Re-registration and transfers

If you are considering transferring assets to Fidelity Adviser Solutions, we are here to support you all the way. We’ll help you manage the whole process from start to finish.

Moving clients to a new platform has historically been perceived as a time-consuming, labour-intensive task. So, we’ve completely reviewed our re-registration and transfer proposition to help make the process as simple and efficient as possible. Here you’ll find all the support you’ll need prior to, during and upon completion of any applications on behalf of your clients.

Benefits of working with us

Process

- A fully compliant process supporting the requirements of the FCA’s Platform Market Study

- We only ask for client signatures if the existing provider requires a letter of authority

- We provide automated electronic transfers between fund managers and other platforms, allowing for a smoother process

- Our re-registration and transfer process is fully online.

People

- Support from our experienced and skilled transfer specialists

- Consultative engagement to help design and implement your bespoke transfer plan

- Continuous point of contact throughout your transfer project.

Tools

- Online illustrations are available, if required

- You can enter the acquisition costs once assets are re-registered to an Investment Account in order to receive capital gains reporting

- Re-registration and transfer tracking tool provided as an integral part of your clients' accounts.

Technology

- We support you by determining whether the fund/share class held by your clients are available on the platform and available for re-registration

- A bulk re-registration/transfer service, should you wish to move a book of business altogether.

Please email us if you would like to discuss new business opportunities or anything related to re-registrations or transfers.

There are two ways to move client assets from one platform to another. You can either move the assets in-specie (re-registration) or through a cash transfer.

- Re-registration allows your clients to remain invested, depending on the availability of the assets on the new platform. This option usually takes longer than cash transfers due to the complexity of the process.

- Cash transfers on the other hand usually take less time but expose the client to market fluctuations as they will be out of the market for a period of time until the cash is reinvested at the new platform.

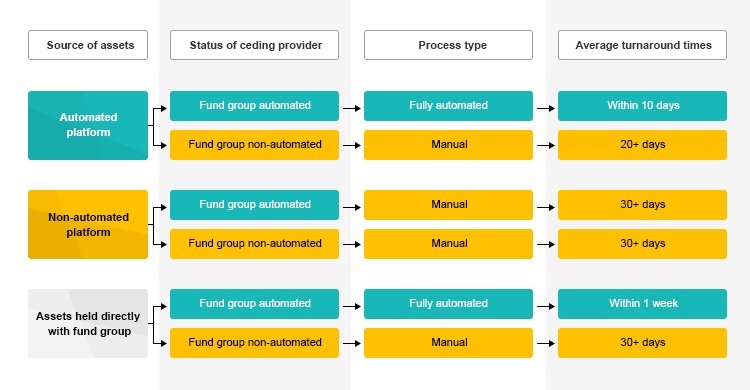

The transfer and re-registration process is summarised in this diagram, although you can also find out more from the sections below.

You can also find out more in our

guide to moving client assets.

Skip to section

How the re-registration process works

The re-registration process has multiple stages:

- The adviser submits the application and, if a provider is not electronically enabled, a letter of authority

- We review the application and issue a valuation request to the ceding (current) platform

- The ceding platform attempts to locate the client based on our information

- If the client is matched, a valuation is issued to us

- If the client is not matched, a rejection is issued to us

- We review the valuation and determine if re-registration is possible for each asset

- If the asset is available on our platform, then the re-registration application can proceed

- If the asset is not available on our platform but an alternative share class of the same fund is available, a conversion is requested

- If the asset is not available on our platform and there is no alternative share class available:

- Investment Accounts – the asset is excluded but the rest of the assets will be re-registered

- ISA – a request is made to sell down the asset and to send the cash to us

- We issue a transfer instruction (known as an acceptance) including specific asset instructions

- The ceding platform reviews the transfer instruction

- If all instructions are valid, they instruct the fund providers to execute stock transfers (and conversions or liquidations where required)

- If any asset instruction isn’t valid, or there are any client restrictions discovered (AML, etc.), a rejection is issued to us

- The fund provider executes a stock transfer, conversion or liquidation and sends a Confirmation of Transaction (COT) to us and the ceding platform

- We receive the COT and apply the units to the client’s account. If a cleaner version of the fund available, we will automatically send a conversion instruction to the fund provider to convert to the preferential share class

- Once all the assets are received, the ceding platform will issue any cash on the account to us. We will locate the payment (either cheque or BACs) and place the cash into the client’s account.

How the cash transfer process works

Cash transfers are simpler than re-registrations:

- The adviser submits the application and, if a provider is not electronically enabled, a letter of authority

- The ceding platform attempts to locate the client based on our information

- If the client is matched, a valuation is issued to us

- If the client is not matched, a rejection is issued to us

- We issue a cash transfer instruction

- The ceding platform reviews the transfer instruction

- If client data is matched and all required paperwork received, the ceding platform sells down all assets

- If any data is not matched or there are client restrictions (AML) or any paperwork outstanding, a rejection is issued to us

- The ceding platform issues any cash on the account to us. We will locate the payment (either cheque or BACs) and place the cash onto the client’s account.

