AIM portfolios

An AIM portfolio offers your clients the opportunity to reduce the Inheritance Tax (IHT) payable by their estates on death, while maintaining access to capital and income.

The shares in a listed AIM company are recognised as ‘unquoted’ for tax purposes, meaning your clients could benefit from business relief, with 100% relief from IHT, provided the shares have been held for a period of no less than two years at the time of death.

Investing ISA accounts in AIM portfolios

We support both partial and full investments into AIM portfolios. If you wish to partially invest in an AIM portfolio, it is possible to split existing ISA accounts, rather than having to transfer monies to another provider.

Access AIM portfolios on our platform

With an ever-increasing number of Discretionary Fund Managers (DFMs) on Fidelity Adviser Solutions, the number offering these types of portfolios is increasing too.

To find out which DFMs offer these types of portfolios, visit our list of available DFMs using our platform.

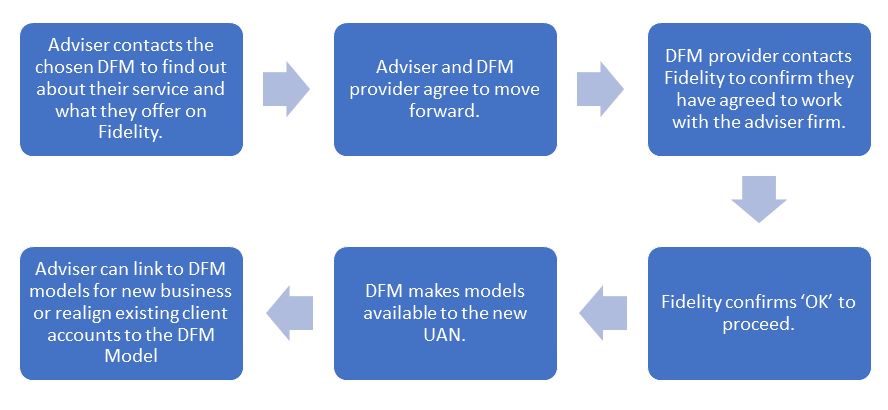

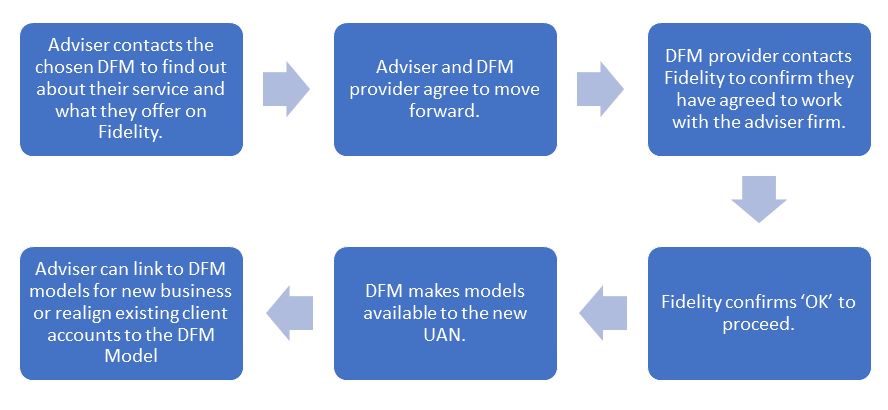

If you don’t currently use a DFM or would start to use a DFM who offers AIM portfolios, it’s a simple process and no paperwork is required. The process is illustrated below: