Information-only advisers

An ‘information-only’ adviser is an adviser who doesn’t carry out transactions for a client, but has permission to access some of their financial information. If a client has given you permission to receive information about their Fidelity account(s), this is what you need to do.

To request information, please choose which type of account you need access to.

ISA accounts, Investment accounts, Pension accounts, Junior ISA accounts and Junior SIPP accounts

The way you get information and the type of information you’ll receive depends on whether you’re registered with Fidelity Adviser Solutions.

Registered with Fidelity Adviser Solutions | Not registered with Fidelity Adviser Solutions | |

|---|---|---|

Example | Your company/firm is authorised by the FCA and already has a Unique Agency Number (UAN) registered with Fidelity. You have an existing login ID (consultant ID) and a PIN set up*. | Your company does not have a Unique Agency Number (UAN) registered with Fidelity. Your company or firm is authorised by the FCA, and it doesn’t have a UAN – a Unique Agency Number To register now go to Start Adviser Registration. |

How to get information | Our online ‘Information only request’ service allows you to enter the client details and choose the clients’ account(s) that you’d like information on.** You request is actioned immediately. | If you are unable to register, you can send us a Letter of Authority to: Post it to: |

Information you’ll receive | You’ll have access to two online reports, further details can be found below. | We’ll post you a statement & valuation that includes all transactions from when the client first opened their account(s) with Fidelity (this will not include transactions relating to the client’s Cash Management Account). |

If your firm hasn’t yet registered with Fidelity Adviser Solutions, you can do this online -

Start Adviser Registration.

* Please contact your firm administrator If your firm is already set up with access to our online services but you don’t yet have your own individual login (consultant ID). They’ll be able to quickly set you up as a user.

**This service is not available for Pension Trustee, Company, Charity, or Trust Accounts. A signed Letter of Authority can be submitted via post.

Client Report | Money in and money out report |

|---|---|

|

|

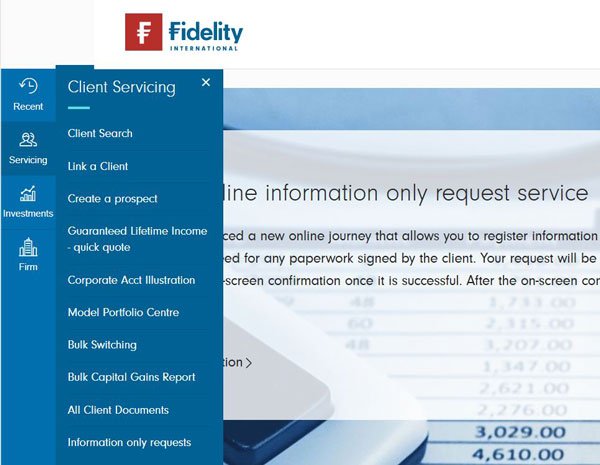

- Once you’re logged in to the platform, you’ll find the ‘Information only request’ service under the ‘Client Servicing’ menu on the left-hand side.

