Bereavement and planning ahead

In this section, you’ll find all the information you need in relation to administering an account following the death of a client. In addition, you will find forms and information for registering an Expression of Wish for a client’s pension as well as the rules and procedures that relate to inherited ISAs.

You’ll also find comprehensive information on the different types of Power of Attorney and how these can be registered (Court of Protection is covered too).

Following the death of a client, there are set procedures in place for dealing with their investments. Our aim is to make the process as smooth as possible as we appreciate this will be a very difficult time for the family and others connected to the deceased.

Skip to section

What steps need to be taken

To support the persons responsible for your deceased client’s estate, we have outlined the three steps that need to be taken when handling the investments. The following steps apply to ISAs and Investment accounts only.

Full details and information on other accounts, such as pensions, can be found in our Guide for executors and administrators. This document may also provide useful information to advisers dealing with the death of a client. A brief summary of each step also appears below.

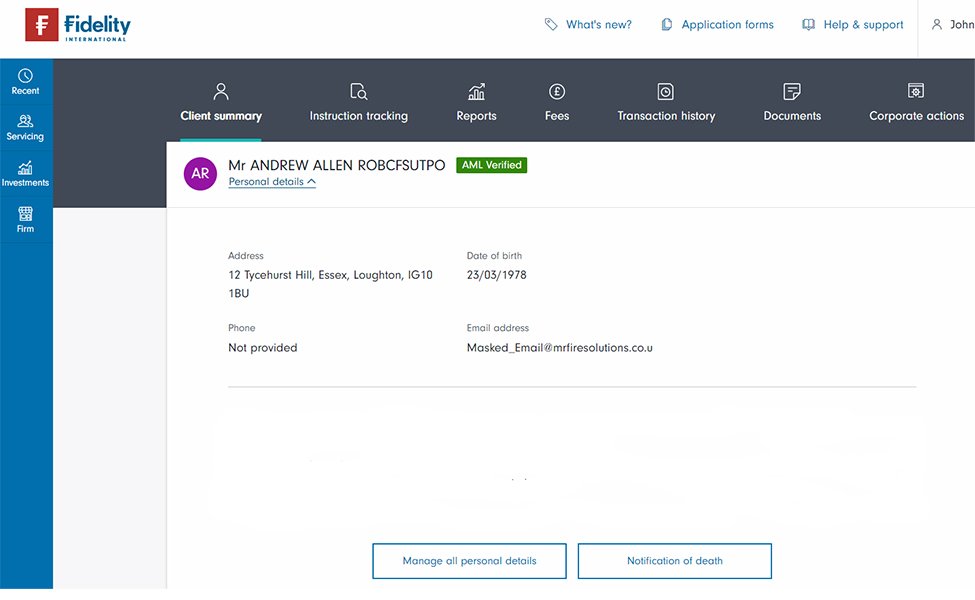

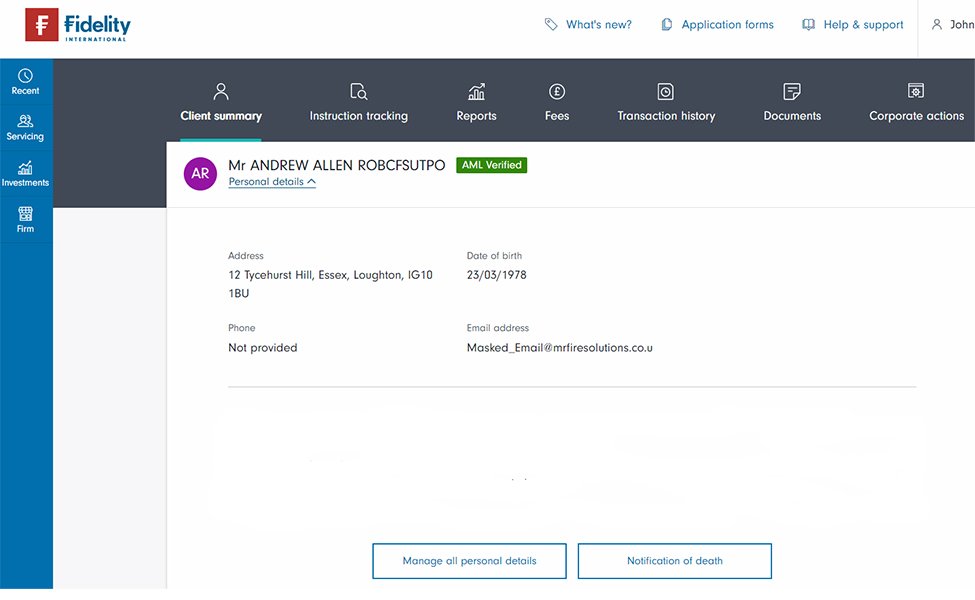

The first thing to do is to let us know that the client has died, you can do this online within the client summary screens. Once you have the client in context, click on ‘view client details’ and you will see the option to ‘notify us of a death’.

