In the November 2025 Budget, the Chancellor somewhat unexpectedly announced an across the board 2% rise in the rate of income tax paid on savings interest generated outside of ISAs and pensions from April 2027. Therefore, the savings basic rate will rise to 22%, the savings higher rate to 42% and the savings additional rate to 47%.

It is understood that the increased rates of savings tax will also apply to the taxation of onshore and offshore investment bonds, including the internal rate of taxation for onshore bonds. As such, the internal rate of taxation (and credit) for onshore bonds will be aligned to the basic rate of tax at 22%.

In her Budget statement, the Chancellor also announced that dividend tax rates will rise by 2% (to 10.75% for the dividend ordinary rate and 35.75% for the dividend upper rate), although this increase comes into effect from April 2026. Investments held within General Investment (collective) Accounts will therefore be affected by this increase.

These tax increases have inevitably raised the old question of what is the most tax-efficient way to invest – within collectives or in an onshore or offshore bond? Of course, it’s easy to be persuaded to consider one tax wrapper over another by focusing on one element of investment return, or one set of circumstances. However, to truly consider the most efficient wrapper, it is important to consider several variables. These include, but are not limited to:

- How long the investment is likely to be held.

- The expected marginal rate(s) of tax borne during the investment.

- The expected marginal tax rate(s) on encashment.

- What allowances (savings, dividend, and capital gains) are likely to be available each year.

- The investments chosen, the expected annual distribution yield, and an estimation of annual return.

The last bullet point is especially important. For example, the Fidelity UK Index (Inc) Fund currently has an expected yield of 2.98%, whereas the Fidelity US Index (Inc) Fund has an expected yield of 0.92%. In other words, to properly analyse the most tax-efficient tax wrapper, you must first understand the likely returns.

How the tax increases impact wrapper choice

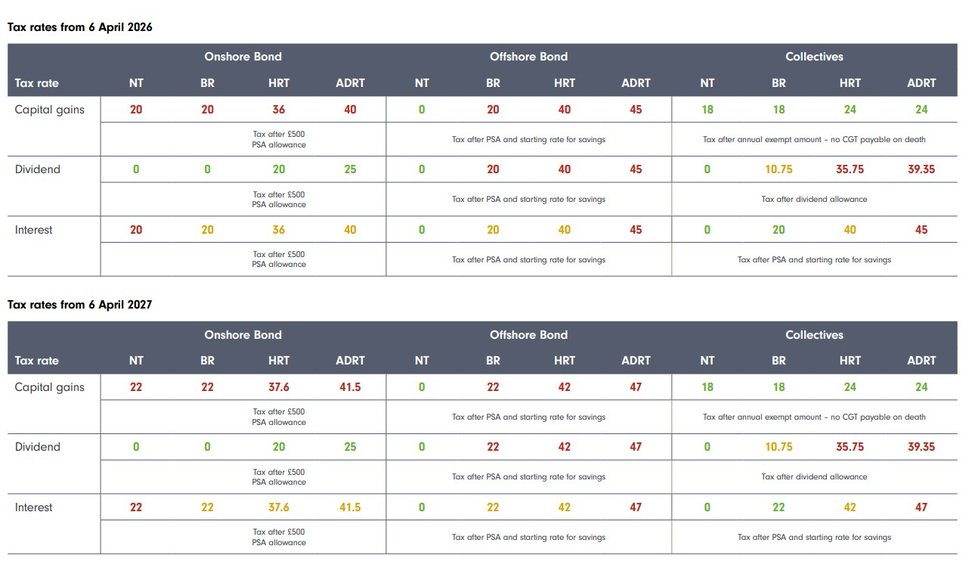

So, let’s consider which wrappers have the lowest effective tax rate both now and when the tax increases are implemented. Firstly, a reminder of the tax rates that apply as at 6 April 2026 and 6 April 2027:

Now, to establish which wrapper has the lowest effective tax rate, we need an example. Let’s take an investor who wishes to invest over 10 years in a 60/40 split of equities and bonds. To keep things simple, I’ve assumed the client invests purely into a world index fund (currently yielding 1.5%) and a global bond fund (yielding 4%) with an overall annual return of 6% and no withdrawals. This breaks down as 3.5% annual capital growth, 0.9% dividend and 1.6% interest.

