To help get you to the right website, please choose one of the options below

Search

Login

Log out

Menu

Close

Products & investments

Products & investments

Products

Back

Pension Flexible Investment and Retirement Solutions Standard Life Smoothed Return Pension Fund Standard Life Guaranteed Lifetime Income plan Taking retirement income ISA Investment Accounts Pension Trustee, Company and Trust accounts Cash The Canada Life International Bond Utmost Wealth Solutions − offshore bond products

Products

Pension Flexible Investment and Retirement Solutions Standard Life Smoothed Return Pension Fund Standard Life Guaranteed Lifetime Income plan Taking retirement income ISA Investment Accounts Pension Trustee, Company and Trust accounts Cash The Canada Life International Bond Utmost Wealth Solutions − offshore bond products

Investments

Technical resources

Technical resources

Technical matters

Back

Tax year end planning tools and resources Replacement of the lifetime allowance Retirement Income Pension Forum The Platform Clinic Pension, retirement and tax planning The beneficiaries flexi-access drawdown conundrum Retirement and pensions training Personal tax and trust planning training

Technical matters

Tax year end planning tools and resources Replacement of the lifetime allowance Retirement Income Pension Forum The Platform Clinic Pension, retirement and tax planning The beneficiaries flexi-access drawdown conundrum Retirement and pensions training Personal tax and trust planning training

More support

Paraplanner technical hub

Back

Technical hub Retirement income Regulation, due diligence and compliance Training support

Paraplanner technical hub

Technical hub Retirement income Regulation, due diligence and compliance Training support

In this section

Frequently asked questions

Below you will find answers to some of the frequently asked questions (FAQ’s) about the Standard Life Guaranteed Lifetime Income plan (referred to as ‘the plan’). Throughout these FAQs, we’ll refer to the Fidelity Pension Trustee, legally known as the FIL SIPP Trustee (UK) Limited (“Fidelity Pension Trustee”).

The Guaranteed Lifetime Income plan (referred to as ‘the plan’), purchased by a lump sum payment, pays a guaranteed income into a client’s Product Cash Account, which sits within their Fidelity Drawdown Account, for the rest of their life. The plan may also pay additional beneficiary benefits, via the product cash account following a client’s death, where the death benefit option (known as Value Protection) has been selected when they take out the plan.

Your client can purchase additional plans if they want to add more guaranteed lifetime income in the future (subject to product eligibility). Each new Plan will be priced based on the benefit options your clients choose, their personal, health and lifestyle status, and the plan rates available at the time.

The Plan can only be purchased using pension savings from a flexi-access drawdown arrangement within the Fidelity Pension. Flexi-access drawdown is simply a way of withdrawing money from your clients’ pension savings to live on in retirement. It can provide your clients with flexibility over how and when they receive their income.

You can find all the plan information and supporting literature here.

The Guaranteed Lifetime Income plan is designed to form part of a blended drawdown strategy, providing a secure, guaranteed income while allowing the remainder of the client’s assets to stay invested for long term growth. Although it can be used as the client’s only drawdown asset, this is not the intended use.

Allocating 100% of drawdown assets to the plan

If you intend to place all of a client’s drawdown assets into the plan and pay out all of the guaranteed income, please be aware of the following operational requirements:

- The drawdown account must hold enough available cash or assets to cover at least two regular taxable income payments.

- Platform fees must be met from available cash or via fund sales.

- As a result, taxable income cannot be paid out until the third guaranteed income payment from Standard Life has been received, as only then will there be sufficient surplus assets to:

- cover platform fees, and

- meet any income shortfall.

How to avoid delays in setting up taxable income

To enable taxable income to start immediately, consider creating an initial surplus within the drawdown account. This can be done by:

- Crystallising additional funds from the Pension Savings account, or

- Using a smaller portion of the client’s pot to purchase the guaranteed income.

Ongoing requirement

Any surplus you establish must be maintained on an ongoing basis to ensure that platform fees and income payments can continue to be supported.

Currently, your clients must be between the ages of 55* and 85 to purchase the Guaranteed Lifetime Income plan. *The minimum age will increase to 57 from 6 April 2028.

