To help get you to the right website, please choose one of the options below

Technical resources

Technical matters

Technical matters

Tax planning opportunities for 2025/26 Replacement of the lifetime allowance Retirement Income Pension Forum The Platform Clinic Pension, retirement and tax planning Pensions tax relief and annual allowances The beneficiaries flexi-access drawdown conundrum Retirement and pensions training Personal tax and trust planning training

More support

Paraplanner technical hub

Paraplanner technical hub

Technical hub Retirement income Regulation, due diligence and compliance Training support

In this section

Cash accounts including interest

Here you’ll find details on our cash facilities, including the current interest rates. These consist of a central Cash Management Account (CMA) and Cash Accounts for each product (ISA, Pension and Investment Account).

Interest rates

The current interest rates we pay on cash held in our accounts are:

| Account | Gross rate of annual interest | Annual Equivalent Rate (AER) |

|---|---|---|

| ISA (including Junior ISA) | 2.65% | 2.68% |

| Investment Account | 2.65% | 2.68% |

| Cash Management Account | 2.65% | 2.68% |

| SIPP (Including Junior SIPP) | 2.75% | 2.78% |

More information on interest payments:

- Interest rates can be changed at any time. The rates above are effective from 1st July 2025.

- Interest payments will be made monthly in arrears on or around the 21st of each month and there will be no lower limit on interest paid

- The interest paid each month is based on the account’s cash balance each day of the previous calendar month

- Where HMRC requires, the interest will be paid net of basic rate tax. This would be in the case of interest paid into our Investment Accounts and Cash Management Account. Interest in ISAs and Pensions is paid gross.

- We will initially pay interest to the account on which the interest was accrued, but as part of our treatment of income options, for ISAs and Investment Accounts, you can choose to then have this interest payment moved to the Cash Management Account

- We do not charge a service fee for holding cash, but we do retain some interest which reduces our net rate.

| Effective Date | ISA (incl. JISA) | Investment Account | Cash Management Account | SIPP (incl. JSIPP) |

|---|---|---|---|---|

|

01/07/25 - present |

2.65% |

2.65% |

2.65% |

2.75% |

|

01/06/25 - 30/06/25 |

2.65% | 2.65% | 2.65% | 2.70% |

| 01/05/25 - 31/05/25 | 2.95% | 2.95% | 2.95% | 3.00% |

| 01/03/25 - 30/04/25 | 2.95% | 2.95% | 2.95% | 3.05% |

| 01/01/25 - 28/02/25 | 3.15% | 3.15% | 3.15% | 3.25% |

| 01/12/24 - 31/12/24 | 3.10% | 3.10% | 3.10% | 3.20% |

| 01/09/24 - 30/11/24 | 3.35% | 3.35% | 3.35% | 3.50% |

| 01/04/24 - 31/08/24 | 3.60% | 3.60% | 3.60% | 3.70% |

| 01/01/24 - 31/03/24 | 3.45% | 3.45% | 3.45% | 3.65% |

| 01/10/23 - 31/12/23 | 3.35% | 3.35% | 3.35% | 3.55% |

| 01/09/23 - 30/09/23 | 3.00% | 3.00% | 3.00% | 3.50% |

| 01/07/23 - 31/08/23 | 2.75% | 2.75% | 2.75% | 3.25% |

| 01/06/23 - 30/06/23 | 2.35% | 2.35% | 2.35% | 2.80% |

| 01/05/23 - 31/05/23 | 2.10% | 2.10% | 2.10% | 2.55% |

| 01/04/23 - 30/04/23 | 2.05% | 2.05% | 2.05% | 2.50% |

| 01/03/23 - 31/03/23 | 1.60% | 1.60% | 1.60% | 2.10% |

| 01/02/23 - 28/02/23 | 1.50% | 1.50% | 1.50% | 1.90% |

| 01/01/23 - 31/01/23 | 1.45% | 1.45% | 1.45% | 1.85% |

| 01/12/22 - 31/12/22 | 1.10% | 1.10% | 1.10% | 1.40% |

| 01/10/22 - 30/11/22 | 0.70% | 0.70% | 0.70% | 0.95% |

| 01/09/22 - 30/09/22 | 0.45% | 0.45% | 0.45% | 0.60% |

| 01/07/22 - 31/08/22 | 0.05% | 0.05% | 0.05% | 0.25% |

Cash Management Account

The Cash Management Account (CMA) allows your clients to hold cash outside of product wrappers and offers the following features:

- Fees and withdrawals can be facilitated for ISAs and Investment Accounts

- Natural income from account assets can be consolidated into the CMA which can then be withdrawn

- Cash can be moved between the CMA and an ISA or Investment Account

- Clients can deposit directly into the CMA themselves.

