In this article, I’m going to look at deducting fees from ISAs and Investment Accounts in the most tax-efficient manner. I’ll cover how to avoid taking money from a tax-efficient ISA and minimising the impact of any potential capital gains on an Investment Account.

Preserving assets within an ISA

I’ll begin by looking at a client who holds an ISA. Typically, fees are deducted and paid from the account which generates the fee. This includes ongoing adviser, discretionary fund manager and platform fees. However, we always create a Cash Management Account when an account is opened on the platform. This is an independent cash account that is separate from the tax wrappers and its use is optional.

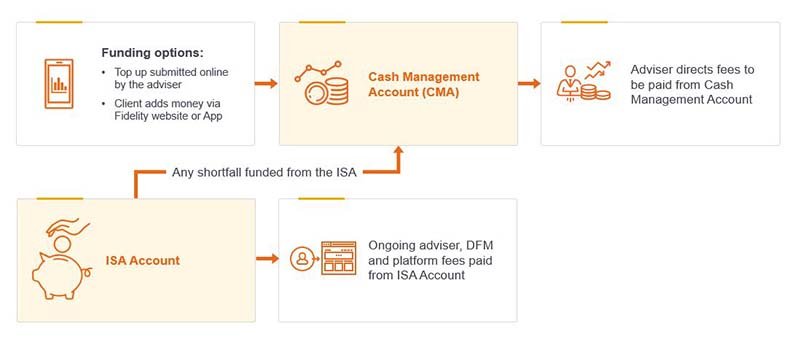

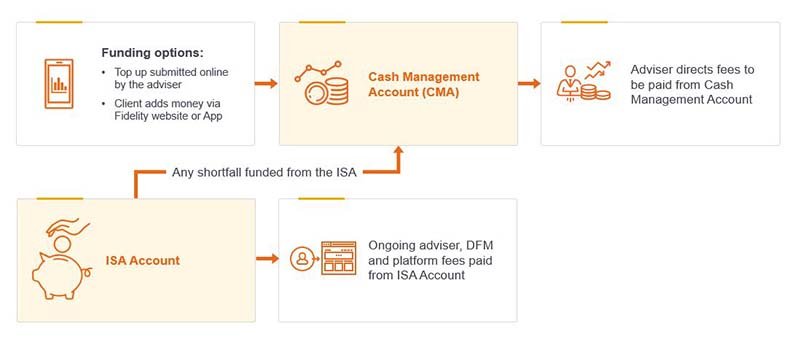

One of the key benefits of the Cash Management Account is the ability to pay fees from it. So, as shown below, you can set recurring fees to come from the Cash Management Account. This helps preserve the money held in the client’s ISA.

Directing fees to be paid from the Cash Management Account

Of course, in this scenario, the Cash Management Account needs to be funded. You can do this by submitting a top up online or, if the client is web registered, they can add money to their Cash Management Account via our website or App.

If there’s ever insufficient funds in the Cash Management Account to pay the fees, or the client decides they no longer want to fund these separately, we’ll simply default to selling from the ISA. This means the fees will always be paid. If we ever need to sell from the ISA to fund fees, we will use any available cash first. Where there’s insufficient cash, we will sell from the largest fund, or you can nominate a fund to sell from.

Where an Investment Account is held alongside an ISA

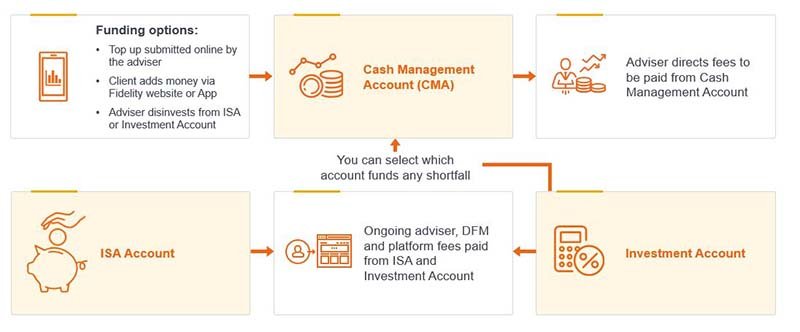

I now want to look at the options where the client holds both an ISA and Investment Account. As I mentioned previously, ongoing fees are normally deducted and paid from the account which generates the fee, so both accounts in this example. However, you can arrange for the fees for both accounts to be paid from the client’s Cash Management Account.

Again, you can fund the Cash Management Account by submitting a top up online, or the client can add money themselves via our website or App. If the client doesn’t want to pay money in directly, you can sell funds from an Investment Account or an ISA into a Cash Management Account.

Alternatively, simply nominate the account for Fidelity to use if there’s a shortfall. Either way, you can target the account and funds based on the client’s tax position. In the example below, I’ve used the Investment Account. Where this is the case, we’ll use any cash first. If there’s insufficient cash available, you can nominate a fund for disinvestment, to help control the client’s capital gains position. If no nomination exists, we’ll use the largest fund within the account.

Nominating the Investment Account if there is a shortfall

To use the Cash Management Account in this way, the Investment Account must be held in a sole name. A stock transfer can be submitted to change an account from joint to single ownership, if appropriate.

Finally, I want to stress there are no requirements for any cash management on the platform. These are options to assist with tax planning on behalf of your clients. Where necessary, we have an auto disinvestment policy in place to meet all payments, meaning the fees are always paid, regardless of the cash position.

If you want to know more about using the Cash Management Account to fund fees, I recommend downloading our helpful factsheet. In addition, you may find the other articles in this series helpful when administering client accounts – these touch upon practical tips for pension planning, practical capital gains management, tax planning using a Bed & ISA and using the ISA allowance in uncertain times.

Important information

This article provides information and is only intended to provide an overview of the current law in this area and does not constitute financial advice, tax advice or legal advice, or provide any recommendations. The value of benefits depends on individual circumstances. The minimum age clients can normally access their pension savings is currently 55, and is due to rise to 57 on 6 April 2028, unless they have a lower protected pension age. Different options may have different effects for tax purposes, different implications for pension provision and different impacts on other assets and financial planning.

Issued by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited.

UKM0424/386671/SSO/0325

Online facility for stock transfers between Investment Accounts

In this article, I highlight our new online transfer facility and the many re…

Practical tips for pension planning

In this article, I’d like to highlight the information available that can ass…

Practical capital gains management

In this article, I’d like to highlight some of the reporting available that c…