Automated process

Including check for potential loss of safe guarded benefits

If you are considering transferring assets to Fidelity Adviser Solutions, we are here to support you all the way. We’ll help you manage the whole process from start to finish.

Moving clients to a new platform has historically been perceived as a time-consuming, labour-intensive task. So, we’ve completely reviewed our re-registration and transfer proposition to help make the process as simple and efficient as possible. Here you’ll find all the support you’ll need prior to, during and upon completion of any applications on behalf of your clients.

Please email us if you would like to discuss new business opportunities or anything related to re-registrations or transfers.

Pension transfers can be requested as a ‘cash transfer’ or ‘re-registration’.

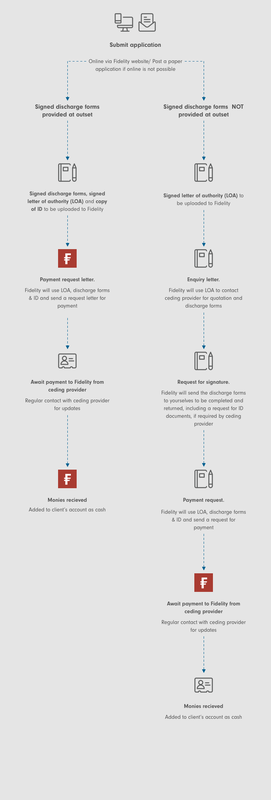

Here we provide you with an overview of the pension cash transfer process, and the various steps involved, so that you can manage your clients’ expectations.

The length of time it takes to complete a cash transfer will depend mainly on whether the current provider uses an electronic transfer system and how quickly they respond to our requests for information.

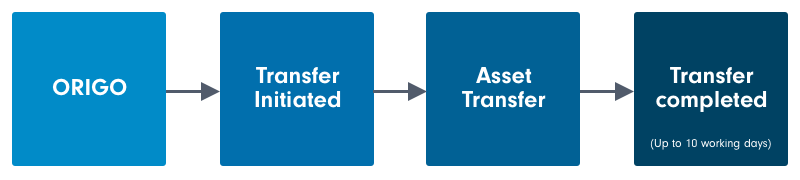

Most leading providers use the Origo system to facilitate the transfer, which means the pension can be transferred electronically without needing client signatures. In the event the existing provider does not use Origo, then the transfer will need to be processed manually and paperwork will be required. Where we know a provider does not use Origo, a letter of authority will be provided and this will need to be signed by your client. However, it is always good practice to check with the ceding provider as to whether they will also require a discharge form to be completed and signed.

With regards to adviser permissions, we check the adviser has these at the beginning of the journey.

Automated process

Including check for potential loss of safe guarded benefits

How you can help speed up the process

Check with the existing provider whether the plan you are proposing to transfer is available on Origo. If not, ask them if they require any signed discharge forms or any additional requirements. These will need to be signed and sent to us once you have submitted the online application.

Please see our Discharge forms checklist for further information.

For non-Origo schemes, please also send a signed transfer letter of authority.

You are able to keep track of all cash transfer cases online via our transfer tracking tool which can be found within Client Management (simply select the client and scroll to the 'Instruction tracking' tab). This will support you with tracking transfer cases without having to contact us directly.

For cash transfers, the tracking will highlight each step of the process and an indicative timeline will be provided for completion of the instruction based on average timescales of automated versus non-automated providers.

We will confirm once the existing provider has accepted our transfer request. Equally, we will tell you if it has been rejected. For any rejections, if we can resolve the issue, the instruction will be resubmitted under a new instruction reference. If a new instruction is not created, a rejection letter will be sent and you will need to submit a new instruction as appropriate.

Where a letter of authority is required, we will highlight this within the tracking.

Please note transfer tracking is not currently available for drawdown transfers.