Clients are provided with a Cash Management Account if they have at least one ISA or Investment Account held solely in their name (the CMA is not available for joint holders).

Product Cash

Cash can also be held within an ISA, Pension and Investment Account as part of the product structure. This is known as Product Cash and is held alongside other assets within the wrapper. Product Cash can be used to fund investments or as a temporary home at times of market volatility when a client wants to sell out of funds or other investments.

Each pension account, including drawdown, has its own cash account and it is used to make all transactions related to the pension.

Frequently asked questions – cash accounts

No, a minimum holding is not required.

We don’t charge a service fee for holding cash. However, we reserve the right to retain an amount of the interest received from the bank(s) we deposit the money with to cover the cost of providing the service.

Interest is not paid on cash that's unsettled from a sale. Reserved or ring-fenced cash still accrues interest.

Unfortunately, this is not possible.

Client cash in the Fidelity Pension is held by the trustee in deposit accounts that are separate from cash held in other product types, such as the ISA and Investment Account.

On average, client cash balances in the Fidelity Pension are higher and held for longer periods of time which allows us to deposit a slightly higher proportion of that cash in notice accounts that pay a higher rate of interest. We pass the benefit of this through to customers as a higher rate of interest on their cash balances.

Yes, but the interest is paid to Product Cash within the product wrapper.

Where an account is closed, Fidelity reserves the right to stop paying interest on this account from the date of closure.

We do not pay interest on cash for accounts not yet moved to our main administration system held within these product types, as the cash is held in a deposit account which currently does not pay interest.

Once the account moves to our main administration system, interest will be paid on cash held. Interest will be paid into the account generating the interest. The rate applied will be for Investment Accounts. Interest is paid gross where the holder is a charity, a pension trustee, or an offshore bond provider, and is otherwise paid net of the basic rate of income tax.

Fidelity has multiple levels of protection for your clients' money in the event that something goes wrong. Fidelity is authorised and regulated by the Financial Conduct Authority, which means we always hold a significant amount of liquid capital. And because we are an investment firm, not a bank, we are required to separate client money from our own. In the unlikely event that we become insolvent, your clients’ money would be ring-fenced from any corporate money, and any shortfall may be covered by the FSCS.

FSCS protection

The Financial Services Compensation Scheme is an independent body set up by the Government under the Financial Services and Markets Act 2000 and funded by the financial services industry. As the ‘fund of last resort’ for customers of failed authorised financial services firms, it can pay your client compensation if a firm becomes insolvent or is in default and cannot meet any valid claims against it.

The FSCS will provide compensation of up to £85k when a financial services company fails, and your clients have lost money as a result.

Please visit the FSCS website for more detailed information on how the Scheme operates.

Any cash held is spread across several banks for your clients' security. The latest figures showing how the money is allocated between the banks we use are given below. Please note that this allocation is regularly reviewed.

ISA, Investment Accounts and Cash Management Accounts

| Bank | Percentage allocated to that bank* |

|---|---|

| Barclays Bank Plc | 30% |

| HSBC Bank Plc | 28% |

| Royal Bank of Scotland Plc | 4% |

| Lloyds Bank Plc | 8% |

| Bank of America N.A. | 13% |

| NatWest | 4% |

| JPMorgan Chase Bank N.A | 13% |

* Effective from June 2025

Our Pension

| Bank | Percentage allocated to that bank* |

|---|---|

| Barclays Bank Plc | 28% |

| HSBC Bank Plc | 32% |

| Royal Bank of Scotland Plc | 4% |

| Lloyds Bank Plc | 8% |

| Bank of America N.A. | 11% |

| JPMorgan Chase Bank N.A. | 13% |

| NatWest | 4% |

* Effective from June 2025

This split is reviewed and adjusted over time depending on market activity.

