Your pension phased drawdown service

Our pension drawdown service has been enhanced and provides the ability to set up:

- Automated regular crystallisation and PCLS

- Automated regular taxable income

- One-off crystallisations/PCLS and;

- One-off taxable income or;

- Combinations of instructions as detailed below.

How we crystallise assets and pay out PCLS and taxable income

Regular crystallisations and taxable income

Our automated service allows you to set up regular crystallisations, providing your clients with a regular PCLS (tax-free cash) payment without the need to submit an instruction each time.

For regular crystallisations, money is moved to the Drawdown account by using any available cash first and for any shortfall, assets will be moved proportionately.

To meet your clients’ needs and provide flexibility, we offer a choice of crystallisation frequencies: monthly, quarterly, half yearly and yearly, as well as two payment dates; either the 10th or 25th of the month.

Once the crystallisation has been processed, we pay PCLS and any income as follows:

For regular PCLS, this is taken from cash first, but where there is insufficient cash, our default is to take the shortfall by disinvesting proportionately from all assets in the drawdown account, or you have the option to select the largest fund. A 2% oversell will be made to allow for market movements/brokerage charges.

For regular income, this is taken from cash first and any shortfall will be funded by either proportionately disinvesting from assets, largest fund or nominated funds. When instructing a standalone regular income, a 2% oversell will be made to allow for market movement/brokerage charges.

This flowchart is designed to support you in identifying the options available to your client, and any additional considerations you need to be aware of.

10-min watch

One-off crystallisations and taxable income

For one-off crystallisations, we have enhanced the options as to how money can be moved from the Pension Savings Account into the Drawdown account, allowing for more flexibility in how you choose to crystallise assets:

- Cash first then proportional

- Cash first then largest fund

- Defined cash then proportional

- Defined cash and funds

- All proportional

The number of options allows you to tailor how we crystallise to suit the investment strategy you hold on an account.

For one-off PCLS, this will be funded using any available cash first and any shortfall will be funded by either proportionately disinvesting from assets, largest fund or nominated funds. A 2% oversell will be made to allow for market movement/brokerage charges.

For one-off taxable income, this will be funded using any available cash first and any shortfall will be funded by either proportionately disinvesting from assets, largest fund or nominated funds. A 2% oversell will be made to allow for market movement/brokerage charges.

Combining One-off crystallisation with regular income

If you wish to crystallise a larger amount to realise more tax-free cash but then make smaller regular taxable income payments over a period of time, this combination can now be achieved with the benefit of having the increased number of crystallisation options as well as disinvestment options for tax free cash and taxable income.

It is important to note that the new crystallisation and disinvestment options noted above are not available when instructing a one-off crystallisation combined with a one-off income together. However, if these new options are required, PCLS and Income can be submitted separately.

8 minutes

4 minutes 41 seconds

8 minutes

Benefits for you

Bank mandates

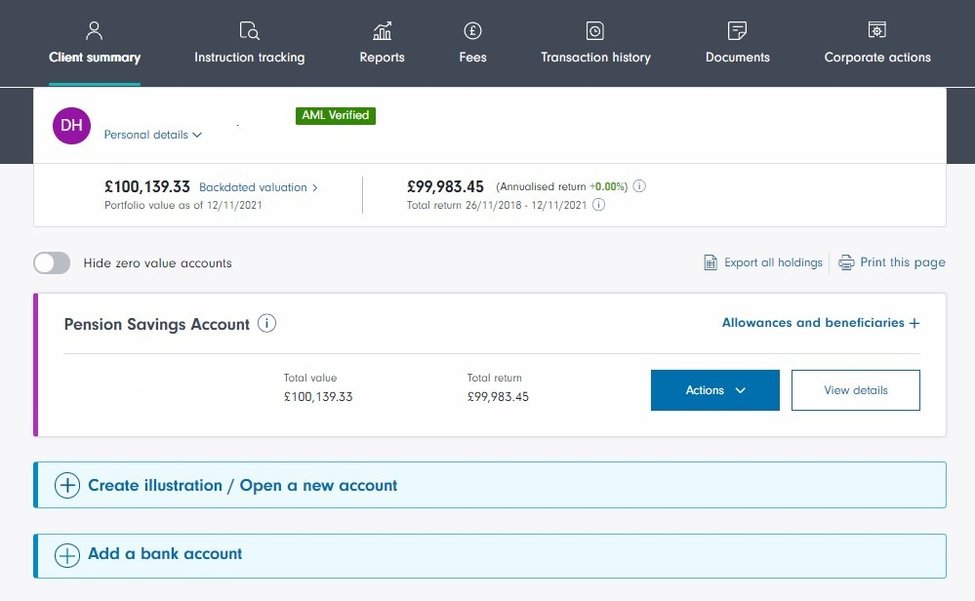

With the new service, it’s important to set up the client’s bank account online if one hasn’t been set up already. You can do this at any time and once added, it will be verified through our automated, online verification system and you will be instantly notified whether the bank account has passed the verification, or not. This should be done on the client summary screen prior to setting up a crystallisation.

Please note a bank account cannot be set up within the crystallisation journeys.

If the bank account cannot be verified, you will be directed to call us on a dedicated line to go through verification manually with our Bank Mandate Verification team.

The flexible pension decumulation options available on our platform include a variety of payment choices to suit clients' needs: one-off Pension Commencement Lump Sum (PCLS), one-off taxable income, regular PCLS, and regular taxable income. These can be managed online through straight-through processing (STP). Additionally, the service supports manual requests for UFPLS, small pots, and withdrawals due to ill-health or serious ill-health. Dive into our comprehensive guide for detailed insights on processes, timescales, and strategic combinations to maximise your clients’ retirement planning.