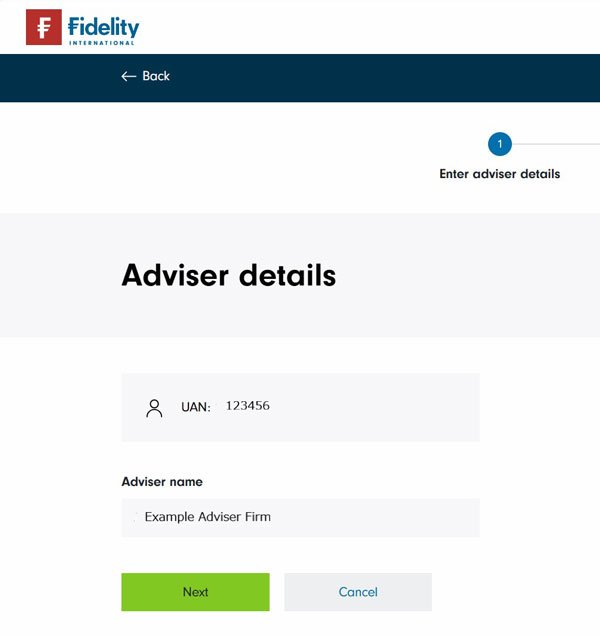

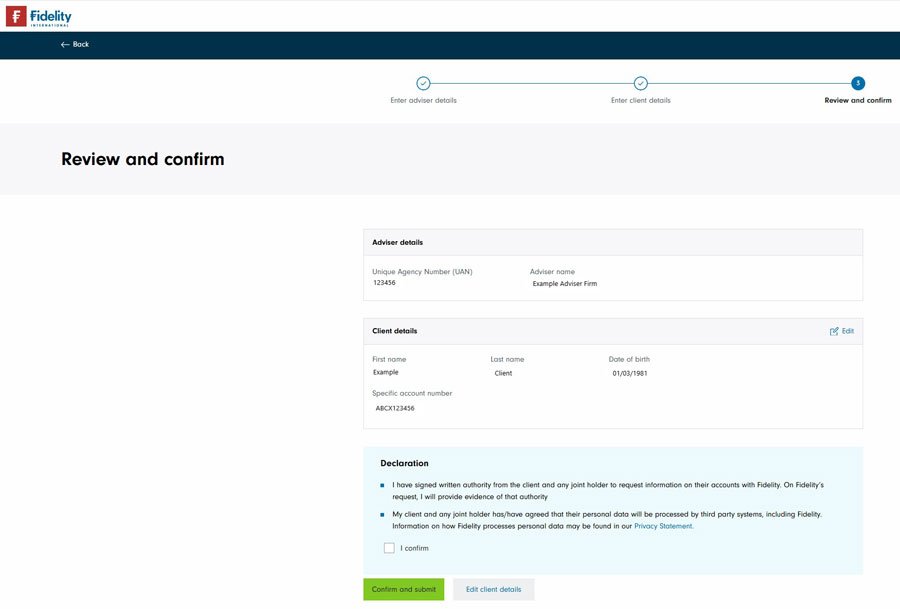

- Your Unique Agency Number (UAN) and adviser name will automatically be pre-populated.

- If you are logging in from your firm’s head UAN, a drop-down list will be visible allowing you to select a specific sub UAN.

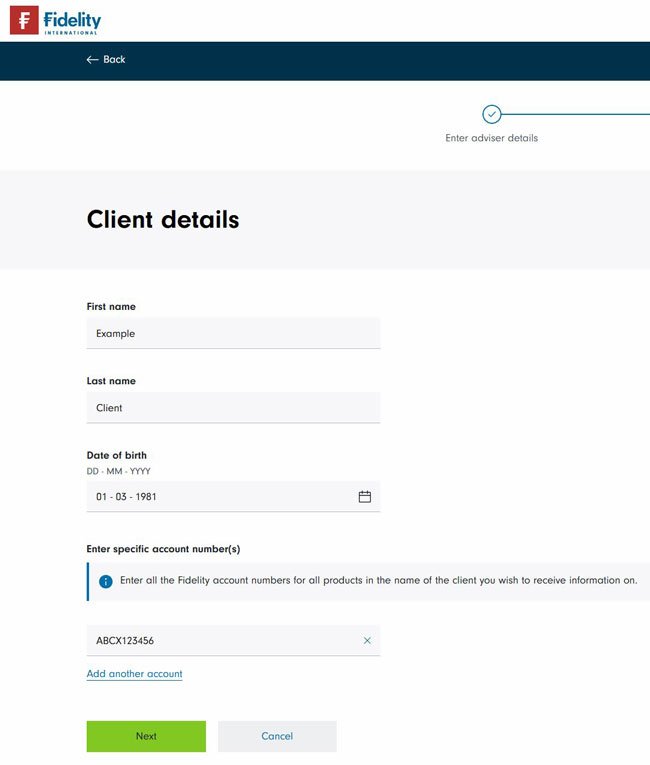

- Simply enter the client’s name, date of birth and the specific accounts numbers that you’d like information on.

- Please note that we cannot accept the ten-digit customer reference number that starts with 100.

- Customers can find their Fidelity account numbers on customer documents or by logging in online to their account. Typically, these are 10 characters long and follow the format ABCD123456, ABC1234567, AB12345678, or 2000123456.

- You can review the information you've entered before submitting your request.

- Once you click 'Confirm and submit' , your request will be processed immediately with on-screen confirm provided once successful.

- You’ll receive instant access to the Client Report which can either be downloaded in PDF or Word format.

- You choose the reporting period and the report sections you’d like to include in the report

- At the top right of the Client Report you’ll see an option to generate the Money in and money out report.

- The Money in and money out report will be sent to the reporting services portal within 24 hours, you’ll receive an email notification when it’s ready to download.

Frequently asked questions

Here are some of the frequently asked questions we receive from adviser firms requesting account information.