FSCS protection is per eligible claimant per failed institution. Whilst Fidelity would suspend trading in any collapsed funds, for more information on FSCS protection at a fund level please contact the FSCS directly.

In the event that a bank fails, your monetary holdings with Fidelity will be reduced in proportion to the client money held by Fidelity with that bank.

When your clients invest through a distributor like Fidelity, any cash held on their behalf is placed with a range of different banks in designated client bank accounts. As the cash is kept completely separate from Fidelity’s own money, in the unlikely event that we became insolvent it would be returned to your client in an orderly manner.

When you invest in funds, they are held by Fidelity using a nominee structure. This allows us to administer your investments efficiently, while ensuring that your clients are clearly identified as their owner. This means that in the unlikely event of Fidelity becoming insolvent, any money we owe will not be paid out with your clients’ funds.

- Non-UK domiciled funds are not covered by the Financial Services Compensation Scheme (FSCS).

- Details of compensation schemes available to investors for non-UK domiciled funds may be found in the fund’s KID, prospectus or other supporting documents provided by the fund provider.'

You can add a lump sum payment to a client’s Cash Management Account (CMA) on their behalf. Payments can be made by debit card, cheque or bank transfer. Money can also be added to a specified account (Product Cash) as part of a lump sum investment, funded either by a bank transfer or cheque (and by debit card for ISAs and Investments Accounts). Clients can also add cash to their CMA, or to Product Cash within any of their accounts, through our enhanced end investor website.

When paying money into Product Cash, advisers should simply select the relevant ISA, Pension or Investment Account and then select cash from the investment table.

Yes, as well as cheque and debit card, you can now select ‘Bank transfer’ so that your clients can move money from their bank accounts directly to their Cash Management Account. Below we demonstrate this easy four-step process.

