There are a number of ways clients can take an income from their pension with us. They can enter into flexi-access drawdown and you have the ability to arrange automated regular crystallisations on their behalf. In addition, we support clients with existing capped drawdown arrangements as long as they remain within the income limits. Clients can also make UFPLS withdrawals and can receive small pots, ill health and serious ill health payments (subject to meeting the conditions for these payments).

We’ve introduced the ability to set up automated regular crystallisations. These new improvements have enhanced our existing drawdown functionality, which also enables your clients to take one-off crystallisations and PCLS (tax-free cash) along with regular and one-off taxable income.

Skip to section

Benefits of phased drawdown

How our phased drawdown facility works

The new automated service allows you to set up regular crystallisations, providing your clients with a regular PCLS (tax-free cash) payment without the need to submit an instruction each time. Within the same journey, you will also be able to set up regular income.

To meet your clients’ needs and provide flexibility, we offer a choice of crystallisation frequencies: monthly, quarterly, half yearly and yearly, as well as two payment dates; either the 10th or 25th of the month.

10-min watch

How we crystallise assets and pay out PCLS

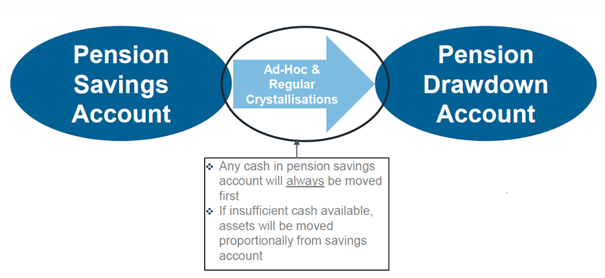

Money is always moved from the Pension Savings Account to the Drawdown Account first. To do this, any money in the Pension Cash Account will be used first. If there is insufficient cash, then assets will be moved proportionately from the Pension Savings Account.

Once the assets have been moved to the Drawdown Account, payment of the PCLS will then be made.

For regular PCLS, this is taken from cash first, but where there is insufficient cash, our default is to take the shortfall by disinvesting proportionately from all assets in the drawdown account, or you have the option to select the largest fund. A 2% oversell will be made to allow for market movements/brokerage charges.

For regular income, this is taken from cash first and any shortfall will be funded by proportionately disinvesting from assets.

In the tables below you can see how to submit instructions for different scenarios.

Scenario 1

Scenario: Client wants to start taking a regular PCLS only.

Key points to note:

- Regular PCLS required.

- Taxable income not required.

- Client has an existing Pension Savings Account.

- Client does not have money in an existing Drawdown Account.

Submission:

- Single submission via the new screens.

- Quote & submission possible within the new journey.

Instruction tracking available?

- Yes, online via Instruction Tracking.

Scenario 2

Scenario: Client wants to start taking a regular PCLS and taxable income.

Key points to note:

- Regular PCLS required.

- Taxable income required.

- Client has an existing Pension Savings Account.

- Client has money in an existing Drawdown Account.

Submission:

- Single submission via the new screens - regular PCLS and regular income can be set up in the same journey

Instruction tracking available?

- Yes, online via Instruction Tracking.

Scenario 3

Scenario: Client wants to start taking a regular PCLS and taxable income.

Key points to note:

- Regular PCLS required.

- Taxable income required.

- Client has an existing Pension Savings Account.

- Client does not have money in an existing Drawdown Account.

Submission:

Income required is between 0% - 90% of the maximum available.

- Single submission via the new screens - regular PCLS and regular income can be set up in the same journey

Income required is 90% - 100% of the maximum available.

- We can only pay out this level of income where there are assets in the Drawdown Account equivalent to at least 10% of one taxable income payment or there are 12 months’ worth of crystallisations in the pension savings cash account.

- In order to create a residual value, you will be required to submit a one-off crystallisation for month one based on a higher amount than usually required but keeping the income level the same.

Instruction tracking available?

- Yes, online via Instruction Tracking.

Scenario 4

Scenario: Instruct a transfer from an external provider and set up a regular crystallisation/PCLS/income.

Key points to note:

- Regular PCLS required.

- Taxable income may or may not be required.

- Client does not have an existing Pension Savings Account.

- Client does not have money in an existing Drawdown Account.

Submission:

Two options to set up:

- Option 1 – Instruct the transfer and once the assets have been received, set up the regular crystallisation/PCLS/income.

- Option 2 – Instruct a one-off crystallisation/PCLS/Income as part of the transfer, but a regular crystallisation will also need to be set up for month two onwards.

Instruction tracking available?

- For the transfer to immediate drawdown and one-off crystallisation/PCLS/income payment - no online tracking available.

- For the regular crystallisation/PCLS/income (if required), instruction tracking available via Instruction Tracking.

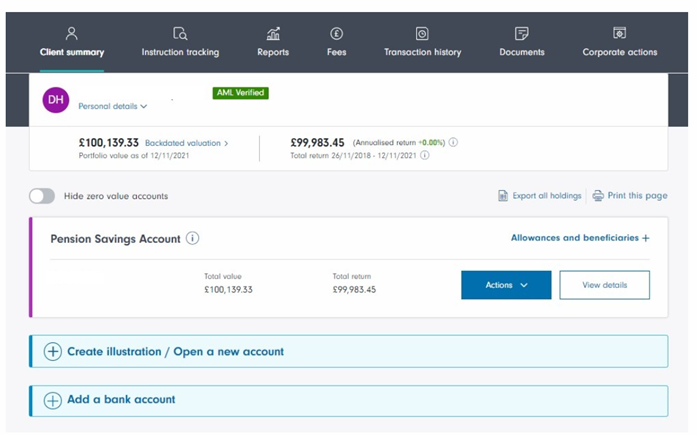

Bank mandates

With the new service, it’s important to set up the bank account online if one hasn’t been set up already. You can do this at any time and once added, it will be verified through our automated, online verification system and you will be instantly notified whether the bank account has passed the verification or not. This should be done on the client summary screen prior to setting up a regular crystallisation.

Please note a bank account cannot be set up within the regular crystallisation journey.

If the bank account cannot be verified you will be directed to call us on a dedicated line to go through verification manually with our Bank Mandate Verification team.