About our Pension

Our low-cost, flexible personal pension offers access to funds and ETIs, such as Exchange Traded Products, Investment Trusts and equities, for both pre- and post-retirement planning purposes. It is also available as a Junior SIPP.

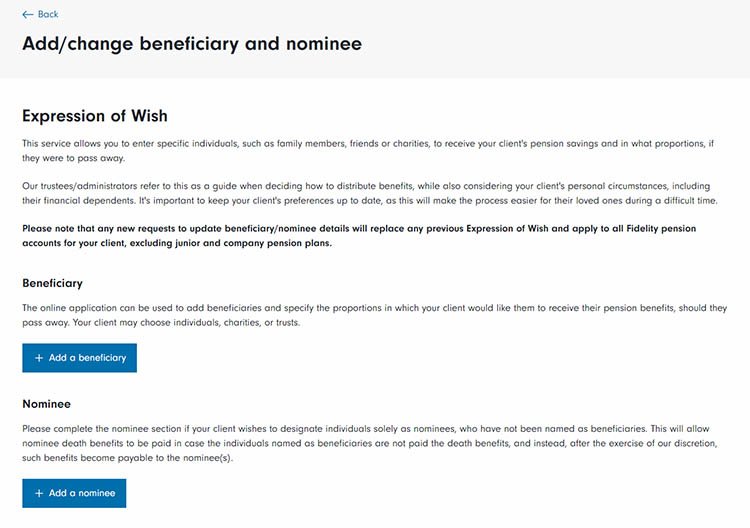

In the event of a client’s death their pension will usually provide benefits to be passed on to others. Please complete an Expression of Wish form to name the individuals that the scheme administrator should consider when exercising discretion as to whom any benefits may be paid.

The Expression of Wish for your client's pension accounts (which can include individuals, charities or trusts) can be registered in either of the following ways:

1. Completing the online Expression of Wish journey and submitting online.

2. Printing and completing the relevant form; Expression of Wish and Nomination form or the Expression of Wish and Nomination form (including Charities and Trusts). This can then be sent to us via the Upload & Send service. Please note that Expressions of Wish for junior pensions must use this option.

To complete the Expression of Wish online (whether adding or amending details), please follow the below steps:

1. Search for client

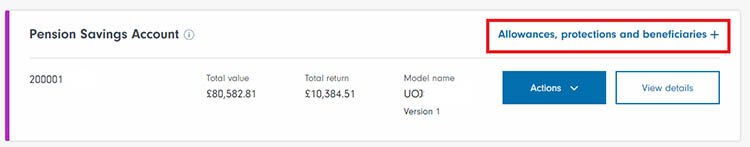

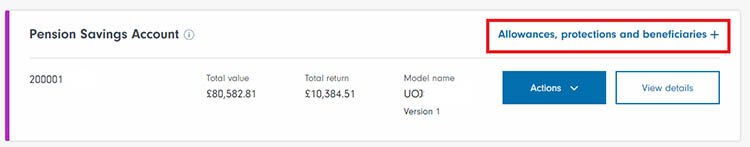

2. Once client is in context, click on Allowances, protections and beneficiaries link to expand the account card.

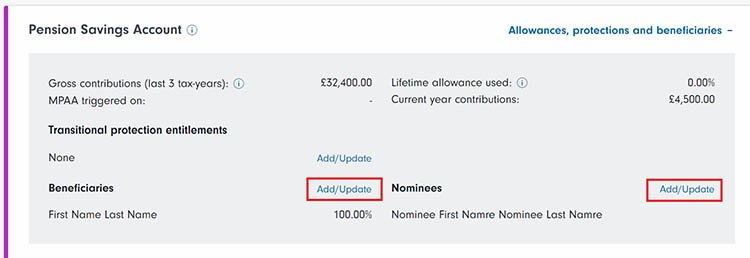

3. To add or amend a beneficiary or nominee, click ‘Add/Update’

4. On the following screen, to add/amend a beneficiary or nominee, click on the relevant link.

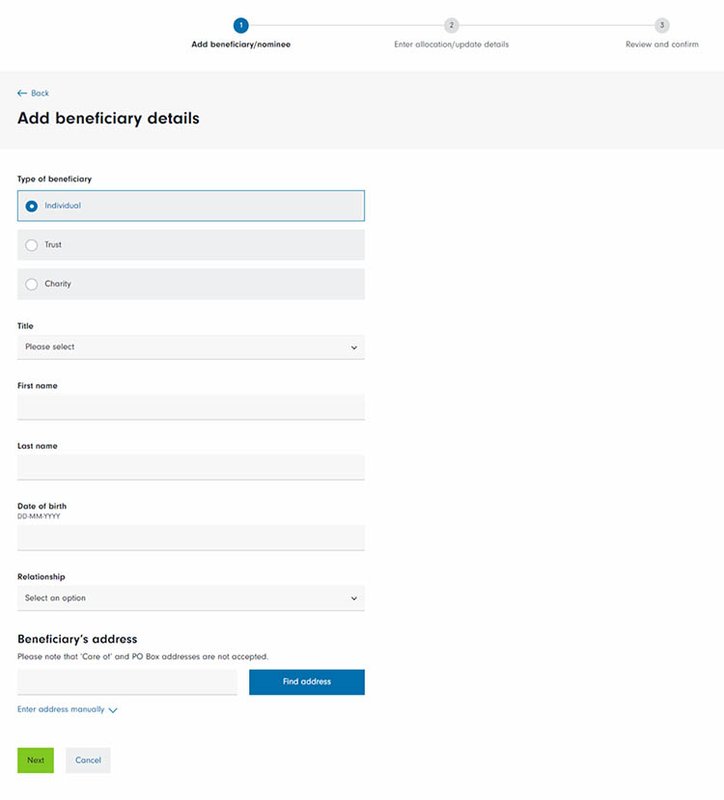

5. Complete the relevant details for beneficiaries.

To add a beneficiary that is an individual, you will need the following information to complete the online form:

- Name

- Address

- Date of birth of the nominee/beneficiary

- Their relationship to the pension account holder

- The percentage allocation.