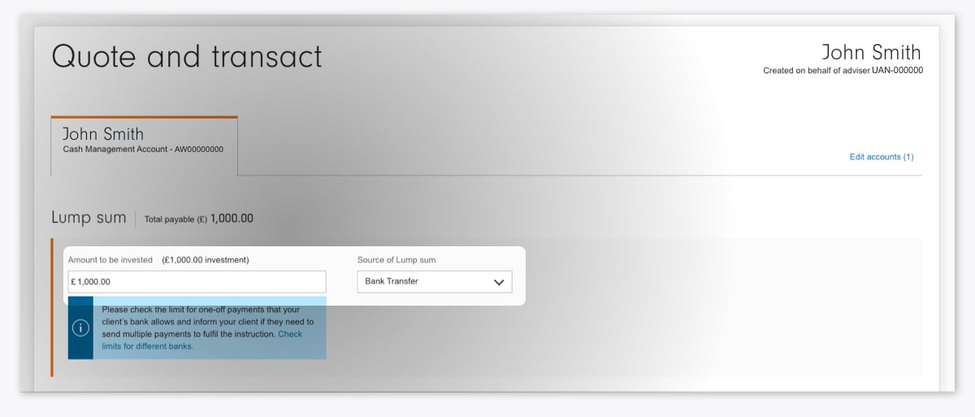

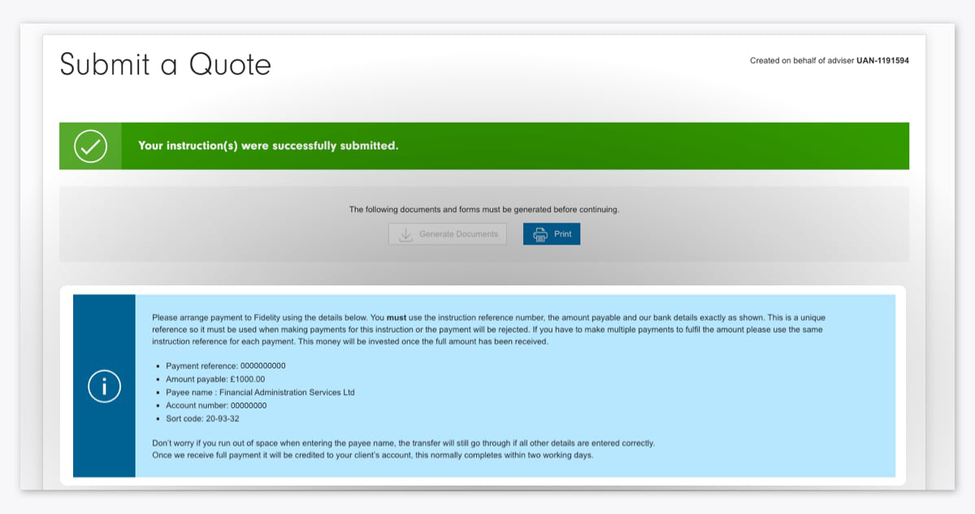

Step 1

Select ‘Bank Transfer’ from the ‘Source of Lump Sum’ drop down, once you have entered the lump sum amount.

Step 2

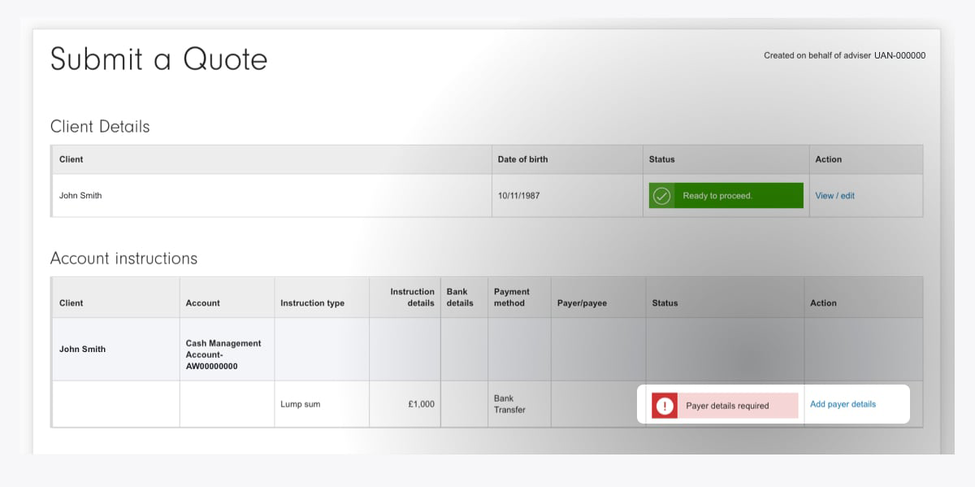

Select ‘Add payer details’ on the ‘Submit a Quote’ page.

Step 3

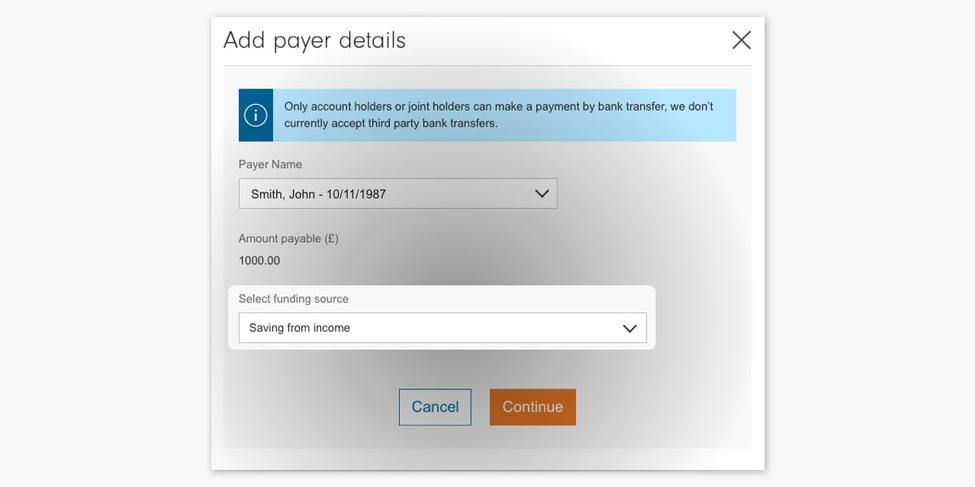

Choose the ‘Select funding source’ and the relevant source.

