As people begin to reflect on their life after work, they’re often consumed by one question: How much do I need for a comfortable retirement? This isn’t just about the level of income they need, but how much should they have saved to provide that income?

The Pensions and Lifetime Savings Association developed the Retirement Living Standards. The study estimates the annual income required at different levels of comfort for a single person and a couple. They define three categories of expenditure: ‘modest’, ‘moderate’ and ‘comfortable’.

The figures for a comfortable retirement are as follows:

| Net | Gross | |

|---|---|---|

| Single | £43,900 | £52,220 |

| Couple | £60,600 | £69,446 |

Source: Retirement Living Standards, Pension and Lifetime Savings Association, 2023.

In terms of defining ’comfortable’, it’s worth noting that this isn’t living extravagantly. The Retirement Living Standards study assumes the weekly shop is at Sainsbury’s, holidays allow for 14 days in the Mediterranean plus three weekend city breaks and motorists will drive a three-year-old Ford Fiesta, replaced every five years1.

The Retirement Living Standards figures are helpful in defining the income level, but how much is required to fund that income? We could simply assume a reasonable withdrawal rate and work from that. In its 2024 study2, Morningstar modelled safe withdrawal rates based on future assessments of returns and current market conditions. The Morningstar analysis suggests that a safe withdrawal rate for UK retirees, based on a 90% probability of success over a 30-year period is 3.7%. Bear in mind, the recent FCA thematic review3 made the point that reliance on a single rate without taking into account individual circumstances should be avoided.

If a gross income of £52,220 is needed for a comfortable retirement, and the maximum State Pension of £11,973 is included, this leaves a balance of £40,247. Ignoring other assets, and any defined benefit income, this would require a fund of more than £1m (based on withdrawing 3.7%). If the 25% tax-free cash is used as part of the fund this would bring the number down a little. People who can provide for a comfortable retirement on this basis are in a privileged position.

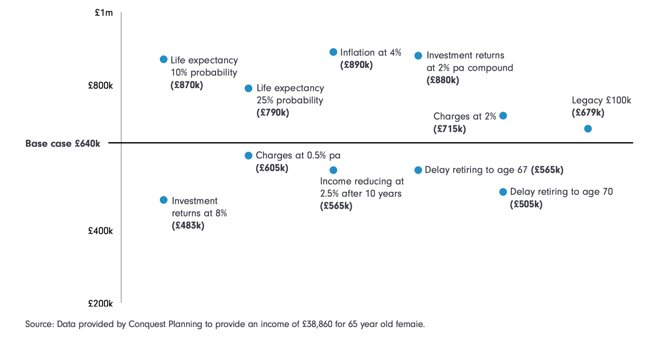

What happens if the figures don’t add up? There are actions people can take including retiring later, ignoring inflation, withdrawing income at a higher rate or taking on more investment risk. Analysis by Conquest Planning, undertaken in the tax year 2023/24, attempts to assess the relative impact of different factors on the amount required for a comfortable retirement. The calculations are based on data at that time. While this may not reflect the current situation, it is likely that the relative impact of the different factors that influence the cost of funding a comfortable retirement will still be valid. You can find out more about the precise assumptions used in our report How much does a comfortable retirement cost?

The study looked at men and women separately as well as single or married. The chart below is for a 65-year-old man living for 20 years (average life expectancy). This brings the cost of a comfortable retirement down to £600,000 (funds only need to last for 20 years). Different influences are then explored. These cover the cost of living to 92 (see ‘25% probability), or 96 (10% probability), delaying retirement to 67 or 70, the average rate of inflation increasing from 2% to 4% and the impact of reducing income by 2.5% each year after 10 years. The study also looked at investment returns higher and lower than the core assumption of 5% and charges higher and lower than 1% p.a. The impact of leaving a legacy of £100,000 is also considered.

Impact of varying assumptions on cost of a comfortable retirement

If we look at the factors that increase the base costs, the probability of living to 96 has the greatest impact (£835,000), but only one in ten, 65-year-old men will live this long. Living to 92 has less impact, but is still significant (£750,000), three out of four, 65- year-old men will die before 92. Inflation increasing from 2% to 4% is a significant risk factor (£803,000). Low investment returns of 2% p.a. also have a major impact (£810,000), while ‘Charges at 2%’ and ‘leaving a legacy of £100,000’ have less impact, relatively speaking.

Turning to those variables that lower the base case costs, high investment returns of 8% have a significant impact. The base case costs reduce from £600,000 to £460,000. Similarly, deferring retirement to age 70, including delaying receipt of the State Pension, also reduces the cost to £460,000. Delaying retirement to 67 and reducing income after 10 years have less impact (reducing the costs to £520,000 and £530,000 respectively).

Overall, delaying retirement by five years has a significant influence on lowering the cost of a comfortable retirement, as does higher investment returns - emphasising the need to maintain exposure to high-risk assets (sequencing risk aside). In contrast, living significantly longer than average life expectancy, low investment returns and high inflation all significantly increase costs.

The calculations for females and married couples, as well as more details on the analysis, are included in our report on this subject How much does a comfortable retirement cost?

Latest articles

Evolving stability: smoothed funds reimagined

Trying to shield policyholders from the extremes of market volatility isn’t a…

Tax increases reignite the bonds versus collectives question

Tax hikes on savings and dividends from 2026 and 2027 slightly shift rates bu…