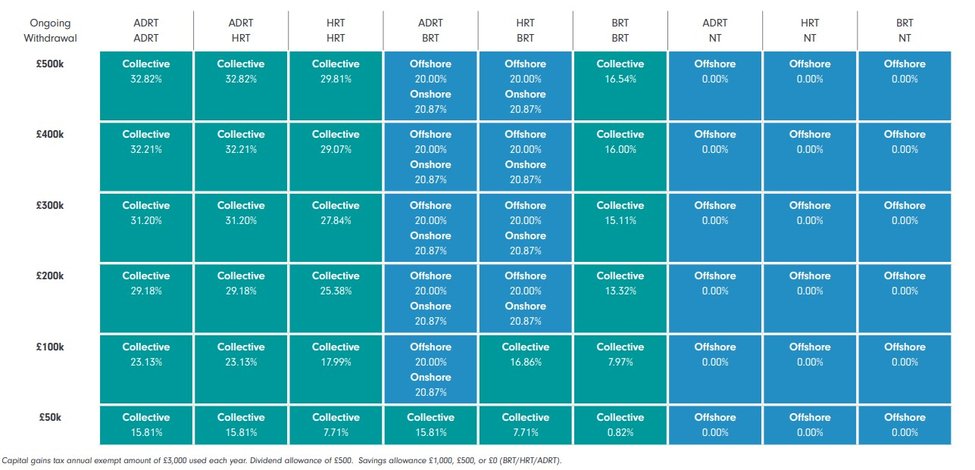

Based on current tax rates (before any Budget changes), the comparison of different wrappers would look as laid out immediately below. The wrappers shown are those with the lowest effective rate of tax deducted over the investment term (where the difference is less than 1%, more than one wrapper is shown).

Comparing the options – current tax rates

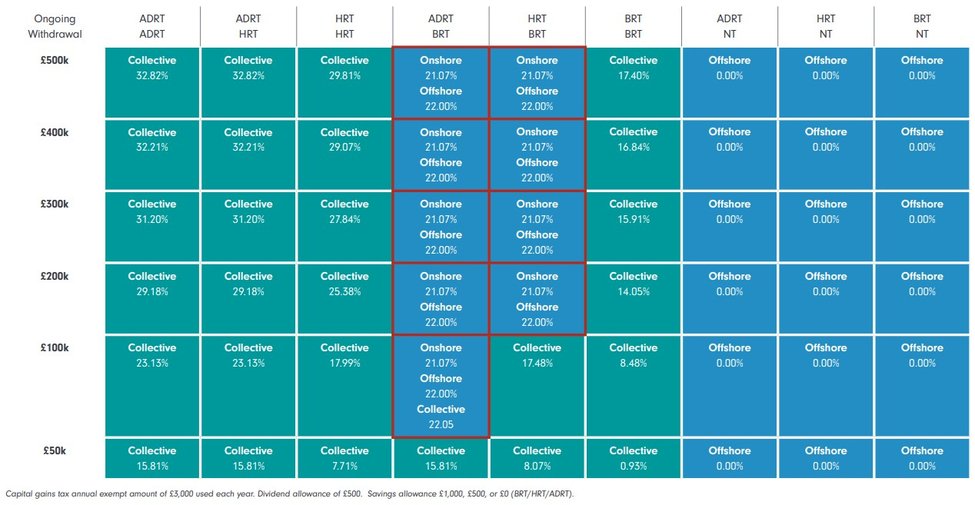

Now, let’s compare this with someone investing on 6 April 2026 and incorporate the tax changes.

Comparing the options – new tax rates (2026/27 and 2027/28 changes)

As you can see, while the rates of tax will change, it makes minimal difference to the tax wrapper preference. As mentioned before though, it is important to consider each individual client and their own circumstances and ensure any valuable allowances are used as part of a financial plan.

Latest articles

Evolving stability: smoothed funds reimagined

Trying to shield policyholders from the extremes of market volatility isn’t a…

Inheritance tax - Give while you live

Using pension savings to sidestep inheritance tax

Does saving into a pension still make sense?

This article explores the impact of the 2027 IHT rules, busts common myths, a…