Each plan can be purchased for your clients with a minimum sum of £10,000, up to a maximum of £500,000. The total amount of Guaranteed Lifetime Income your clients can invest in multiple plans within flexi-access drawdown is £1,000,000.

The plan is purchased and held by the Fidelity Pension Trustee as a Trustee Investment Plan (TIP) on behalf of individual members.

The Guaranteed Lifetime Income plan is held as an asset of your client’s Fidelity Drawdown Account and any income from the Guaranteed Lifetime Income plan will be paid into the corresponding Product Cash Account via the Fidelity Pension Trustee. It doesn’t constitute a unit-linked fund or unit-linked insurance business.

The Guaranteed Lifetime Income plan is not a lifetime annuity as defined by pensions’ regulations and as set out in the Finance Act 2004. It’s a contract of lifetime insurance between Phoenix Life Limited and the FIL SIPP Trustee (UK) Limited (“Fidelity Pension Trustee”).

It doesn’t pay Pension Commencement Lump Sum (PCLS) or facilitate adviser charging as it is a scheme investment, not a pension scheme in its own right.

The plan doesn’t facilitate any adviser remuneration. However, you may wish to find an alternative way of deducting your fee from your client’s other investments. Please refer to our Adviser Fees service.

Standard Life's charges are incorporated into the income your clients receive from the plan. We don’t make any ongoing fund management or administration charges for the plan. Please note that the notional value of the Guaranteed Lifetime Income plan is subject to Fidelity’s platform charges. The notional value of the Guaranteed Lifetime Income plan is equal to the amount used to purchase the plan less the total income paid at the valuation date.

No, currently the plan is only available through our platform as part of flexi-access drawdown.

Yes, the plan is priced in the same way as a conventional underwritten annuity. Every income rate is personalised and may be enhanced when personal, health and lifestyle factors are taken into account.

Yes, the Guaranteed Lifetime Income plan is underwritten using the same criteria as a conventional underwritten annuity.

The Guaranteed Lifetime Income plan is only available on a level basis, and all income is payable monthly on the 15th. No escalating income options are available for the plan. If the amount of guaranteed income needs to increase over time, this can be achieved by purchasing additional tranches of Guaranteed Lifetime Income at a later date to increase the total amount of guaranteed income (subject to product eligibility).

Standard Life compare Guaranteed Lifetime Income plan rates against conventional underwritten annuities available in the market as part of the quote process. In order to receive the comparison, you will need to confirm your client’s consent to sharing their information as part of the quote and apply portal journey. While conventional annuities don’t offer the same flexibility and efficient income planning opportunities, Standard Life believe they can provide a useful basis for comparison from an income perspective.

The MPAA will be triggered when your clients first take income from flexi-access drawdown into their chosen bank account. Therefore, purchasing the plan itself will not trigger the MPAA. This is because income is paid directly into the Product Cash Account within a client’s Fidelity Drawdown Account, which could be reinvested within the Drawdown Account should they choose. In this case, the MPAA would not be triggered until income is first withdrawn into the client’s chosen bank account.

The minimum age you can normally access pension savings is currently 55, and is due to rise to 57 on 6 April 2028, unless your client has a lower protected pension age. The value of investments and the income from them can go down as well as up so your client may get back less than they invest.

Related content

About our Pension

All the information you need on our Pension, including account opening and dealing, re-registrations & transfers and withdrawals.

Adviser Fees service

How to set up and manage your fee arrangements with your clients through our flexible and convenient service.

Retirement income hub

A hub presenting insights and ideas on ensuring a client’s income lasts a lifetime.

How can I use the Guaranteed Lifetime Income (GLI)

You can get a Personal Quote for your client using the Guaranteed Lifetime Income plan quote and apply portal, which is available through Client Management. The portal contains questions about your client's personal situation, which includes health and lifestyle status. This will enable us to provide a personalised quote quickly within the portal journey.

If you have already received your client’s quote and the client would like to make an amendment – for example, to receive a higher income or add a death benefit, you can simply amend the quote options and request a new quote. If your client wants to amend the health and lifestyle information, you will have to update the medical records first.

