Initiating pension stock transfers

By selecting the tabs below, you can find more information on the following:

- Features of the service

- How the service works

- Pre-sale illustrations

- Initiating a pension stock transfer

- Best practice for new accounts

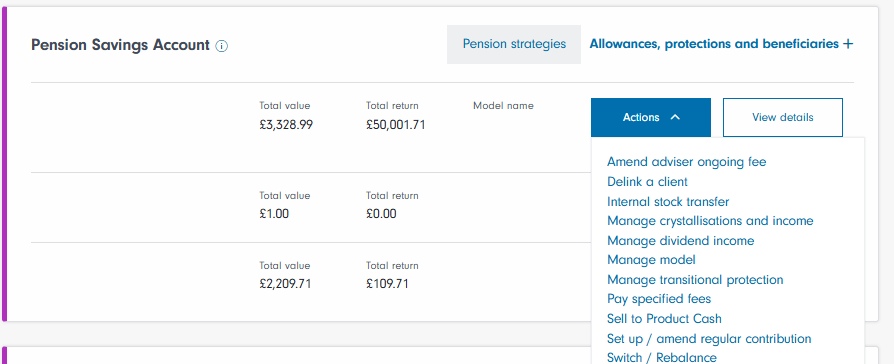

You can initiate a pension stock transfer from an existing Pension Savings Account or Pension Drawdown Account from the ‘Actions’ menu on the Account Summary screen.

Step 1: Define the target account

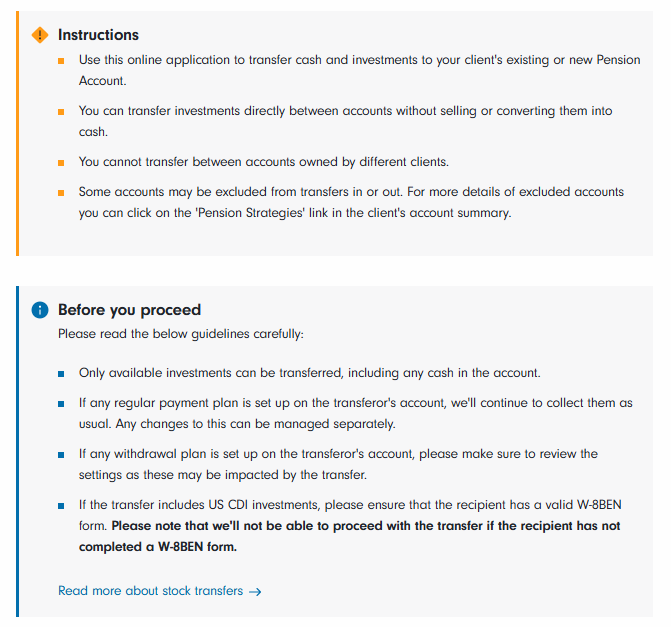

There are several important points to bear in mind when using the stock transfer process. You will need to declare you have read and understood certain notices before you submit the instruction for processing.

In the instruction set up process, select the destination account using one of the following options:

- Transferring to another account owned by the same client

- Pension Savings Accounts must have no limiting factors.

- Pension Drawdown Accounts must be in the same arrangement as the source account.

- When creating a new account for the same client to where the investments will be moved

- Pension Drawdown Accounts will be created in the same arrangement as the source account.

Step 2: Select the type of transfer

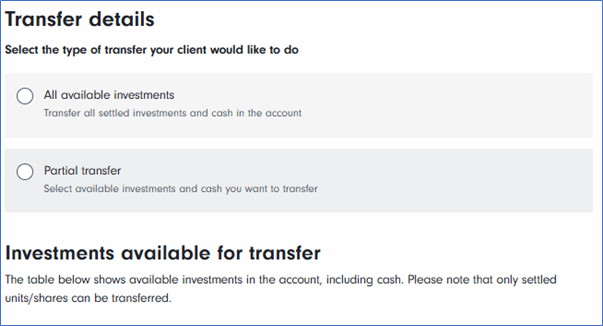

There are two options when transferring assets:

- Moving all available investments: this will move all settled units and shares to the target account