Questions not applicable to our products

The following list of questions are not applicable to any of our products available through the Fidelity Adviser Solutions platform.

- Is there a future guaranteed value?

- Is there a guaranteed With Profits bonus rate?

- Is there a guaranteed growth rate?

- Is there a potential for future bonuses?

- Are there any encashment penalties?

- Is there a market value adjustment?

- Is there a loyalty bonus payable under the contract?

- What is the remaining term of the policy?

- Does the policy allow lives assured to change?

- Are there any exit penalties?

- Does the client hold With Profit Funds?

- Please confirm the number of segments a client holds?

- Do you offer a reversionary bonus?

- Is the client invested in a life styling strategy?

The information within the Client Report and the Money in & money out report will help answer many of the question you have. Please note if you aren’t registered with Fidelity Adviser Solutions, we’ll send you a Statement and Valuation that includes all transactions from when the client first opened their account(s) with Fidelity.

Question | Answer |

|---|---|

What type of plan does the client hold? | This is included in both the Client Report and the Money in & money out report |

What was the start date? | The Money in & money out report shows the date of the client's first investment |

Can you send me any illustrations or projections for a client's pension account? | Your client can provide you with a copy of their annual benefit statement; we cannot provide you with this information |

What was the initial amount invested? | The Money in & money out report shows the amount of the client's first investment |

How do I find details of any subsequent lump sums invested? | The Money in & money out report shows the date and amount of any subsequent investments |

Where can I find details of any regular contributions? | The Money in & money out report shows any regular contributions. The account information section of the Client Report shows if the client is still contributing on a regular basis |

What is the current valuation? | This is shown on the Client Report |

What is the transfer value? | This is the same as the current value |

What is the date of the valuation? | This is shown on the Client Report |

Have there been any withdrawals from the investment? | The Client Report shows a total of all withdrawals. The Money in & money out report provides a breakdown of withdrawals and dates. |

If yes, what withdrawals have there been? | This is included in both the Client Report and the Money in & money out report |

Has the client taken any income? | This is shown on the Client Report |

In which funds is the plan invested? | This is shown on the Client Report |

Where can I see a full transaction history? | This is not available, however the Client Report and the Money in and money out report will provide you with current valuation, all contributions, all withdrawals as well as details on fund performance, investment charges, asset allocation and an account set-up summary |

How can I see the current plan holders? | This is included in both the Client Report and the Money in & money out report |

What is the death benefit if different to the current value? | This will be the same as the current value |

What is the surrender value? | This will be the same as the current value |

Amount of lifetime allowance used for this policy? | This information is available within the account summary section of the Client Report |

Who is nominated beneficiary on this plan? | This information is available within the account summary section of the Client Report |

Have any pension assets been crystalised and withdrawn? | This is included in both the Client Report and the Money in & money out report |

Does the client hold any form of transitional protection? | This is included in the Client Report |

What is the Allocation rate? | We do not have exact rates. The Money in & money out report will show details of investment amounts. |

Question | Answer |

|---|---|

Can you supply details of unrealised gains and any previous realised gains/Capital Gains Tax Report? | No, we are unable to provide previous realised gains or a Capital Gains Tax Reports. This reporting is available online for adviser firms with full servicing rights. |

Is internal fund switching allowed? | Yes |

Is it possible to transfer or re-register the account to a different provider? | It is possible to transfer from or to another provider as cash or in-specie (depending on the eligibility of the funds they hold). Please note that any investment transferred as cash will remain out of the market during the transfer process. |

What death benefits are available? | Fidelity facilitates beneficiary flexi-access drawdown. Clients can complete an Expression of Wish form to name the individuals that the scheme administrator should consider when exercising discretion as to whom any benefits may be paid. |

How can clients take money out of their pension? | Clients have the following options for making withdrawals from our pension: income drawdown, PCLS, phased drawdown, UFPLS and small pots |

What interest rate do you pay on cash? | Our cash rates can be found - here |

Does the plan allow partial transfer out? | No |

Do you offer financial advice on this plan? | No |

Do you offer a waiver of premium? | No |

Can clients pass on the accumulated value of their Fidelity ISAs to their spouses and civil partners in the event of their death? | Yes |

Please provide details of alternative schemes the client could transfer to with yourselves and any enhanced terms that may be offered | Before processing a pension transfer out (cash or re-registration), we need to complete due diligence on the receiving scheme, to ensure we're fulfilling our regulatory requirements. For transfers to providers that we interact with frequently, we complete our due diligence up front, so don't need anything additional for individual transfers. |

| What is the total ongoing charge and transaction costs for each fund? | Please refer to the relevant factsheet for each fund. You can find this by using the search at the top of the page. The Client Report provides details of all charges the client has paid during the selected reporting period. | ||||||||||||

| Where can I find what assets are available on the platform? | Download our fund list - here. | ||||||||||||

