Withdrawals and account closing

Our income and withdrawal options for ISAs and Investment Accounts offer great flexibility – clients can take a natural income (dividends and income distributions) from their holdings or set up a fixed withdrawal plan where payments can be managed to suit their needs. Payments can be made on a number of dates.

Information on making withdrawals from our Pension can be found here.

Our fixed withdrawal plan allows clients to receive set regular payments from their investments. Payments can be made monthly, quarterly, half-yearly or annually from as little as £50 per payment. There is a choice of payment dates – 1st, 10th, 17th or 25th of the month – and you can also specify which investments the income should come from.

Skip to section

Setting up a withdrawal plan

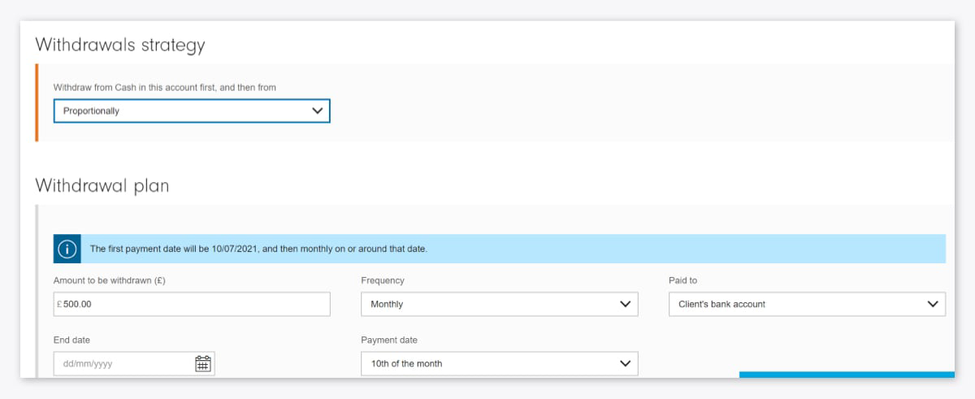

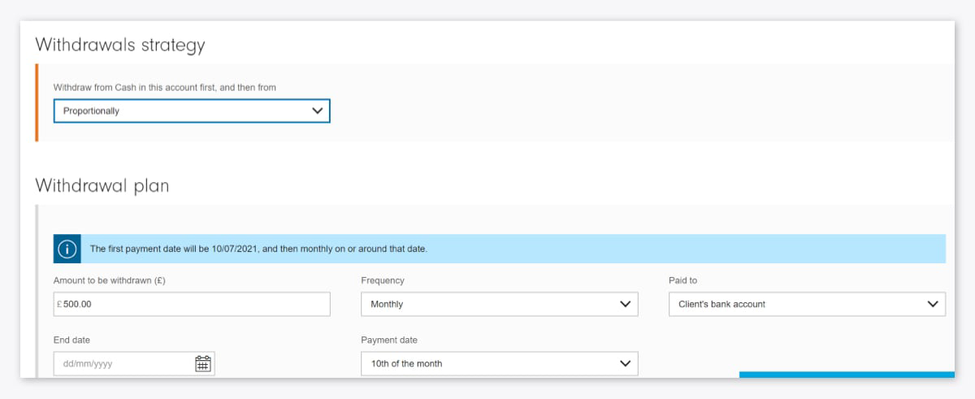

A withdrawal plan should be set up through 'Quote and Transact' within Client Management. You have the flexibility to specify the withdrawal date, next payment date, and the amount. Separate withdrawal plans need to be set up for ISAs and Investment Accounts.

The minimum a client can withdraw from a single investment is £50 and there is no maximum limit. We make no charges for setting up, changing or cancelling withdrawal plans or for making a one-off withdrawal.

Payments can be made to the client’s bank account or their Cash Management Account (overseas clients can only sell to cash or withdraw to their UK bank account). The processing of income payments begins nine working days before the chosen date.

If you would like to update your client’s bank details for future withdrawals, you can do this online. To add a bank account, simply click into the ’Client Summary’ and ’manage personal details’, where you will be able to add the bank details.

How to video: Managing your clients' income

Administering a withdrawal strategy

In order to raise the specified amount, the system looks to see if there is any available cash in the Product Cash account. If there is a shortfall, then assets will be sold to make up the balance. You can choose to cover the remaining amount by setting up a withdrawal strategy, which can be done through any of the options below:

- Manually entering the withdrawal target percentage from the existing investments

- Taking the shortfall proportionally across your client’s existing investments

- Taking the shortfall from the client's largest fund, and then the next largest and so on

- Aligning the shortfall target percentage(s) to the selected investment approach (model portfolio if one is selected).

If an investment does not have enough shares/units to cover the payment, the sell process will revert to the largest asset and so on. If one or more investments cannot be sold and you have selected a proportional withdrawal strategy, then the sell process will ignore the sell-ineligible investments and withdraw proportionally from the remaining investments.

The minimum a client can withdraw from a single investment is £50 and there is no maximum limit.

Payments can be made to the client’s bank account or their Cash Management Account (overseas clients can only sell to cash or withdraw to their UK bank account). The processing of income payments begins nine working days before the chosen date.

Frequently asked questions

When you have selected your client, choose ‘Edit’ or ‘New’ from ‘Regular instructions’ on the ‘Account view’ page. Here you can:

- Set the amount to be paid out in each instalment

- Set a frequency of monthly, quarterly, half-yearly or annually

- Select if the withdrawal will go directly into the bank account or into the Cash Management Account (CMA)

- Choose an end date for the withdrawal plan, after which we will automatically stop payments (if none is set, the plan will continue indefinitely). End date is inclusive, which means if this date occurs on the same day as the payment is due then the payment will be made

- Set one of the four different payment dates (1st, 10th, 17th or 25th of the month)

- If you are changing an existing withdrawal plan, you must choose the month/year from which to start the amended plan.

To cancel a withdrawal plan, go to ‘Regular instructions’ on the ‘Account view’ page. Please note that we no longer accept withdrawal plan changes by secure message.

Withdrawal plans are available on ISA and Investment Accounts (separate withdrawal plans need to be set up for both accounts). There is a separate process for making regular drawdown payments from our Pension. Information on taking pension benefits can be found here.

We will first try to raise the cash by selling from investments as per the chosen withdrawal strategy for the client. If this raises insufficient funds, we will then raise cash from other funds in the account starting with the largest fund. If we still cannot raise enough money for the withdrawal, we will sell exchange traded investments, such as investment trusts or exchange traded funds.

If there is not enough money in the account as a whole, we will not make the payment.

Any amendment or setup of a withdrawal plan can take up to 12 working days to take effect. If your client has an existing withdrawal plan payment due within the next 12 working days, no changes will be made to that scheduled payment. Amendments will take effect from the next scheduled payment date displayed in the quote.

If you would like to update your client’s bank details for future withdrawals, you can do this online. To add a bank account, simply click into the ’Client Summary’ and ’manage personal details’, where you will be able to add the bank details.

No, we cannot make withdrawal plan payments to a secondary holder’s bank account in their own name.