Unsurprisingly, strategies have been developed to combat this danger. These may all be appropriate in the right circumstances, but there can be a price to pay. This may be a drain on performance or restrictions on withdrawals.

Some of the more common methods of tackling sequencing risk include:

- Living off natural income or yield. Clients use the interest, dividends and income generated by their fund and withdraw this each year. The obvious disadvantage is that income is likely to vary year by year.

- Fixed percentage of the fund. A variation is to take a fixed percentage of the fund value each year (as opposed to a fixed percentage of the initial fund value). Again, income can rise and fall from year to year.

- Rising equity glide path. This involves starting with a low exposure to equities, usually between 20-40%, rising over time to between 40-80%. However, if markets rise during the early years, there is an opportunity cost.

- Cash bucket. A further approach is to hold a cash buffer. This usually involves dividing the fund into sub-funds or ‘buckets’, typically cash, bonds and equities. The cash bucket might equate to 2-3 years income to ride out market falls.

Each of these can be effective, but all may come at a price. This could be lower exposure to equities or holding significant cash reserves. Alternatively, income might fluctuate from year to year (which may not be practical).

How worried should we be about sequencing risk?

Significant market falls, without a relatively quick recovery, are rare. US data reveals that the average length of a bear market is about 9.6 months. Since 1945, there have been 15 bear markets – one roughly around every 5 years . This suggests that, over most time periods, markets rise. Holding excess cash or reducing equity exposure may detrimentally impact performance.

Are there strategies that might produce better long-term outcomes and protect against sequencing risk? There is evidence that including a guaranteed lifetime income within drawdown could achieve this. These products are similar to annuities and available on investment platforms.

Consider a 65-year-old with a £500,000 fund planning to take an income of £20,000 each year. Using annuity rates as an example, a single life, level annuity purchased with £200,000 would currently provide over £15,000 p.a. That means the client would have to withdraw a little over 1.5% from the remaining fund. This is based on a level annuity, so inflation protection would need to be provided by the remaining fund (note that rates for guaranteed lifetime income products on investment platforms may differ from annuity rates).

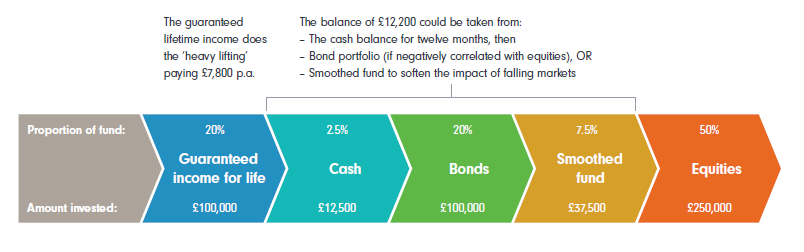

In this example, 40% of the fund is used to buy a guaranteed lifetime income and 60% is invested in equities. Bonds could be added to aid diversification. What if we use 20% of the fund to buy an annuity, invest 20% in bonds and the remaining 60% in equities? Again, using annuity rates as a proxy, single life, level annuity rates at age 65 provide around £7,800 per £100,000 purchase price leaving £12,200 to be found from the remaining fund. This means just over 3% still needs to be withdrawn. This could leave the client still exposed to sequencing risk. Adding a small cash reserve could mitigate this or income could be taken from the bond element (assuming a negative correlation with equities).

A further refinement could be to add a smoothed managed fund. When markets fall, the value of the fund may fall, but by less than the actual movement in the price of the underlying assets. The addition of a smoothed fund provides an alternative source to make up any shortfall if bonds and equities are positively correlated (and any cash reserve has been exhausted).

The chart below is an example of how these assets could be deployed to mitigate sequencing risk without holding significant cash reserves or at the expense of significantly limiting exposure to equities. In any particular case, the assets deployed and the percentages adopted would depend on the individual circumstances of the client.

A guaranteed lifetime income and a smoothed fund can mitigate sequencing risk

There are several benefits to this strategy:

- Guaranteed lifetime income generates much of the income required in the early years.

- A small cash reserve of 2.5% could provide 12 months’ income.

- Bonds could be used to generate income if bond values rise when equities fall.

- If bonds and equities both fall a smoothed managed fund could act as a stopgap to cushion the impact of any further market falls.

This is not intended as a panacea. In any particular instance, any of the other strategies reviewed could be more appropriate. It will depend on the objectives and circumstances of each case. To find out more about how this approach compares with a more traditional strategy, check out our report The benefits of integrated solutions.

Latest articles

Evolving stability: smoothed funds reimagined

Trying to shield policyholders from the extremes of market volatility isn’t a…

Tax increases reignite the bonds versus collectives question

Tax hikes on savings and dividends from 2026 and 2027 slightly shift rates bu…

Inheritance tax - Give while you live

Using pension savings to sidestep inheritance tax