What is the fee arrangement set up with the full servicing adviser? | Unfortunately, we’re unable to tell you if a fee arrangement existed or provide details of any fee arrangements that have been agreed by the client with the servicing adviser. | ||||||||||||

What charges are applied to the account for advised clients? | We charge a service fee of 0.25% per annum based on the value of the assets held with us. In addition, clients will pay an Investor Fee of £45 per annum payable monthly. For more information relating to our charges, please refer to our online guide, ‘Pricing at a glance’, which can be found under the ‘Technical & resource centre’ then ‘Literature library’. | ||||||||||||

What charges are applied to the account for Fidelity Personal Investing clients? | If your client is a Fidelity Personal Investing customer, they will pay an annual service fee based on the value of their investments. For investments below £25,000 this is a flat fee of £90. Over £25,000 the service fee becomes tiered, and customers will typically pay 0.35%. Please note that customers with a monthly Regular Savings Plan (RSP) of £50 or over who have investments worth less than £25,000 will be charged just 0.35%.

| ||||||||||||

What are your charges for switching? | We do not impose an additional fee for switching. | ||||||||||||

Is there a bid/offer spread on your funds? | Bid/offer spreads apply only to our unit trust range and are a standard feature of this investment type. | ||||||||||||

Are there any additional charges? | In addition to our charges, the client will pay annual ongoing fund charges relating to the underlying funds they are invested in. | ||||||||||||

Are there any suspended assets within the portfolio? | Please refer to the relevant factsheet for each fund. You can find this by using the search at the top of the page. | ||||||||||||

What is the maximum number of funds that can be invested in at any one time? | There is currently no maximum | ||||||||||||

How can I obtain discharge forms or Pension Scheme Tax Reference (PSTR)? | For pensions, we will send any additional paperwork that we require, such as our discharge forms, once we’ve received a customer-signed transfer LOA. | ||||||||||||

Do you offer any fund discounts? | Fidelity actively negotiates cheaper share classes with many providers within the industry. Download our fund list - here. | ||||||||||||

How many funds and fund management companies are available on the platform? | Over 6,900 investment options from more than 140 different providers, including funds, Exchange Traded Products, Investment Trusts, and direct equities. Alternatively download our fund list - here. | ||||||||||||

How do I know if an investment is onshore or offshore? | Please refer to the relevant factsheet for each fund. You can find this by using the search at the top of the page. | ||||||||||||

| Do you offer any guarenteed investments? | Yes, for further details click here. |

Workplace pension schemes

We’re sorry – our online service isn’t available at the moment

At the moment, you aren’t able to request a Workplace Investing Client Report online because we’re having some technical issues. We’re working hard to resolve the problem and we’ll add updates to this page, so please check back soon.

If you require urgent client information, please email pensions.service@fil.com, call or write to us.

| You’re registered with Fidelity Adviser Solutions, if: | You’re not registered with Fidelity Adviser Solutions, if: | |

|

To register now go to Start Adviser Registration | |

| If you’re registered: | If you’re not registered: | |

| To ask for information | Use our online services. Simply enter the client details and choose the accounts you’d like information about. We’ll process your request and the Report will be available within 24 hours.* | If you are unable to register, you can send us a Letter of Authority. |

| To access the report | It will be uploaded to your Adviser Firm Documents. You’ll find it under the ‘Firm’ tab on the left-hand menu. | We’ll send you a copy of the Report by post within 10 working days of receiving your request. Please note that your request will be processed much more quickly if you use our online service. |

If your firm is set up for access to our online services, but you don’t have your own individual log in, speak to your firm administrator. They’ll be able to set you up as a user with your own consultant ID.

*Important Information:

- If the scheme is based overseas or involves hybrid benefits requiring contact with a third party, the report will be issued to you by post within 10 working days.

Want to register your firm with Fidelity Adviser Solutions?

It’s easy to do online. Go to

Start Adviser Registration and follow the instructions.

