To help get you to the right website, please choose one of the options below

Products & investments

Products

Products

Pension Flexible Investment and Retirement Solutions Standard Life Smoothed Return Pension Fund Standard Life Guaranteed Lifetime Income plan Taking retirement income ISA Investment Accounts Pension Trustee, Company and Trust accounts Cash The Canada Life International Bond Utmost Wealth Solutions − offshore bond products

Investments

Technical resources

Technical matters

Technical matters

Tax year end planning tools and resources Replacement of the lifetime allowance Retirement Income Pension Forum The Platform Clinic Pension, retirement and tax planning The beneficiaries flexi-access drawdown conundrum Retirement and pensions training Personal tax and trust planning training

More support

Paraplanner technical hub

Paraplanner technical hub

Technical hub Retirement income Regulation, due diligence and compliance Training support

In this section

Avoiding delays at tax year end

To ensure your client’s applications are processed on time for the current tax year, we've listed below some important points around cash availability for any payments out, bank mandate verification and our 'Upload & Send' service.

Cash available

To ensure monies are received by your client before tax year end, we would suggest switching to cash at least 10 working days beforehand to avoid any delays.

Please do not send us any written instruction which can be conducted online, eg, a sell or pension withdrawal instruction as your instruction may not get processed.

Crystallisations

For crystallisations, to speed up tax-free cash payments, it would be advisable to ensure that there is cash available in the Product Cash Account within the Pension Savings Account.

Income payments

For any income payments from a pension, it would be advisable to ensure that there is cash available in the Product Cash Account within the Pension Drawdown Account.

Having settled cash available by the deadline will ensure payments are made quickly without the need for funds to settle.

Selling funds to cash

When selling funds to cash, there are four different sell methods to choose from providing you flexibility in how you manage this process:

- Cash Amounts (£) - select an amount per asset to generate a specific value from the sale

- Percentage Amounts (%) - select a percentage per asset to generate a total amount from the sale

- Quantity (shares/units) - select a number of units/shares to sell. The amount raised will depend on the price achieved on the day of the deal

- Proportionally by value - sell from all assets in the proportions in which they are currently held to generate a total value for the sale.

Bank mandate verification

Please ensure that any verification on bank accounts has been carried out or that payments are being paid to existing bank accounts already set up on the platform to avoid any delays in payments out.

Bank accounts can be added into our online system at any time ready to be used for setting up a regular savings plan or withdrawal.

Adding or checking a bank mandate online:

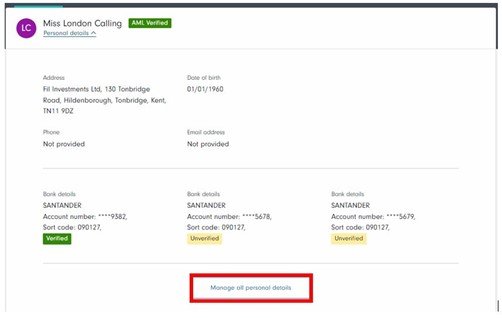

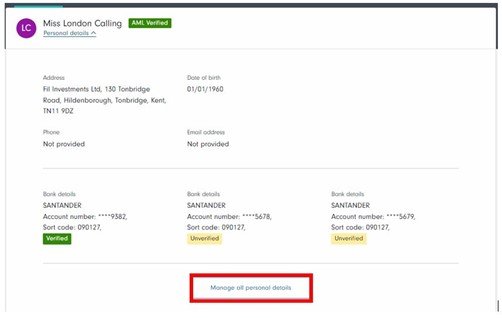

To add a bank account, simply click into the ’Client Summary’ and ’Manage personal details’, where you will be able to add the bank details:

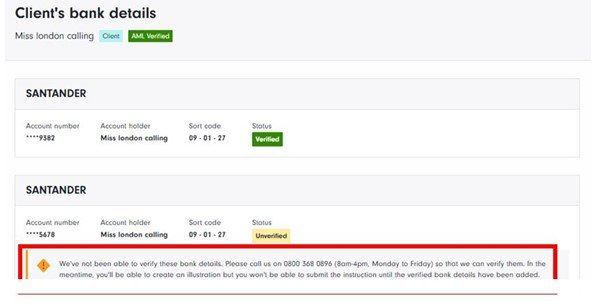

Once a bank account has been added, it will be verified through our automated, online verification system.

You will be instantly informed whether the bank account has passed or failed the verification process. If the bank account fails, you will be provided with a phone number to call us to verify the bank account over the phone, this will instantly update on the system once verified.

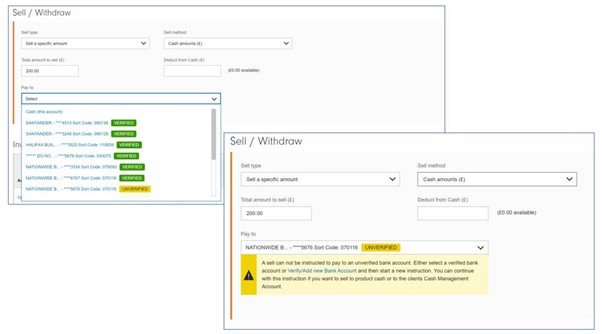

A transaction cannot be submitted online if the bank account is unverified.

Any bank account on a client’s record, will clearly show whether it is verified or not.

Online banking

Online banking - this is the quickest and easiest method of payment. See online payments section.

Upload & Send

Our Upload & Send documents service allows you to upload documents – digitally signed if necessary – from a list of instruction types.

For more information on this service and to find out what documents are available, please click here (login may be required).

Benefits

- Your request will be sent automatically to the team who deals with the process

- Reduction in the time involved in posting documents

- Less paper required and cost savings on postage

- All documents can be signed using digital signatures through DocuSign or Adobe sign. For information on our Digital Signatures Policy, please see below

- You will be able to upload more than one document at any one time

- You will be able to upload different document types, i.e., PDF, Excel, etc.

- We will accept certified copies of trust deeds reducing the chance of deeds getting lost

- You can view all instructions submitted using this service, as well as the current status of individual instructions.

Digital Signatures Policy

We will accept digital signatures on all application forms signed via DocuSign, Adobe Sign or any other provider that is legally recognised in the UK. We reserve the right to reject a Digital Signature from a provider that does not meet the criteria below:

- The Digital Signature provider must be compliant with the Electronic Communications Act 2000 as well as the Electronic Identification Authentication and Trust Services (eIDAS2016)

- When you submit a document to us you must provide the audit sheet that your Digital Signature provider offers which will typically include a time and date stamp as well as an audit trail which will show us who has signed the document.