To help get you to the right website, please choose one of the options below

Products & investments

Products

Products

Pension Flexible Investment and Retirement Solutions Standard Life Smoothed Return Pension Fund Standard Life Guaranteed Lifetime Income plan Taking retirement income ISA Investment Accounts Pension Trustee, Company and Trust accounts Cash The Canada Life International Bond Utmost Wealth Solutions − offshore bond products

Investments

Technical resources

Technical matters

Technical matters

Tax year end planning tools and resources Replacement of the lifetime allowance Retirement Income Pension Forum The Platform Clinic Pension, retirement and tax planning The beneficiaries flexi-access drawdown conundrum Retirement and pensions training Personal tax and trust planning training

More support

Paraplanner technical hub

Paraplanner technical hub

Technical hub Retirement income Regulation, due diligence and compliance Training support

In this section

ISA and Investment Accounts

Here you’ll find a range of materials available including guides to help with client discussions. We’ve also detailed the Bed and ISA process and provided some pointers for calculating capital gains on Investment Accounts.

Capital gains management – Investment Accounts

At face value, calculating the gains or losses on an investment seems a relatively straightforward process. In reality, it can be quite complicated. In this video, Paul Squirrell covers the methodology for performing these calculations as well as how to establish whether any tax is payable and, if so, how much.

Jon Hale highlights some of the reporting available to help with the management of capital gains on behalf of your clients. These reports are split into two key areas – First, reporting across your business and then at account-level, which provide far more detail.

Tips for your end of year planning

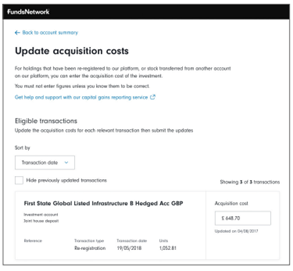

In order for our capital gains reports to produce accurate figures for assets re-registered to our platform, the relevant acquisition cost for each investment needs to be entered onto our system. It’s important to perform this task for clients who re-registered assets to the platform.

Next steps

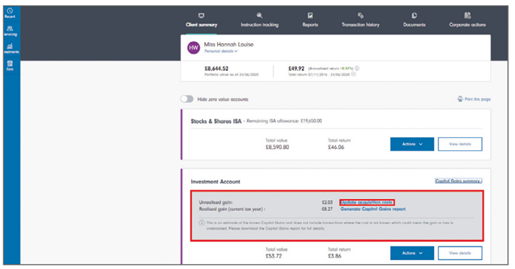

To update acquisition costs, simply locate the client by selecting ‘Servicing’ from the blue menu bar that appears when you first log into client Management (alternatively select them from ‘Recent’ if you have recently viewed their accounts). You can access the ‘Update acquisition cost’ facility from your client’s Investment Account by opening up the ‘Capital Gains summary’ (see below). The ‘Update acquisition cost’ screen is also shown below.

Clients will usually have to pay capital gains tax on their overall gains above their tax-free allowance (this was £12,300 in 2022/23. It was reduced to £6,000 for 2023/24 and to £3,000 since April 2024). The good news is, it’s possible to carry forward any capital losses to offset chargeable gains in future tax years. These losses have to be reported to HMRC within four years.

Our realised gains report can quickly identify clients that have either exceeded the annual exempt amount or who are able to report a loss to HMRC.

Next steps

1. Run a realised gains report:

- A bulk report can be downloaded that shows all clients who have incurred a gain or loss

- An individual client report can be downloaded that identifies the gain or loss at a fund level

- The bulk realised gains report is available for the current and previous 4 tax years

To run a bulk report, select ‘Servicing’ from the blue menu bar that appears when you first log in, and you’ll see an option for ‘Bulk Capital Gains report’. From here you can download a realised or unrealised capital gains report via PDF or CSV.

To produce an individual report, simply locate the client and from their Investment Account open up the ‘Capital Gains summary’, where you’ll have the option to ‘Generate Capital Gains report’.

If you need more help with using our Capital Gains reports, you may find it useful to download our guide.

2. Consideration could also be given to moving unwrapped assets into an ISA, as appropriate. You can find out more about our ISA Contribution report here.

Any capital gains tax (CGT) liability needs to be considered when a client sells assets within an Investment Account. This includes sales made to fund fee payments. Therefore, where CGT may be an issue, consideration should be given to whether it’s appropriate for a client’s fees to be paid through asset sales within the Investment Account. If appropriate, cash can be held within the Product Cash Account, as we always use this before selling assets. Alternatively, the Cash Management Account can be used as the first port of call for the payment of ongoing fees - which the client can easily fund themselves through their online account or via the Fidelity app.

Next steps

- Identify clients who may have a potential CGT liability by running a consolidated capital gains report. To run an individual report, simply locate the client and from their Investment Account, open up the ‘Capital Gains summary’, where you’ll have the option to ‘Generate Capital Gains report’.

If you need more help with using our Capital Gains reports, you may find it useful to download our guide. - Where appropriate, set fees to be paid from the client’s Cash Management Account. To do this, click ‘View details’ within the client summary to view the current fee set up. From the ‘Actions’ tab, select ‘Manage fee funding’ where you can change the payments from the ISA/Investment Account to The Cash Management Account.

- Nominate which account should be used for disinvestment should there be insufficient funds available in the Cash Management Account.

Please note that to use the Cash Management Account for ongoing fees, the Investment Account must be held in sole names.

Capital gains tax is charged at either 18% for basic rate taxpayers or 24% for higher or additional taxpayers. Therefore, where married couples or civil partners are in different tax bands and one or both have exceeded the annual exemption limit – or one has an unused allowance – it may be appropriate to consider transferring unwrapped assets to the other party. This is because married couples and those in a civil partnership can transfer assets to each other without any CGT being charged. Consideration should also be given to jointly-held assets, where the gain calculation is based on each individual’s share of the asset.

Our realised gains report can quickly pinpoint clients that have exceeded the annual exemption amount, which may help you identify clients where transferring assets to their partner may be an appropriate course of action.

Next steps

- Update CGT acquisition costs online following a stock transfer, as appropriate (please see the first point above)

- Run a realised gains report to identify clients who have exceeded the annual exemption limit. To run an individual report, simply locate the client, and from your client’s Investment Account, open up ‘Capital Gains summary’, where you’ll have the option to ‘Generate Capital Gains report’.

If you need more help with using our Capital Gains reports, you may find it useful to download our guide.

For more information, visit Tax planning insights and practical tips or check the Platform Clinic.