Topping up a pension cash account

Reasons to top up a Pension Cash Account

You may wish to top up a Pension Cash Account for the following reasons:

- Prior to a client’s retirement, you may wish to top up their PCA a year or two beforehand in order to reserve some money for tax-free cash

- During retirement to cover, for example, income required by the client for the next two years

- To pay for fees (rather than selling down from a client’s account on a regular basis, money is kept in cash to pay for fees due).

Topping up a PCA also brings the following benefits:

- A smoother and quicker process to top up product cash without needing to go through the switch journey

- For proportionate sells to cash, there’s no requirement to calculate the amounts to be sold from each fund as this is calculated for you

- No further requirements to delink and relink models, making the process less time consuming.

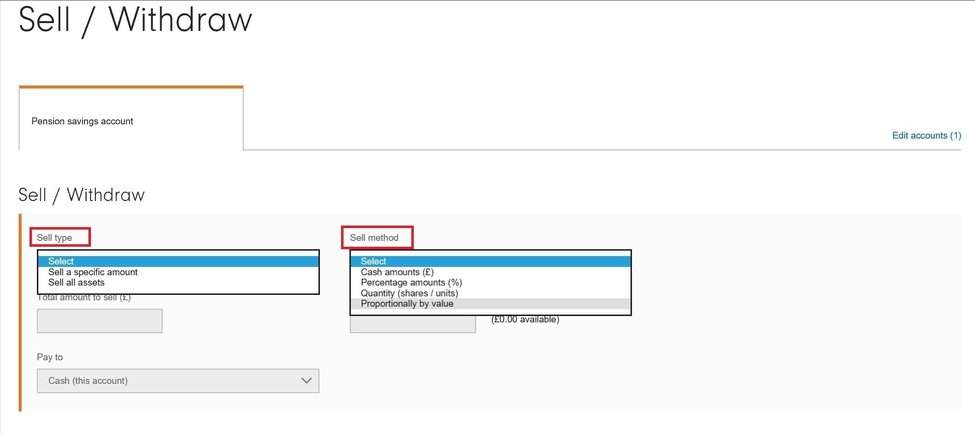

You will then be asked whether you want to sell a specific amount or all assets. You will also be asked to specify the method by which you wish to sell (there are four options):

- Cash amounts (£)

- Percentage amounts (%)

- Quantity (shares/units)

- Proportionately by value – please remember you will not have to select an amount as this will be calculated for you and presented to you on screen for your approval.

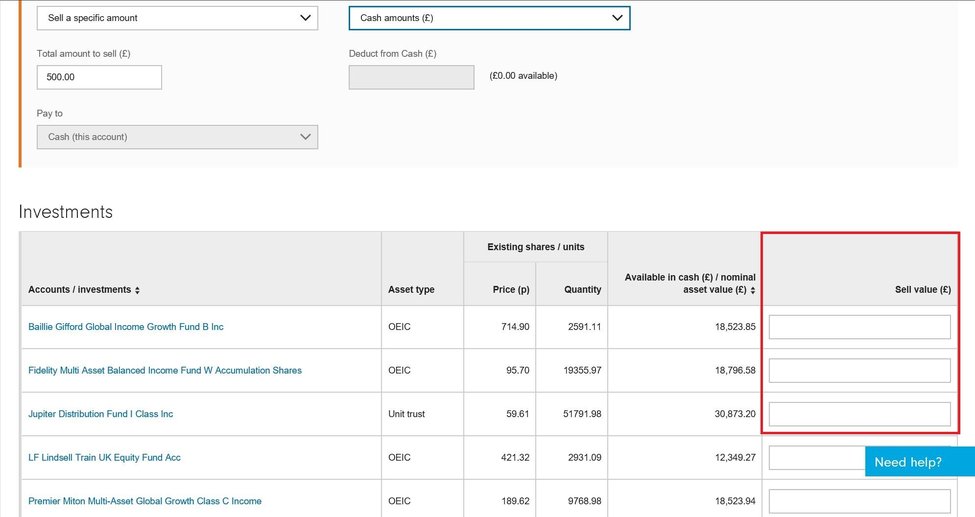

If you wish to sell a specific amount, you will be presented with the following screen where you input the amount required.

Finally, once confirmed, you can view all cash sells within ‘Instruction Tracking’.

Related content

About our pension

Our low-cost, flexible personal pension offers access to funds and ETIs for both pre- and post-retirement planning purposes.

Retirement income hub

A hub presenting insights and ideas on ensuring a client’s income lasts a lifetime.

The Pension Forum

Paul Squirrell, our pension expert, clarifies the rules relating to some specific areas of retirement planning.