Quotes will usually be returned within seconds of submission of your client’s details. We expect this to be the journey experienced by advisers in the significant majority of cases. In some cases, manual underwriting may be required. The quote portal will inform you if this is the case and how to proceed. Standard Life will aim to respond to a manual underwriting request within five working days. You’ll be notified once this manual underwriting process is complete, and your client’s quote is available.

Every effort is made to make sure you receive a guaranteed quote. However, if it isn't possible to do this for your client, Standard Life will highlight this to you when they return the quote. You'll be provided with an indicative (non-guaranteed) quote and informed how to request manual underwriting so you can get a guaranteed quote.

Yes, there is a downloadable form available in the library of the portal, alternatively you can download here. This form is similar to the industry standard Retirement Health Form (RHF) and is tailored to the specific areas covered by the Guaranteed Lifetime Income plan. You can choose to either print and post the form, or email it to your client to complete separately. Please be aware that if this form is completed and posted back to you to complete the online process, there is a potential data protection risk. It’s advisable to ask your client to send their response to you via secure email, or alternatively to deliver this form back to you by hand and for you to store it securely once the data has been entered into the Guaranteed Lifetime Income plan portal. Please note, there’s no guarantee that any email you send will be received, or will not have been tampered with. You shouldn’t send personal details by email.

The Guaranteed Lifetime Income plan is designed to form part of a blended drawdown strategy, providing a secure, guaranteed income while allowing the remainder of the client’s assets to stay invested for long term growth. Although it can be used as the client’s only drawdown asset, this is not the intended use.

Allocating 100% of drawdown assets to the plan

If you intend to place all of a client’s drawdown assets into the plan and pay out all of the guaranteed income, please be aware of the following operational requirements:

- The drawdown account must hold enough available cash or assets to cover at least two regular taxable income payments.

- Platform fees must be met from available cash or via fund sales.

- As a result, taxable income cannot be paid out until the third guaranteed income payment from Standard Life has been received, as only then will there be sufficient surplus assets to:

- cover platform fees, and

- meet any income shortfall.

How to avoid delays in setting up taxable income

To enable taxable income to start immediately, consider creating an initial surplus within the drawdown account. This can be done by:

- Crystallising additional funds from the Pension Savings account, or

- Using a smaller portion of the client’s pot to purchase the guaranteed income.

Ongoing requirement

Any surplus you establish must be maintained on an ongoing basis to ensure that platform fees and income payments can continue to be supported.

The plan is available on a single life basis only and the income is paid on the 15th of every month, or the working day before if the 15th isn’t a working day.

The income will remain fixed for the whole of your client's life. However, additional tranches can be purchased later if your client wishes to increase the total amount of guaranteed income generated (subject to product eligibility).

The plan also provides an option to include a death benefit in the form of 100% Value Protection. If selected at outset, Standard Life will pay a lump sum to the Fidelity Pension Trustee in the event of your client’s death, with the lump sum paid into your client’s Product Cash Account. This will be equivalent to 100% of the amount used to purchase the plan, less the total amount of income received from the plan.

Once the income received by your client is the same or more than the purchase price, no Value Protection will be payable.

No, you can create as many quotes as you want for your client.

Guaranteed quotes will be valid for a period of 14 calendar days from the point the quote is generated.

Yes, if your client agrees to run a whole of market check Standard Life will run a comparison against conventional annuities available in the market. While conventional annuities do not offer the same flexibility and tax advantaged features, they can be used as a basis for comparison from an income perspective.

Once you have completed the questions in the Guaranteed Lifetime Income plan portal and your client has the funds held in cash within their Product Cash Account within their Fidelity Drawdown Account, you’ll be able to apply on their behalf. There may be times when the ‘apply’ option isn’t available. This could be because of a lack of available funds, or if the quote guarantee period has expired. The reason will be made clear to you in the portal as appropriate.

You’ll need to ensure there are cleared funds available in the client's Product Cash Account within their Fidelity Drawdown Account before making their application. Once this is done and the application is successful, an automatic check will be made to see whether rates have improved to either give your client the best available income in the case of a fund driven quote, or reduce the capital required to secure the required level of income in the case of an income driven quote.