Points for consideration before moving assets

- Fund eligibility – check the client’s funds (and share classes) are able to be moved. Eligibility can be ascertained in the re-registration quote. The system will inform you whether the fund can be re-registered and whether it will be subject to a conversion or not. If the fund is eligible but we hold a different share class, we’ll show that fund can be moved but we’ll then convert it into the alternative share class.

- ISAs – if we don’t have access to a fund the client holds, we’ll request that this holding is sold and sent across as cash. This means the transfer will always be fully completed. Any fund sold down and sent as cash will be placed into Product Cash.

- Investment Accounts – if we don’t offer the fund, we’ll leave this with the existing provider and only move the assets we can accept (including any holding in cash). If you wish to bring across all assets, any assets that we don’t offer will need to be converted into an alternative fund that we do offer or be moved into cash. However, you would need to consider any CGT implications of moving these assets.

- If a fund being moved is still in a bundled share class, we’ll automatically convert this fund into the equivalent clean share class.

- Check whether the old plan manager charges exit or other service fees that might need to be taken before the client moves assets to us. The payment of any fees often delays the completion of an application.

Guides

Frequently asked questions

Even small differences can cause delays. If any of the details differ, the application is likely to be rejected. For example, if the client has married and they still have their account in their maiden name with the other provider, this will need to be updated before the application can proceed.

- For an ISA, ensure the correct plan year is requested – current, previous or both.

- Check that client details match with us and the ceding provider. The automated validation between us and the other party uses the following information:

- Client first name and surname

- Date of birth

- National insurance number

- Post code

- Account number

- Product

- Other platforms have different account number formats – have you quoted the correct one? Example account numbers can be found here.

Company Format of reference number Example Major Fund Groups (DST - formally IFDS) 10 numerical digits which may have preceding zeros 0123456789 AXA Elevate EL followed by seven numerical digits EL1234567 Standard Life Wrap / Fund Zone SP or WP followed by seven numerical digits SP1234567 Invesco Perpetual 10-digit number starting with 000 0001234567 Cofunds (Aegon) Retail Aegon wrapper ID which is eight digits, starting with an 8 80583890 Old Mutual Wealth (Skandia) Nine-digit number starting with a 1. Older cases will be eight digits 100123456 Hargreaves Lansdown Nominees Ltd Seven-digit number starting with a 1 or 2. Older cases start with a 1 2012345 Legal & General Six-digit number. Cash ISAs are eight digits 85440719 Aegon Investor Portfolio Service Eight-digit number starting with a 5 56789101 Virgin VIR followed by an eight-digit number VIR12345678 Virgin Money Reference numbers vary in length and may contain numbers and letters 54321X-01234 -

When using our online service, please ensure you select the correct ceding company as many companies have different named entities. If you are unsure, it is best to look at previous documentation or contact the ceding company for clarification.

-

Check details are up to date and the client is verified for anti-money laundering (AML) purposes – many providers will reject requests if the client isn’t verified. Please ensure the client satisfies the other scheme’s requirements before submitting your request.

-

Letters of authority (LOA) will only be needed for providers who are non-TEX members (non-automated), and we’ll need to apply for the transfer manually. Our system will only produce LOAs for non-TEX members which can be downloaded from the documents section.

-

As part of our process, you can set up an Adviser Ongoing Fee. This is a new facility (previously you had to wait for assets to arrive before you could set up a fee).

We use a portal called Altus to communicate electronically with counterparties (ceding platforms or fund providers). Where electronic communication is supported by all counterparties, re-registrations and cash transfers can take a matter of minutes or days. Where any of the counterparties are not electronically enabled, this adds an immediate delay.

- If a ceding platform is not electronically enabled

- They will require an LOA (letter of authority) with a wet signature from the client (some are happy with electronic signatures).

- Each communication stage will be sent via post (adding 1-2 weeks at that stage).

- If any of the fund providers are not electronically enabled

- They will require the ceding platform to send them a paper stock transfer form or conversion instruction signed by two authorised signatories in the business via post (some are happy with a fax but email is rarely accepted).

- They will send the Confirmation of Transaction confirming the assets are with us by post, potentially adding a week to us applying the units (although this is rare as we are continuously reconciling).

Factors that can cause delay:

- Manual processing (by any of the parties involved)

- Sending information via post

- Rejections (issues with any of the instructions or client data)

- Conversions (most fund providers are not electronically enabled for conversions)

- Complex asset types

- Complex product types (pensions, especially those in drawdown).

Letters of authority (LOA) will only be needed for providers who are non-TEX members (non-automated), and we’ll need to apply for the transfer manually.