Step 4

The following screen provides our bank details and references for your client to use when sending us the lump sum amount. You can download these details to send on to your client.

ISA and Investment Accounts

Income can be paid to a client’s bank account or be reinvested back into the investment. All income payments out to a client bank account will be consolidated into a single payment per period. We offer a range of frequency and date options.

Income can also be paid to cash within the account (Product Cash) or into the Cash Management Account. Advisers may wish to do this, for example, to cover future fee payments or fund future investments.

Pension Savings Accounts & Pension Drawdown Accounts

Income can be managed under the ‘Manage income treatment’ section and can either be reinvested or paid to Cash within the account (Product Cash).

ISA and Investment Accounts

Money realised through a redemption can be paid to a client’s bank account, Cash Management Account or Product Cash (cash within the account).

The money can also be paid to cash within the account (Product Cash) or transferred into the Cash Management Account. Advisers may wish to do this, for example, to cover future fee payments or fund future investments.

Pension Savings Accounts & Pension Drawdown Accounts

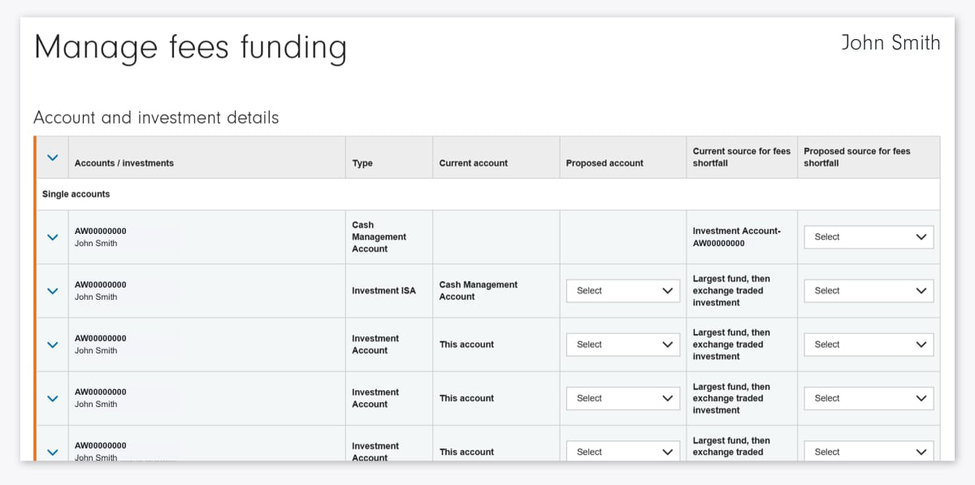

For ISAs and Investment Accounts, the default is for the fee to come from Product Cash but you are able to specify that the adviser ongoing fee (AOF) and the DFM ongoing fee (if applicable) should be taken from the client’s Cash Management Account (CMA). If a client holds both an ISA and Investment Account, then it is possible for the ISA AOF to be paid from the Investment Account via the ‘Manage fees funding’ page. Here, you can set fees to come from the CMA and then set the Investment Account as the shortfall account should there be insufficient cash available in the CMA at the time the fee is due.

Within all accounts (ISA, Investment Accounts and Pension), you can nominate a fund from where the fee should come from. The system will look at Product Cash first to take the fee. If there is insufficient money in the Product Cash account, it will take the fee from the nominated fund. If no nomination is made, the system will default to the largest mutual fund followed by the largest Exchange Traded Product (ETP).

Our Service Fee, charged at 0.25% on the value of a client’s investments, is taken from the cash within each account (Product Cash) by default. Any shortfall can be made up by redeeming units from either a nominated fund or the largest fund held within the client’s account. For ISA and Investment Accounts, you can ask us to pay the fee from the client’s Cash Management Account.

Our Investor Fee, charged at £45 per annum and collected monthly in instalments, will normally be taken from the Cash Management Account (CMA). If there is not enough cash in the Cash Management Account to pay a fee, then you can choose which account we should seek to take the fees from.