To help get you to the right website, please choose one of the options below

Products & investments

Products

Products

Pension Flexible Investment and Retirement Solutions Standard Life Smoothed Return Pension Fund Standard Life Guaranteed Lifetime Income plan Taking retirement income ISA Investment Accounts Pension Trustee, Company and Trust accounts Cash The Canada Life International Bond Utmost Wealth Solutions − offshore bond products

Investments

Technical resources

Technical matters

Technical matters

Tax year end planning tools and resources Replacement of the lifetime allowance Retirement Income Pension Forum The Platform Clinic Pension, retirement and tax planning The beneficiaries flexi-access drawdown conundrum Retirement and pensions training Personal tax and trust planning training

More support

Paraplanner technical hub

Paraplanner technical hub

Technical hub Retirement income Regulation, due diligence and compliance Training support

In this section

Cash reporting

Whilst we don’t mandate a cash holding on the platform, we recognise that you may want to monitor cash balances for various reasons. We have a number of reports under Reporting Services which can help identify cash balances either in cash investments or in cash funds.

To find out more about Reporting Services, download the guide for more information.

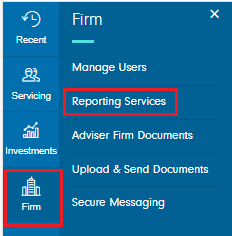

To access Reporting Services, simply log in and select ‘Firm’ > ‘Reporting Services’.

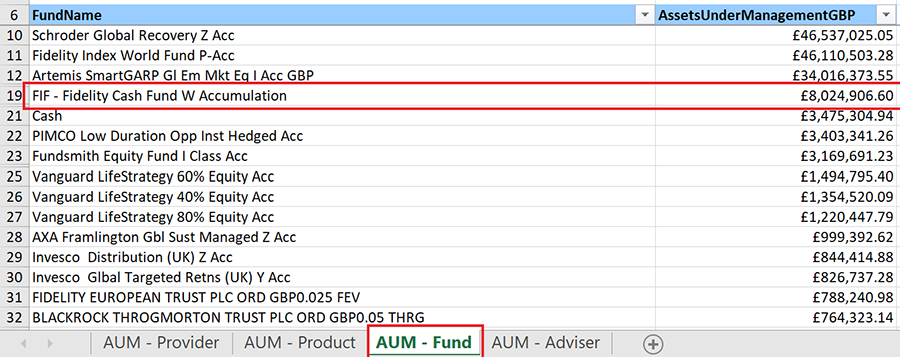

Assets Under Management report

This report gives a snapshot of Assets Under Management, broken down by product, fund provider, fund and agency. You can therefore, easily identify the amount of assets held in a particular cash investment at agency/firm level.

Holdings report

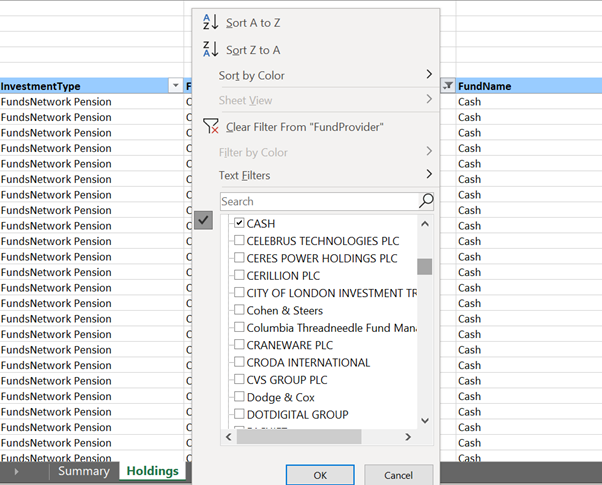

This report details all client holdings by fund and will include the number of units or shares held and the latest fund values. Here you can filter out a particular cash investment and see all clients that have assets in the particular fund.

Cash report

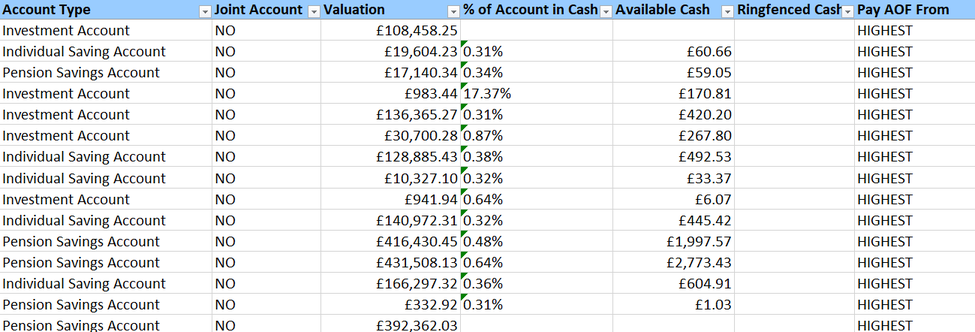

This report shows cash held in the Cash Management Account and cash held within an account (i.e. Product Cash Accounts) in addition to details on regular transactions set up, such as income, fees, and withdrawals. You will easily be able to see what cash account balances are held across your client bank.