Where a LOA is required, this will be available to download within the online journey. You must complete the online journey for all re-registration and transfer applications. Any LOA not downloaded from the online journey must include the 10-digit instruction reference number.

Once an application is submitted, confirmation is given that we have received the application and the process has started. You’ll also be able to see when it’s completed (there is no need to call us to check). You can track the progress of applications from ‘Instructions tracking’ on the client’s account. One of the following will be displayed:

- Submitted – the instruction has been saved.

- Awaiting Letter of Authority (LOA) – we are yet to receive and process the LOA.

- Pending Submission – the instruction is saved but not yet sent to the ceding provider.

- In Progress – the instruction is being progressed. It will remain as this until it’s either ‘Completed’ or ‘Rejected’.

- Completed – all assets are in the customer's account and the instruction is complete.

- Rejected – the instruction has been rejected by the ceding provider.

You can request emails to be sent to you notifying you of any progress changes – simply switch on notifications on the transfer tracking page for the client in question.

The above information can be found for all cases submitted online.

Bulk transfer tracking – we offer the ability to download a report detailing all your transfers and re-registrations to us. You can find a guide to this here.

We know that communication is important. This is what you can expect from us when you submit business:

- Calling you to resolve issues – If there’s a query or we receive a rejection message from the other provider, we will contact you by phone. If we cannot get through to you, we’ll send a letter via your online vault for electronic documents.

- Chasing up on your behalf – We follow up every case from the seventh business day and follow them through to completion. We’ll only contact you during the process if we’re unable to resolve any issues.

- Letting you know when it’s completed – An application containing multiple funds can complete at different times, depending on the automation status of the provider and underlying fund group. Therefore, we’ll send confirmation of transactions for each fund that is settled, with a final completion letter when all assets are received (these will be sent to your online vault).

Throughout the process for automated applications, we will send documentation at different stages to you and your clients.

Re-registrations

- Acknowledgement of request – confirms we have asked the companies stated in the letter for the client’s investment to be sent across. Remember it can take up to eight weeks, depending on the provider.

- Completion letter – confirms the assets that have been received, the number of units and from what company

- Rejection letter – If we are unable to hold a certain fund in an Investment Account, we will confirm in writing that this has been left at the ceding provider.

Cash transfers

- Acknowledgement of request – confirms we have asked the companies stated in the letter for the client’s investment to be sent across. Remember it can take up to six weeks, depending on the provider

- Completion letter – confirms the assets that have been received, the number of units and from what company.

- If using a model portfolio, please remember to assign the model to the client’s account once the assets arrive by using the ‘Manage models’ option. For cash transfers, the model can be linked at the application stage.

- If you want to set up a regular withdrawal plan, and/or a natural income payment, this will need to be applied online once the application is complete by using ‘Quote and Transact’.

- If you require a Regular Savings Plan for an ISA, you need to set this up online once the assets are settled as you cannot have more than one ISA in the current year. Again, please use ‘Quote and Transact’.

This depends on the product type and whether all counterparties are electronically engaged or not:

| Account type | Transfer type | If all counterparties are electronically engaged | Not electronically engaged |

|---|---|---|---|

| ISA/Investment Account | Cash Transfer | 2 weeks | 3 weeks |

| ISA/Investment Account | Re-registration | 3 weeks | 8 weeks |

| SIPP | Cash Transfer | 2 weeks | 10 weeks |

| SIPP | Re-registration | 9 weeks | 12-16 weeks |

Please refer to our timescale matrix below for expected completion times for specific providers.

Producing an illustration or submitting a request for a re-registration or transfer can be done via the ‘Re-registration and Cash Transfer’ option in our online Client Management facility. You can save illustrations for later if you wish. It is a fully online process, except where the current provider still requires a signed letter of authority.

For new or migrated accounts, the only time a form will be required is when the current provider still requires a signed letter of authority (LOA). In this scenario, an LOA will be produced during the online process. You will still need a signed client authority form before setting up a fee arrangement.

Following industry consultation, the FCA laid down new rules which all platforms must follow from 1 February 2021. Platforms are required to work together to find common share classes so that in-specie transfers (re-registrations) can take place. This may result in the client’s assets being converted to a common or cheaper share class (more details can be found here).

Please note: conversions will be performed by the fund manager’s transfer agent and this may be a manual process. Therefore, while the client remains in the market, the time a transfer takes could increase as a result of this new process. For conversions to a cheaper share class, the receiving platform may give advisers the opportunity to opt out of this conversion. If so, advisers can then choose to switch the assets themselves, which may be a quicker process. Fidelity, for instance, offers over 300 preferentially-priced share classes and will automatically convert clients into these post transfer. There is the option to opt-out of this conversion and we would encourage advisers to do so if they are planning to switch their clients’ assets post transfer.

Yes, but please note that your client’s account will not be visible online until there are funds in the account.