In financial folklore, there is a view that expenditure in retirement resembles the shape of a smile. High expenditure during the early years when people are healthy and keen to make the most of retirement, followed by a slowing down as health issues emerge leading to a fall in income needs, then an uptick in expenditure as long-term care costs dominate late in life.

For some people this may be true, but for most people ‘smile’ isn’t the path they’ll follow:

- The Institute and Faculty of Actuaries estimates that, in England, approximately one in four men and one in three women over 65 will have ‘substantial care needs at some point in their lives’1.

- UK census data from 2021 shows that around eight in ten people aged over 90 years were not living in care homes and less than 4% of those aged 80 to 84 were in care homes2.

Increasingly, people will be cared for in their home, but much home care is provided by family and friends. Estimates suggest there are over 5 million unpaid carers in the UK3. In contrast, there are less than 1 million paid carers4.

What’s more, it’s possible long-term care needs may recede further in the future. Robert Butler, founder of the International Longevity Centre, suggests that it is ‘not so far-fetched to imagine a newly vigorous and energetic third of life can be practiced by a majority of older persons who remain physically and mentally able until very close to the end of life’5.

It’s not difficult to understand this perspective. New treatments are being introduced rapidly. The founders of a firm that partnered with Pfizer to manufacture a revolutionary Covid vaccine, have said they’ve made breakthroughs that fuel their optimism for cancer vaccines perhaps as early as 20306.

The path through retirement is not homogenous

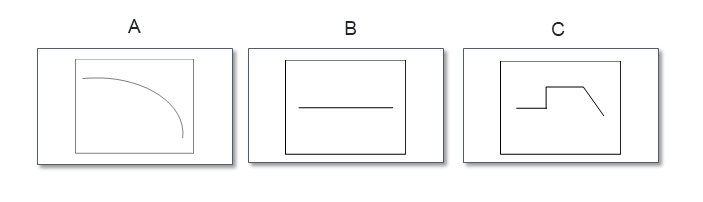

Alternative patterns of expenditure in retirement could take several shapes. In some cases, expenses may gradually decrease as mobility reduces over time, but without the need for expensive long-term care at the end of life (see A below). In other examples, someone could lead a productive retirement, then die after a short illness or suddenly - perhaps after a heart attack, stroke or accident (see B below). Given the increasing trend to gradually transition to retirement, income needs from retirement savings may be small in the early years (to supplement income from employment), then increase when outright retirement occurs, then steadily reduce as health deteriorates (see C below). There are endless permutations.

There are multiple patterns of expenditure during retirement

What are the implications?

There are a number of take-outs:

- It may not make sense for people to deny themselves a comfortable retirement to preserve their retirement savings in case they do require care. This is particularly the case where there is a backstop they can rely on like property equity or the prospect of a windfall legacy. Even if they don’t have a safety net, they won’t be denied access to care (though they may lose the option to choose where and how they are cared for).

- The absence of a homogenous retirement journey means it’s essential that advisers maintain contact with their clients throughout their retirement. Not just to monitor the pattern of expenditure, but also the likely timing of any changes. For example, how many active years will someone enjoy? When will they start to slow down (and how quickly)? If long-term care is required, when will it start - and when will it end?

- If income gradually reduces, it might not be necessary to fully inflation-link income throughout retirement, which means people could take more in the early years. It also means a level annuity may make sense. It provides more income at outset, compared with an inflation-linked annuity, and the fall in expenditure over time might roughly match the declining value of a level income after allowing for inflation.

A final word of warning. A 2022 Institute for Fiscal Studies report suggests that it is not conclusively proven that expenditure falls during retirement. The nature of expenditure may change with a fall in money spent on holidays and socialising, offset by increases in household bills and help around the home (gardening and cleaning, for example)7.

Though we can’t say conclusively that expenditure will fall during retirement, it’s reasonable to assume that it could fall in many instances. Either way, an adviser’s role is critical throughout retirement to steer and direct clients as their circumstances change.

Discover more about inflation and patterns of expenditure in our report The impact of inflation on retirement planning.

Latest articles

Sourcing a report-writing tool – the eight questions to ask provide…

Report writing for clients can be a time-consuming task for advice practition…

Why the 4% rule shouldn’t be ‘the tail that wags the dog’

The recent FCA thematic review of retirement advice questioned whether a sing…

AI and Cybersecurity – understanding the potential security risks

With AI becoming increasingly prevalent in both the professional and personal…