In this article, I’d like to highlight some of the reporting available that can help you manage capital gains on behalf of your clients. These reports are split into two key areas:

1) Reporting across your business

These are bulk reports containing high-level information for all clients with an Investment Account that are linked to your firm. You can access a bulk realised gains report, which shows figures for the current and previous tax years, and a bulk unrealised gains report. This is a good starting point for any capital gains planning exercise.

2) Account-level reports that provide far more detail

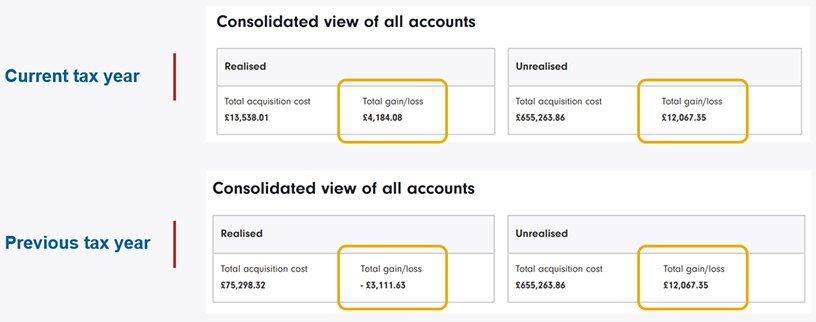

We also offer three account-level reports and, in this article, I’m going to focus on these. Firstly, there is a realised gains report that shows data for the current and previous five tax years. Secondly, there’s an unrealised gains report and finally a consolidated report which combines both these aspects. Importantly for account-level reports, you are able to add in acquisition cost data (as I show below). The consolidated report is a good starting point as it enables you to view the overall position for an account for the current tax year. It provides the realised gain or loss, alongside the unrealised gain or loss on the account. You can also run this report for the previous five tax years. This can help identify losses that can be reported to HMRC and carried over. The unrealised figure will be the same for the current year as it is for previous tax years.

Where the client has multiple Investment Accounts, the report gives an overall position and a breakdown per account as shown below.

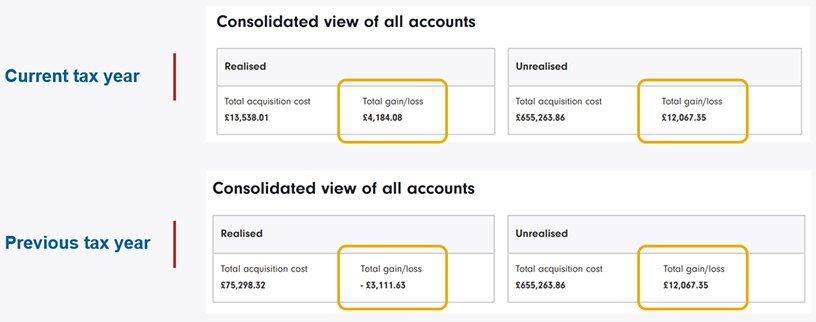

The unrealised gain or loss on the account might look minimal. However, the report breaks the data down at fund level. Depending on the client’s circumstances, this enables you to target individual funds with gains as appropriate, or funds with losses, or a combination of both.

Targeting unrealised gains or losses

This might be useful when the client needs to sell funds to top up their Cash Management Account, when targeting funds for fee nominations or submitting a Bed & ISA instruction. I cover all these scenarios in separate articles in this series:

Tax planning using a Bed & ISA

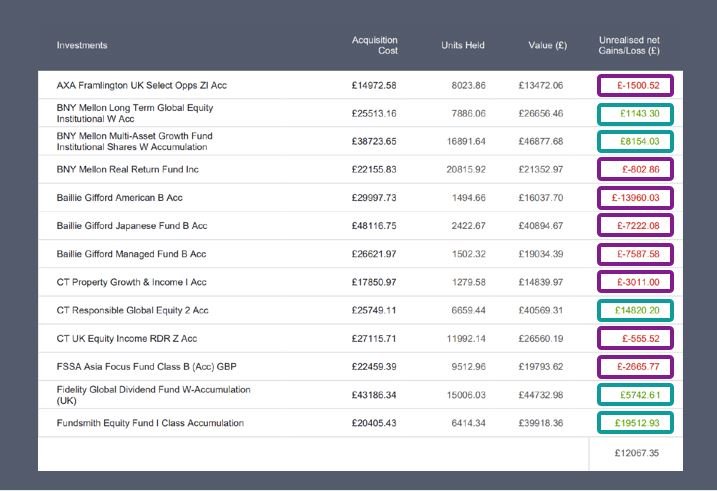

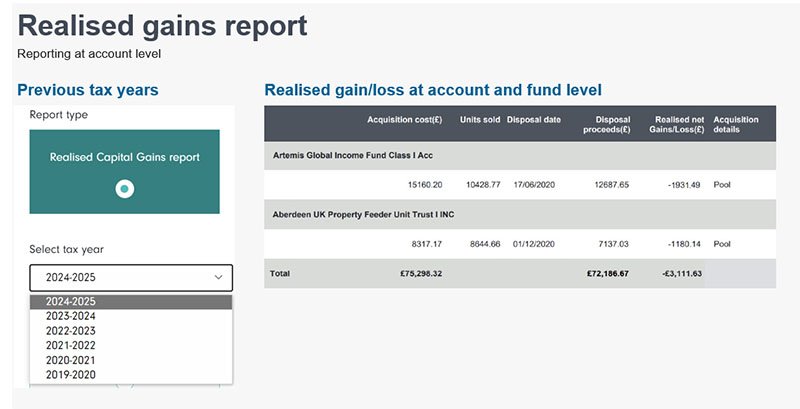

If you need to report capital losses, this information is also available through the realised gains report. As I mentioned earlier, you can run this report for the current and any of the last five tax years. This will show the realised gain or loss at account and fund level as shown below.