Funds will then be removed from your client’s Fidelity Product Cash account and will normally be transferred to Standard Life to complete purchase of the plan within 48 hours. Post sale documentation will then be placed in your and your client's Document Libraries on our platform. The income will be paid from the first payment date detailed in the welcome pack supplied when the plan is purchased.

No, the Guaranteed Lifetime Income plan can be purchased entirely online. To do this, you’ll need to apply and affirm on behalf of your client.

You won’t be able to submit a quote for application outside of the guarantee period. Instead, you’ll need to produce a new quote using the portal which, if guaranteed, will be valid for a further 14 days. Your client’s details used in the earlier quote are stored and therefore, once checked, they can be resubmitted to obtain a new quote. You’ll then be able to use this latest quote to submit an application.

No, the plan is only available through flexi-access drawdown (FAD) accounts. A Capped Drawdown Account would need to be converted to a Fidelity Flexi-access Drawdown Account before a Guaranteed Lifetime Income plan could be purchased.

Quotes are guaranteed for up to 14 days from the date the quote was originally generated. This means if you apply to purchase a plan within the 14-day period, your client will be guaranteed to receive at least the level of monthly income quoted. If rates improve due to market changes during this time, they could receive a better rate than the quoted amount. We’ll confirm whether this is the case as part of the application process. All guaranteed quotes clearly show the quote expiry date.

Yes, your client doesn’t need to hold any funds on our platform in order to obtain a quote. However, your client will need to have cleared funds within their Product Cash Account within a Fidelity Drawdown Account before you can submit an application on their behalf for the Guaranteed Lifetime Income plan. Please be aware that quotes are only guaranteed for up to 14 days from the date they are generated. This means that if it takes longer than 14 days to set up the Fidelity Drawdown Account and have cash available within it, then a new quote will need to be produced.

Yes, you can get a quote without providing health and lifestyle details. However, this means that your client may not receive the best rate possible and may miss out on income for the rest of their life.

This means that the quote is not guaranteed, and you won’t be able to apply for the Guaranteed Lifetime Income plan on this basis. This may be due to the medical or health and lifestyle information provided. If this is the case, you'll be provided with an indication of the income your client may receive and provide you with more details on how to get a guaranteed quote.

Standard Life pay income to the Fidelity Pension Trustee who will pay it into your client’s Product Cash Account within their Fidelity Drawdown Account without any deduction of tax. Your client will only be liable to income tax on the income if they withdraw it from the Product Cash Account into their chosen bank account. This provides valuable tax planning opportunities for you and your client.

Standard Life pay all income from the Guaranteed Lifetime Income plan to the Fidelity Pension Trustee on the 15th of each month, or the working day before if the 15th isn’t a working day. Following this, the money will be allocated into your client's Product Cash Account.

For the first income payment, the Fidelity Pension Trustee will receive the first income on the 15th of the same month (or the working day before if the 15th isn’t a working day) if the application is submitted on or before 3pm on the 8th of the month. For applications submitted after this, the Fidelity Pension Trustee will receive the first income payment on the 15th of the following month (or the working day before if the 15th isn’t a working day).

No, the Guaranteed Lifetime Income plan can only be purchased on a single life basis.

No, the Guaranteed Lifetime Income plan can only be purchased with crystallised funds and held within flexi-access drawdown.

For any pre-sale enquiries relating to the plan, please contact GLI_sales@standardlife.com. You can also speak to your usual Standard Life intermediary sales contact or call 0345 266 0012. Call charges will vary.

There’s no guarantee that any e-mail sent will be received or will not have been tampered with. You should not send personal details by e-mail.

For any post-sale enquiries, please speak to Fidelity Adviser Solutions on 0800 414 181.