When you’ve sent your request, you’ll get access to the following client information. The Report will include:

- An account summary

This includes the name and type of account, and the date the member joined. It shows the scheme's default retirement age, and the selected retirement age (if there is one). And it also includes assumptions about growth. - The total amount invested in the account

The Report shows the total amount invested, and which funds the account is invested into. The client can also check the amount invested on PlanViewer, our online portal. - A one-year transaction history

This is limited to the last 100 transactions. It shows the level and frequency of historical contributions and a breakdown of the different contribution types. The client can view their full transaction history on PlanViewer. - A current valuation of the account

The Report will contain a current, dated valuation, and a transfer value. - Death benefits

The Report includes any benefits to be paid on death. - Benefits transferred in

All benefits transferred in are included. And any protections such as protected tax-free cash, or a protected retirement age – are taken into account. - The Report also includes:

- Investment charges

- Product charges and features

- Information about transferring pensions

- The client’s investment options, and the different ways they could take their pension income

- A transfer illustration, a transfer-out questionnaire and a discharge form.

The Report will be available in your Adviser Firm Documents. You’ll find it under the ‘Firm’ tab on the left-hand menu.

Our online service is quick and easy to use. Here’s a step-by-step guide.

Once you’ve sent us your request, the report will be available in the Adviser Firm Documents section of your account within 24 hours.

Log in to the Fidelity platform, go to ‘Servicing’ then ‘Client Servicing’. You’ll see a tab for ‘Information only requests’.

Your firm’s name and UAN (Unique Agency Number) are already filled in. If you’re logging in from your firm’s head UAN, you’ll see a drop-down list. You can use it to choose a specific sub-UAN. Select Fidelity Workplace Investing and click ‘Next’.

Enter the following details:

- The client’s name and date of birth

- The specific account number(s) you’d like information about.

The account number is on the member’s Annual Statement, or on any other letter they’ve received from us. It’s six or seven characters long and usually starts with a ‘C’ or a ‘5’.

Once you’ve added an account, you’ll see an option to add more if you want to. Click ‘Next’.

You’ll be taken to a confirmation page where you should carefully check the information you’ve given us. You must confirm that you have permission from the client to request their account information, and that they agree to the use of their personal details. Click ‘Submit’.

You’ll see a confirmation that your request has been submitted.

The report will be available in your Adviser Firm Documents within 24 hours. You can get to your documents by clicking ‘Firm’ tab on the left-hand menu.

Some Frequently Asked Questions

The Report should answer most of your questions about the pension account. If it doesn’t, the client can access more detailed information on PlanViewer.

The Report tells you the name and type of scheme, and the date the client joined. It also shows the scheme's default retirement age, and the selected retirement age (if there is one).

The Report shows the total amount invested, and which funds the account is invested into.

The report gives a one-year transaction history which is limited to the last 100 transactions. It shows the level and frequency of historical contributions and a breakdown of the different contribution types.

The client can check their full transaction history on PlanViewer, our online portal.

The Report contains a current, dated valuation and a transfer value.

The Report includes any benefits to be paid on death.

The Report includes all benefits transferred into the account. Any protections included as part of a bulk or block transfer – such as protected tax-free cash, or a protected retirement age – have been taken into account.

You’ll be able to see all investment charges, product charges and features, as well as information about transferring pensions. You’ll also be able to see the investment options available, and the client’s pension income options.

Yes – and there’s no charge for switching.

Yes, they can transfer into or out of their account as cash. But it’s important they understand that while their investments are being transferred as cash, they’ll be out of the market. That means they could miss out on any potential growth during that time.

This will depend on the specific rules that apply to their scheme.

This will depend on the specific rules that apply to their scheme.

No.

No, our Workplace Investing schemes don’t allow for adviser fees or commissions.

We don’t usually need members to take financial advice before they transfer. However, if the pension they want to transfer has safeguarded benefits, we need them to take advice first. Safeguarded benefits could include a guaranteed minimum pension (GMP), a reference scheme test underpin (RST), or section 9(2b) rights.

The Report contains a list of all the investment options that are available, with links to the relevant factsheets.

There's currently no limit to the number of funds a client can invest in at any one time, however they can only invest in funds that the scheme permits.

All fees and charges can be found on the factsheets in PlanViewer.

- Is there a future guaranteed value?

- Are there guaranteed With Profit bonus rates?

- Are there guaranteed growth rates?

- Is there potential for future bonuses?

- Do encashment penalties apply?

- Have there been any market value adjustments?

- Are there any loyalty bonuses or exit penalties?

- Does the client hold any With Profit funds?

- Do we offer reversionary bonuses?

- Does the member have life cover?

- Are there any ongoing adviser fees set up on the account?

- What’s the remaining term on the policy?