Adding acquisition cost data

In order to provide capital gains information, acquisition cost data must be present and there are a couple of instances where you need to add these figures in:

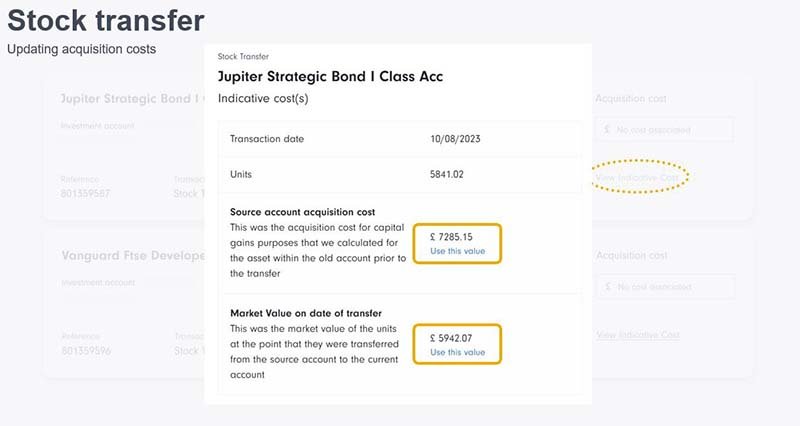

The first is when you’ve completed a stock transfer on the platform. Whilst we have the data, we won’t know the relationship of the transfer and the impact on the calculation of capital gains. This may seem obvious for transfers between spouses or civil partners, but we don’t make that assumption. What we do is provide the data and allow you to make that decision.

Where a stock transfer has occurred, we show the date of the transaction, the funds involved, and the number of units moved. You can enter a figure manually or click ‘View Indicative Cost’. This reveals the ‘Source account acquisition cost’ or the ‘Market value on the date of transfer’. You simply select the appropriate value, and we’ll use this figure for future calculations.

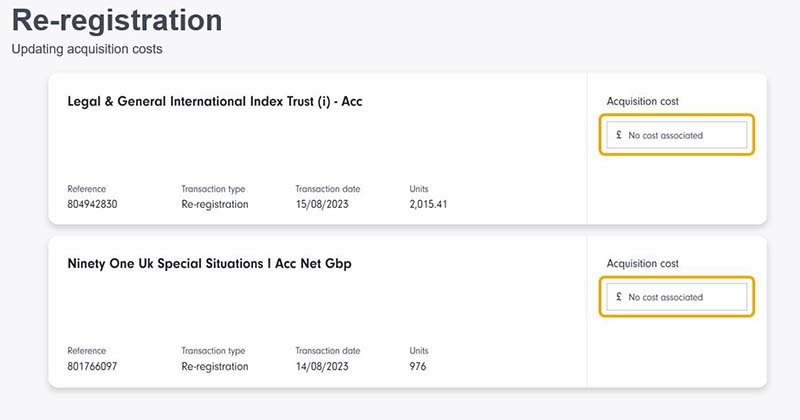

The other scenario is where a client has re-registered Investment Account assets to Fidelity. We are not supplied acquisition cost data as part of the transfer. Therefore, in order to provide you with capital gains reporting, you’ll need to enter this information for each fund, as shown below.

Therefore, if you are planning any consolidation, I would recommend downloading the adjusted acquisition cost data from the ceding provider immediately prior to submitting the re-registration instruction.

If you want to know more about our capital gains reporting facility, I suggest downloading our user guide. We also provide a helpful factsheet that takes you through how to update acquisition costs. In addition, you may find the other articles in this series helpful when administering client accounts – these touch upon practical tips for pension planning, tax-efficient fee funding, tax planning using a Bed & ISA and using the ISA allowance in uncertain times.

Online facility for stock transfers between Investment Accounts

In this article, I highlight our new online transfer facility and the many re…

Practical tips for pension planning

In this article, I’d like to highlight the information available that can ass…

Tax planning using Bed & ISA

In this article, I’m going to talk through the flexible options you have when…

Important information

The value of investments and the income from them can go down as well as up so your client may get back less than they invest. This article provides information and is only intended to provide an overview of the current law in this area and does not constitute financial advice, tax advice or legal advice, or provide any recommendations. The value of benefits depends on individual circumstances. The minimum age clients can normally access their pension savings is currently 55, and is due to rise to 57 on 6 April 2028, unless they have a lower protected pension age. Different options may have different effects for tax purposes, different implications for pension provision and different impacts on other assets and financial planning.

UKM0424/386671/SSO/0425