Yes, checks are performed for a proportion of all Guaranteed Lifetime Income plans sold. Standard Life do this to make sure that the health and lifestyle information provided is accurate and therefore representative of the true rate payable to your client. This means they may ask your client for permission to obtain a medical report or other information. This is known as sample checking and is only carried out in the first six months of a plan being set up. If it's not possible to confirm the information provided in the quote and apply portal, the income payable to your client may need to be reduced. Therefore, it’s important that the information provided is accurate to ensure the best outcome for your client.

Within six months of opening Guaranteed Lifetime Income plans, clients may be included in Standard Life's weekly sample checking process. During this process, Standard Life reviews the medical and lifestyle information provided at the time the plans were initially set up and may contact clients directly for additional details. This could involve a request for a GP report, a GP visit, or asking the client to complete a medical questionnaire. You can keep track of whether your client has been chosen for sample checking, and if these reviews lead to any changes in the client's monthly income payment amounts, by utilising our 'Pension Summary Report' available through our reporting services. Sample checking information is also available under 'View All Plan Details', accessible via the Client Summary screen.

Please be aware that communications between Standard Life and your client are likely to include personal medical information. Consequently, Fidelity will not receive copies of these letters and therefore are unable to upload these to the adviser firm document section of the website. Should there be any changes to the client's monthly income payment amount, Standard Life will send an updated income payment schedule to the client. You'll receive a copy of this schedule which will be available to download online from your client documents.

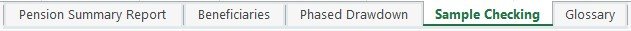

Pension Summary Report

Within the Pension Summary Report, we have added an extra tab for sample checking. The report can be set to run on a regular frequency and will display any clients under your agency who have been included in the sample checking. The tab contains the client's Pension Drawdown Account number, their name, their GLI plan reference, the date they were included in the sample checking, the status of the sample checking, and their current GLI monthly income amount.

In column F of the sample checking tab, you will find the sample checking status for each client. In the table below are brief descriptions of what these statuses mean.

| Sample checking status | Status description |

|---|---|

| OPEN_INVESTIGATION | Client has been included in the sample checking process, and investigations are currently underway. |

| REDRAW_CONFIRMED | This status will only be displayed when adjustments are being made to a client's monthly income amount. |

| REDRAW_UPLIFT | This status will only appear if there has been an increase in the client’s monthly income amount. An ad hoc payment will be issued to cover the shortfall for all previous income payments prior to the redraw. |

| PAYMENT_AWAITED | Fidelity is awaiting an ad hoc payment from Standard Life, which will be credited to cash within a client’s pension drawdown account. |

| COMPLETED | Once investigations are complete, if there has been a change to the GLI monthly income amount, this new amount will be reflected in column G. |

To access reports, simply select 'Firm' from the left-hand menu on the Client Management facility, then choose 'Reporting Services'. After entering your company details, you can select the reports you require. Your report will be ready within 24 hours.

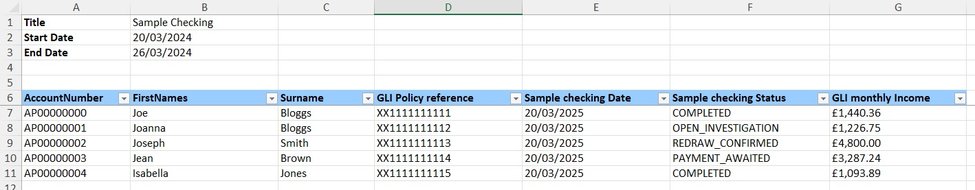

‘View plan activity’

The ‘View plan activity’ screen is similar to the pension summary report, as it shows you all the latest updates of sample checking but at an individual client level rather than firm level. Status updates on 'View plan activity' offer clear tracking of the sample checking steps that have occurred, with information icons providing additional details.

To view sample checking statuses, first locate your client's account online. Next to their Guaranteed Lifetime Income plan, select 'View all plan details'. On the subsequent screen, you'll find all the details relating the client's Guaranteed Lifetime Income plan(s) and an option to 'View plan activity'. If your client has not been selected for sample checking, plan activity will not be displayed.

The minimum age you can normally access pension savings is currently 55, and is due to rise to 57 on 6 April 2028, unless your client has a lower protected pension age. The value of investments and the income from them can go down as well as up so your client may get back less than they invest.