To add a beneficiary that is a Trust, you will need the following information to complete the online form:

- Name of the Trust

- Name of Trustee

- Date the Trust was created

- Trust’s address

- The percentage allocation.

To add a beneficiary that is a Charity, you will need the following information to complete the online form:

- Name of the Charity

- Charity registration number (optional)

- Charity’s address

- The percentage allocation.

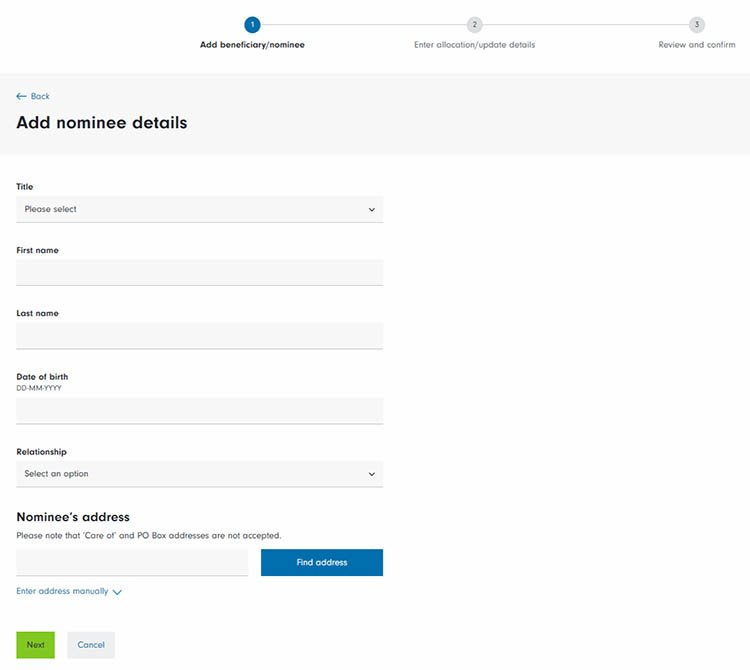

6. Complete the relevant details for nominees, if applicable.

To add a nominee, you will need the following information to complete the online form:

- Name

- Address

- Date of birth of the nominee/beneficiary

- Their relationship to the pension account holder

- The percentage allocation.

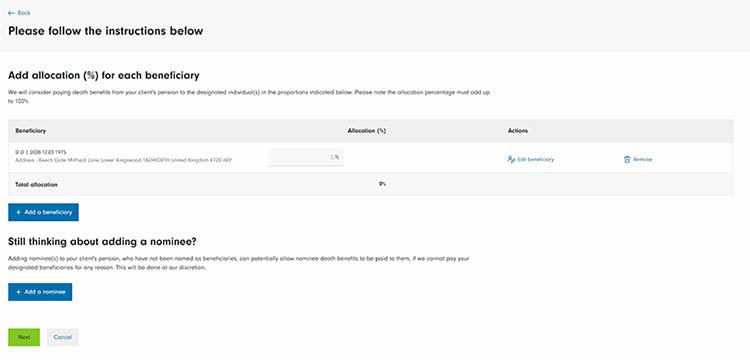

7. Add the percentage allocation for beneficiaries

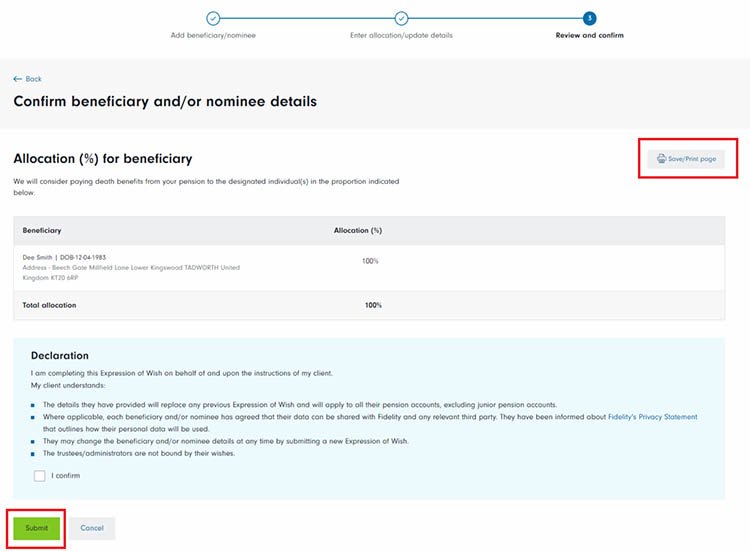

8. Review the details you have entered. You can save a copy to your computer or print what you have entered for audit purposes or to provide to your client for their own records.

9. Submit online form to register the Expression of Wish details.

Once an instruction has been submitted, the updated details will be available to view online by navigating to the client summary screen. If you do not see the updated beneficiaries and nominees, please refresh the page or wait a few minutes before checking again.

Any future amendments to an Expression of Wish will require a new form to be submitted, following the steps outlined above.