Company & Trust accounts move to main administration system

Overview

From February 2024 we began to move Company and Trust accounts to our main administration system, aligning our capability and operating model with that currently available to personally held accounts. The migration is happening in 2 phases:

Phase 1 began in February 2024 and is largely complete. We have migrated the majority of the following client accounts:

- Company accounts

- Charity and Society Accounts

- Canada Life Offshore Bond Accounts

- Utmost Offshore Bond Accounts

- Pension Trust Accounts where accounts are managed by an external pension provider where there is no secondary trustee.

Phase 2 is scheduled to begin in January 2025, will include:

Final Account Migration: April 2025

Our final company and trust account migration is scheduled for the 23rd / 24th April 2025. To make sure we migrate all the remaining clients, we plan to apply a hold on client’s accounts from the 8th April to the 24th April. This will ensure we avoid in flight transactions or regular processes that would stop an account from migrating.

This has the following impacts:

- The dealing suspension will start on Tuesday 8th April by applying a hold on instructions on the accounts.

- It will end around 8am on 25th April, after the migration is complete.

- Regular Savings scheduled to invest on the 18th of April will be cancelled, as settlement of the deals will not complete before the migration date.

- Regular Savings scheduled to invest on the 4th of May will be cancelled, as we need more time to set up the direct debit on our new system than would be allowed if we collect to invest on this day.

- An account that would normally be subjected to a rebalance in the hold period will not be rebalanced due to the hold on trading. Any required rebalances will need to be instructed separately following the migration when the hold has been removed

- It may be appropriate for clients to make a one-off contribution to their accounts to cover the regular savings that we will not collect.

- Any dealing instructions received during the dealing suspension period will be returned unprocessed and can be resubmitted once the suspension ends.

- As the migration is essential to continue to service these accounts, we will not backdate any deals delayed by the suspension period.

Please note:

- Regular Savings Plans on the 4th April and 18th May will collect as usual.

- Adviser Fees for April will be collected and paid out as usual.

- Service Fees for April will be collected as usual.

- Other processes and regular reporting will be run as usual.

- Withdrawal plans will pay out regardless of the account hold.

We will be writing to clients to inform them of this process that will ensure we can migrate their accounts to our main administration. A sample of the letter can be found here.

Communicating with you and your clients

For clients in phase 2, we will be writing to you with a list of client’s accounts that we plan to move to our main administration system. The letter will also include sample content of the letters we will send to your clients and a copy of the Question and Answers that will also be included.

You’ll be able to download the letter from the ‘Adviser Firm Documents’ page once you have logged in. Once we have sent the letter to you, we will start to send letters to your clients. There is more information about the communications we will send to your clients below. We plan to start migrating accounts in January 2025.

For accounts included in phase 2, your clients may receive a number of communications:

- All will receive a migration letter outlining the process of moving to the new system

If an account has a regular saving plan the client will receive - A regular saving plan letter outlining the new options and process for regular savings

- A letter confirming a change of Direct Debit reference

A small number of clients who have not yet consented to move investments to our nominee holding will be written to from 7th October 2024 and consent will be deemed to be given by these clients unless those clients withhold their consent. Where clients actively withhold consent, we will not be able to move them to the main administration system and these accounts will have a reduced service.

Your remaining clients will be written to later in 2024 in advance of the move to the main administration system beginning in January 2025.

What happens when we move accounts to the new system

Before we move the account to the new system, we will convert any remaining holdings in bundled funds to clean share classes where a clean share class exists.

Over the weekend of the migration, you will not be able to instruct changes to the accounts being migrated. Any accounts with in-flight transactions will be excluded from the migration and will be migrated at a later date.

You can always tell if an account has been migrated by looking at the account information report available from Reporting Services.

In column H (“Platform”) accounts moved to the main system will be shown as “New”; accounts yet to be moved will be shown as “Old”. Migrated accounts will also have the migration date shown in column J (“MigrationDate”).

For more detailed information:

Videos

What’s New

Many of the features of personally held accounts will become available to company and trust accounts. This will include the following

| Feature | Description |

|---|---|

| Product Cash Accounts (PCA) |

|

| Cash Management Accounts (CMA) |

|

| Brokerage |

|

| Discretionary Fund Management |

|

| Tax Vouchers |

|

| Private Trusts |

|

What else will change

Adviser Web Site

You will still be able to manage your clients in the same way you can today in the Adviser Site. The online capability remains the same enabling you to view your clients accounts, holdings, performance and settings. You will be able to view the transaction history online and generate the same reports you can today for Company and Trust clients

Web journeys

We have created new web journeys to submit online instructions and you will be directed to these journeys when you start an instruction on a migrated account. These instructions include:

- Switch

- Rebalance (including assigning a model portfolio to an account)

- Managing Adviser and DFM Ongoing Fees

- Setting income preferences on investments in the account

- Adviser Specified Fees

Other instructions can be made using our application forms including:

- Account opening

- Top up

- Re-registration

- Setting up Regular Savings Plans

- Setting up Regular Withdrawal Plans

- One off Withdrawals

You will be able to generate illustrations for the non-online instructions with our new corporate illustration where you will be asked to enter all the details of the instruction to be made. If you wish to include existing holdings in the account, you will be able to manually enter them in the same way you do today. If you wish to submit an instruction on an account once migrated the corporate illustration will direct you to the correct application form if you initiate the illustration from that account

Application forms

Our application forms will be changing to reflect the new capability available to migrated accounts, and you will need to select the correct application form based on whether the client has been migrated.