Related content

About our Pension

All the information you need on our Pension, including account opening and dealing, re-registrations & transfers and withdrawals.

Account dealing

Support for account dealing transactions, such as lump sum investments and top ups, regular contributions and switching.

Retirement income hub

A hub presenting insights and ideas on ensuring a client’s income lasts a lifetime.

Yes, your client has a period of 32 days from the start date of the plan to change their mind. If your client decides to cancel, all funds will be returned to the client’s Product Cash Account within their Fidelity Drawdown Account, less any income payments made during the cancellation period. Full details of how to do this are included in the Guaranteed Lifetime Income plan Key Features Document.

All Guaranteed Lifetime Income plan payments will be paid into your client's Product Cash Account within their Fidelity Drawdown Account. They can then choose to take this as income (at which point it may be liable to income tax), keep it within the Product Cash Account, or re-invest the money into other funds within their flexi-access drawdown account.

Each Guaranteed Lifetime Income plan set up for your client will pay a fixed monthly income for the duration of their life and this income can’t be increased once set up. However, additional tranches of Guaranteed Lifetime Income can be purchased as needed to increase the total amount of guaranteed income payable (subject to product eligibility). These additional tranches will be underwritten using client information obtained at the time of any new purchase.

It’s not currently possible to transfer the plan to another provider. However, a Guaranteed Lifetime Income plan can be converted to a Standard Life Pension Annuity in your client's name.

Where selected, the death benefit option (also known as Value Protection) amount is calculated using the purchase price of the plan, less the total amount of income already paid from the plan.

You will need to notify us about your client’s death so we can update our records relating to their account. We will then notify Standard Life and they will follow their internal death process and pay any death benefit where applicable.

Income payments will continue to be made for the duration of your client's life and will stop upon their death.

If any income payments are made after your client's death, Standard Life will seek to reclaim them from the Fidelity Pension Trustee.

Please update the client's details on the platform. The correct details will be visible the next time you access the Guaranteed Lifetime Income plan portal.

You'll be able to view the following information:

- Plan start date

- The plan status (i.e. active or closed)

- Amount used to purchase the plan

- Whether the client has selected the death benefit or not

- Monthly income amount

- Monthly income payment date

- The number of monthly income payments received to date

- The total amount of monthly income received to date

- The notional value of the Guaranteed Lifetime Income plan

Yes, the plan can be converted to a Standard Life Pension Annuity. This is also called ‘novation’. Your client will receive exactly the same income provided by the Guaranteed Lifetime Income plan; however, this will be paid directly into their chosen bank account rather than into their Product Cash Account within their Fidelity Drawdown Account. Therefore, the flexibility offered around managing income and reinvesting income through flexi-access drawdown will no longer apply. If a death benefit option (Value Protection) was included with the Guaranteed Lifetime Income plan, any remaining Value Protection cover will also be included with the new conventional annuity.

It’s possible to cancel a Guaranteed Lifetime Income plan within 32 days of the start date. After this time, the plan cannot normally be cashed in or surrendered, except:

- Where the plan is subject to a Pension Sharing Order in full

- Where your client’s plan is converted into a conventional annuity with Standard Life

- Where your client dies and a death benefit is payable.

On receipt of a Pension Sharing Order, the plan may need to be partially or fully surrendered. The plan will only be changed or cancelled once all other pension holdings held by your client on the platform have first been sold, and only where required to fund the court order.

No, the notional value cannot be removed or amended. It will, however, decrease each time income is paid.

Related content

About our Pension

All the information you need on our Pension, including account opening and dealing, re-registrations & transfers and withdrawals.

Help with client administration

Here we answer all your questions relating to administrative tasks that are commonly completed on our platform. We also cover the required procedures following the death of a client.

Retirement income hub

A hub presenting insights and ideas on ensuring a client’s income lasts a lifetime.

The minimum age you can normally access pension savings is currently 55, and is due to rise to 57 on 6 April 2028, unless your client has a lower protected pension age. The value of investments and the income from them can go down as well as up so your client may get back less than they invest.