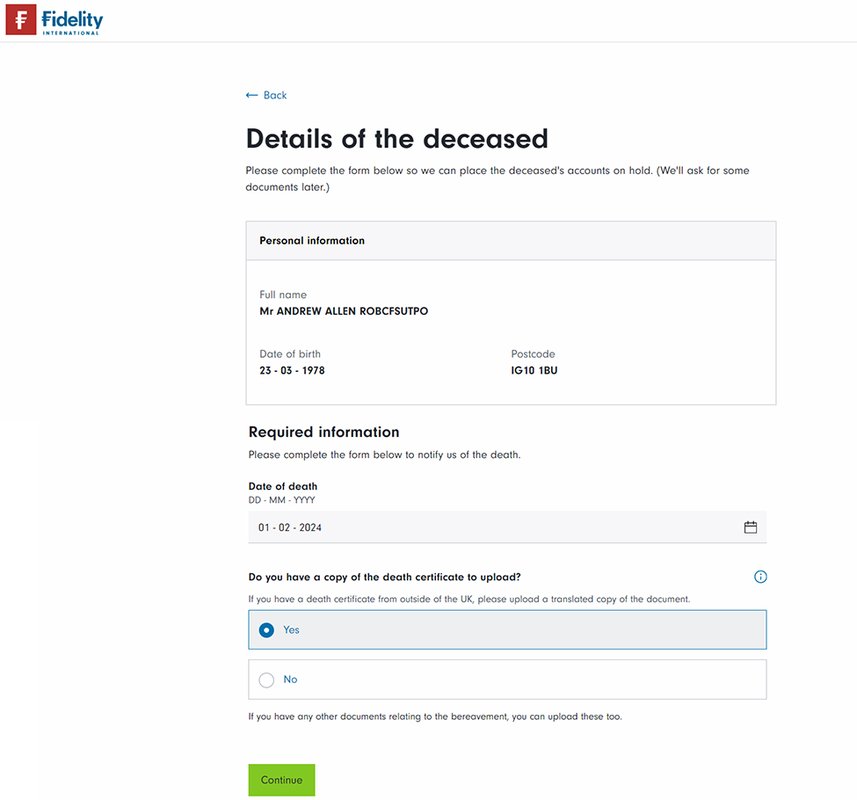

The online journey will allow you to notify us of your clients date of death, you will also have the option to upload the death certificate - we accept certified death certificates for both single and joint accounts. To find out more about our certification requirements please click here.

You will have the option to ‘add a document’ should you wish to send us any further supporting documents at this time.

We can also be notified of your clients death by phone or in writing.

Fidelity

PO Box 391

Tadworth

KT20 9FU

What we’ll do next

Once we have been notified of your client’s death, the following actions will take place:

- A hold will be placed on the account

- Dealing will stop and any income generated by the investments will be reinvested

- Adviser ongoing fees, regular savings and withdrawal plan transactions will cease

- A valuation of the client’s account as at the date of death will be produced.

What you need to do next

Should you wish for the Adviser Ongoing Fee to continue, this will need to be agreed with the executors and both parties should complete the Fee and commission authority for deceased accounts form. This can be uploaded during the online notification of death journey, via our Upload and Send service or posted to us.

The executor or administrator will need to obtain probate, to do this they will need to contact their local probate registry or sheriff court. It usually takes around two months to obtain a grant of representation, but complex cases can take a year or more.

Guidance and support when applying for probate is available at gov.uk/applying-for-probate. Once probate is obtained, they will need to send us a sealed or certified copy of the grant of representation signed by each of the executors. This shows us they are authorised to deal with the estate.

What are the options available for Executor’s who are not applying for probate?

