Withdrawals and account closing

Our income and withdrawal options for ISAs and Investment Accounts offer great flexibility – clients can take a natural income (dividends and income distributions) from their holdings or set up a fixed withdrawal plan where payments can be managed to suit their needs. Payments can be made on a number of dates.

Information on making withdrawals from our Pension can be found here.

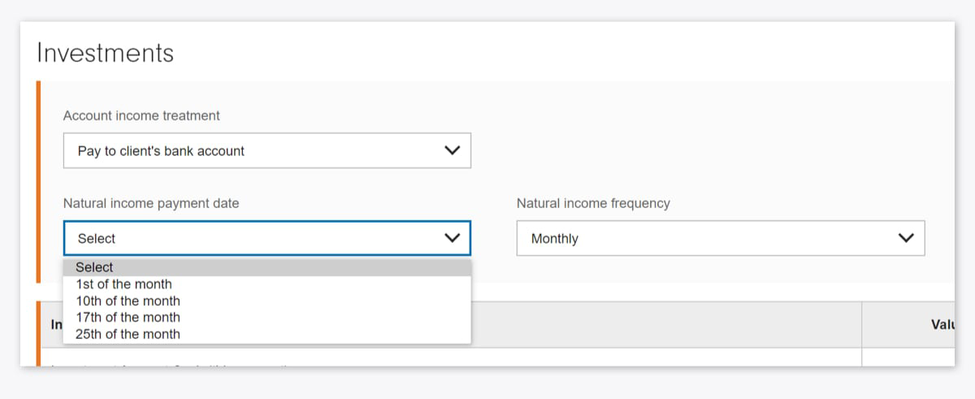

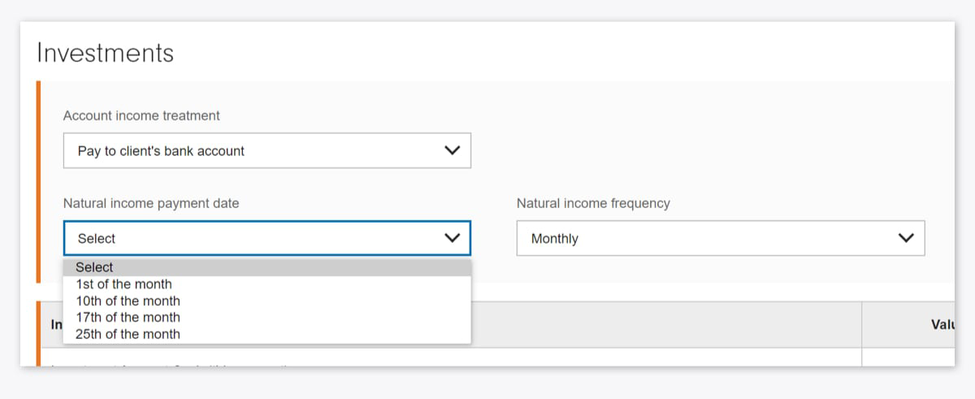

Selecting a payment date

To pay out 'natural income', select 'Quote & Transact' screen within Client Management.

You can choose the frequency at which the income is to be paid; monthly, quarterly, half-yearly or annually, as well as a choice of payment dates for the income to be received in the client's bank account; 1st, 10th, 17th or 25th.

The process of income payments begins four working days before the chosen payment date.

Amend bank details

If you would like to update your client’s bank details used to make regular withdrawals or redemption payments, you can do this online. To add a bank account, simply click into the ’Client Summary’ and ’manage personal details’, where you will be able to add the bank details.