You will be able to find out if the account has been migrated by searching for the account in the account information report available in reporting services.

We will flag in our application forms page when you should submit new account opening instructions with the new application form.

While accounts remain on our old system we will continue to process instructions on our existing application forms which will remain available on our application forms page

Advised client site

Where company and trust accounts are accessible by clients via our end investor site, they will continue to be accessible following the move to the new system. Access to the accounts will be on a read-only basis, and clients will continue to rely on their advisers to initiate instructions on their behalf.

Adviser and Discretionary Fund Manager (DFM) Fees

When accounts move to our new Administration system, multiple fee payments for the month of migration will be paid.

Adviser Ongoing Fees

For the month during which the account moves to the new administration system fees will be paid on both the existing and new basis. For example, for the month of January 2025, for an account moving on February 24th the following payments will be made:

- A single payment will be made to the adviser for the existing Adviser Ongoing Fees for the period of the 1st February to the 23rd February.

- A single Adviser Ongoing Fee payment will be made to the Adviser for the period 24th February to 29th February

Fee deductions will be finalised and completed in March 2025 for payment to intermediaries on the usual date. Adviser Fee statements in this case will contain 2 Fee payments in respect of the migrating account.

DFM Ongoing Fees

When a DFM managed account move to our new Administration system, DFM fees will be able to be paid directly to the DFM and existing rates already paid will still apply.

For the month during which the account moves to the new administration system fees will be paid on both the existing and new basis. For example for the month of January 2025, for an account moving on February 24th the following payments will be made:

- A single payment will be made to the adviser for the existing combined Adviser and DFM Ongoing Fees for the period of the 1st February to the 23rd February.

- A single Adviser Ongoing Fee payment will be made to the Adviser for the period 24th February to 29th February

- A single DFM Ongoing Fee payment will be made to the DFM for the period 24th February to 29th February

Fee deductions will be finalised and completed in March 2025 for payment to intermediaries on the usual date.

Fee Reports

Adviser Fee Report

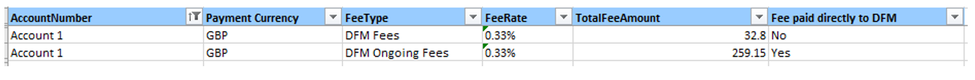

The Adviser Fee report will show 2 rows for each account to detail the pre and post migration day fees accrued. The following example shows two adviser payments for the same account:

Please note the fee rate for the pre migration day accrued fees shows as zero for the fees in this report; the correct fee rate has been applied in this instance.

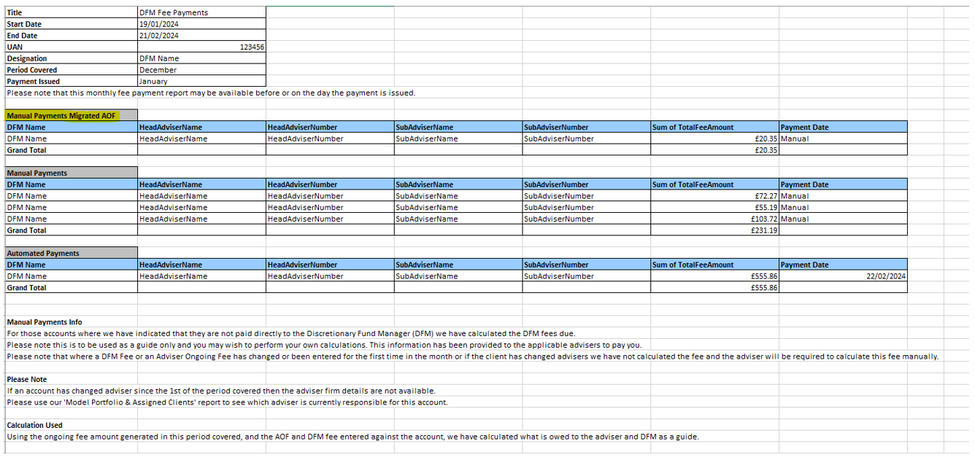

DFM Fee Payment Report

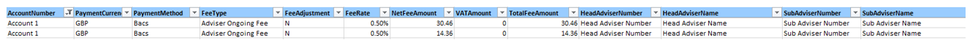

The DFM Fee Payment Report will contain a new section in the summary highlighting the fee payments for accounts we have migrated but still need to be paid manually to the DFM. This is in the Manual Payments Migrated AOF section:

In the Fee breakdown there will be 2 rows, one for the fee paid via the adviser (where the ‘Fee paid directly to DFM’ flag is set to No and the ‘Fee Type’ is DFM Fees), and a second for the fees that do pay directly to the DFM, where the Fee Type is ‘DFM Ongoing Fees’.