There are instances where we can release money from the estate if probate is not being applied for.

| Declaration & Indemnity form | Small Estates |

|---|---|

|

What is this? However here are some of the ways we can support you, while we’re waiting for the paperwork:

To request this, please send us a completed

Declaration & Indemnity form.

|

What is this?

In this case we can accept a Small Estate form but only if submitted with a Will. Please note:

|

This is the point when beneficiaries decide whether they’d like us to invest the money into a new account, transfer the investments into a new name, or sell the investments to cash and send them the money.

Lump Sum and Death Benefit Allowance (LSDBA)

This allowance limits the value of the lump sum pension savings that can be left for a client’s beneficiaries tax free, if they die before the age of 75. The standard LSDBA is £1,073,100. Some people might have a higher allowance if they also had a higher protected lifetime allowance, or tax-free cash protections. If your client has taken any tax-free cash from their pension while they were alive (including a serious ill health lump sum) then their allowance will be reduced by the same amount. If the pension savings they leave are more than their LSDBA, their beneficiaries will have to pay tax on the extra amount, at their marginal rate of income tax.

If your client dies before the age of 75, their pension can generally be paid out as a tax-free lump sum to their beneficiaries subject to the lump sum and death benefit allowance (LSDBA). If their beneficiaries take their pension as drawdown or as an annuity, then the LSDBA doesn't apply and payments will be tax-free if paid within 2 years of notification of death.

After 2 years of notification of death or if your client dies after age 75, their beneficiaries have the same options, but they’ll have to pay income tax on the benefits and the LSDBA won’t apply.

Forms and guides

|

Form |

When should I use this form? |

|

|---|---|---|

|

Sell investment and send proceeds to an executor, administrator, or solicitor |

|

|

|

Move assets to an investment account |

Moving assets to an Investment Account on the death of a Fidelity investor |

Please note: |

|

||

|

Inherited ISA Allowance |

|

|

|

Inherited ISA transfer application |

|

|

|

Sell your own Investment Account to use your inherited ISA allowance |

|

What to do when someone dies

FAQs

Certification must be given by an independent party. The individual cannot be an account holder of the account(s) in question, nor can they be mentioned on the document being certified.

Certifiers must provide:

- a signature (including the date they signed the certification)

- their name and phone number

- their occupation

- their company name and business address (if applicable) and their company or organisation stamp (if applicable).

We cannot accept a certification of a previously certified copy.

Certifiers can be one of the following:

- Solicitor (must be registered with the Law Society in England, Wales, Scotland or Northern Ireland)

- Legal Executive (must be registered with Chartered Institute of Legal Executives (CILEX))

- Barrister (must be registered on Juriosity)

- Independent Financial Adviser (must be registered with FCA).

- Death Certificates

- Death Certificate Verification form

- Grant of Probate (England & Wales only)

We cannot usually disinvest or distribute any assets until the court sealed Grant of Probate is received. However, if you are concerned about stock market performance and wish to protect the account from potential falls in value, or where funds are required to pay Inheritance Tax or funeral expenses, we may be able to make an exception. We can release monies from the deceased’s account directly to HM Revenue and Customs (HMRC) or the funeral director on your behalf. To request this, please send us a completed Declaration & Indemnity form.

If the value of the estate does not exceed the Inheritance Tax nil rate band and the value of the investments is less than £50,000, we can accept a Small Estate form but only if submitted with a Will. Please note that if probate has been applied for, we will need to see this.

The following application forms can be signed digitally or with a copy of a wet signature (digital image):

- Selling in the event of a death of a Fidelity investor

- Selling in the event of a death of a Fidelity investor & ISA application form

- Inherited ISA allowance form

- Moving assets to an Investment Account on the death of a Fidelity investor

- Sell your own Investment Account to use your inherited ISA allowance

- Declaration and Indemnity form (Switch to Cash or Paying HMRC or paying Funeral Directors)

We stop any ongoing fees as soon as we are told a client has died. This means you will not receive fees for the month in which we hear of the death. You have the option of setting up a new agreement with your client’s executors or administrators, using our Fee & Commission Authority (Deceased) form. In line with FCA guidelines, each person who has legal authority to act for the estate must sign this form. The first payment under this new agreement will cover the whole of the month in which the arrangement is set up.

Please note your client's executors and administrators will not be able to sign for a new agreement on a pension.