits depends on individual circumstances. The minimum age clients can normally access their pension savings is currently 55, and is due to rise to 57 on 6 April 2028, unless they have a lower protected pension age. Different options may have different effects for tax purposes, different implications for pension provision and different impacts on other assets and financial planning.

UKM0424/376671/SSO/0325

Online facility for stock transfers between Investment Accounts

In this article, I highlight our new online transfer facility and the many re…

Practical tips for pension planning

In this article, I’d like to highlight the information available that can ass…

Practical capital gains management

In this article, I’d like to highlight some of the reporting available that c…