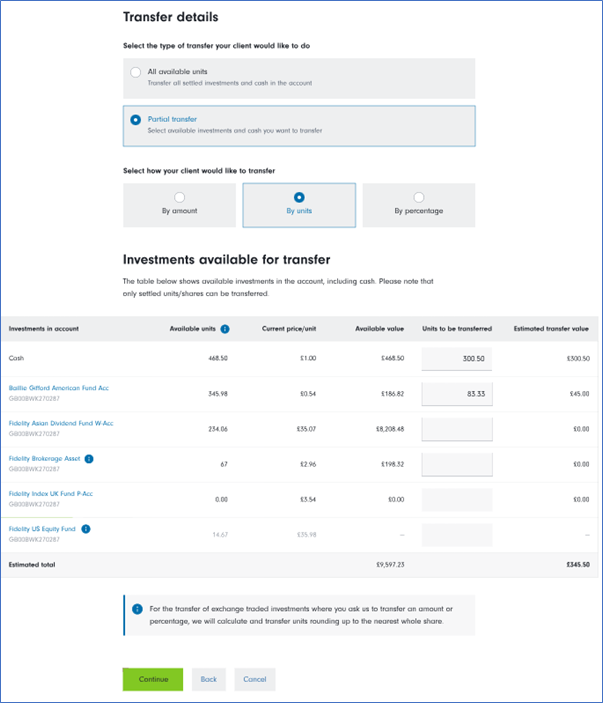

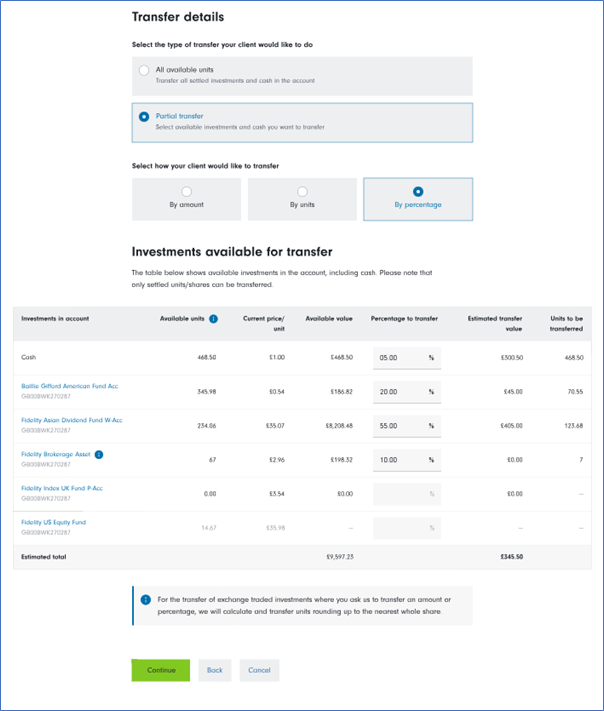

- Selecting a partial transfer: this will move some of the investments to the target account. There are three ways to execute partial transfers (please see below).

Please note:

- Whichever way you choose to transfer the units/shares, we will always calculate the number of units/shares and transfer those rather than seeking to transfer values. For exchange-traded investments, where you ask us to transfer an amount or a percentage, we will calculate and transfer to the nearest whole share.

- The Standard Life Smoothed Return Pension Fund cannot be transferred to a new account. In order to transfer money held in the Smoothed Fund, you will need to sell units from the fund and move the resulting cash.

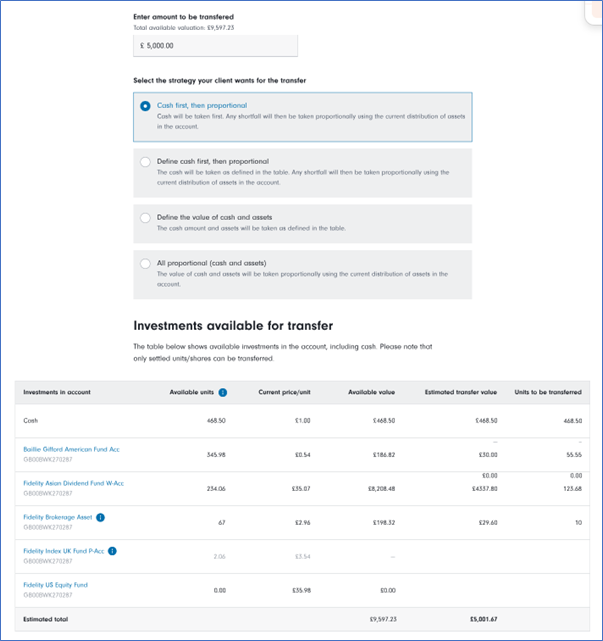

The transferring by amount option allows you to specify the amount of money your client would like to transfer to the target account. We use this figure to calculate the number of units to transfer at the current market price.

There are four possible strategies when transferring by amount:

- Cash first, then proportional. This allow you to use any money held in Product Cash first (all available cash will be transferred). The remaining amount to be transferred will be calculated proportionally across the other assets

- Define cash first, then proportional. This will allow you to enter the amount of cash to be taken from Product Cash first. The remaining amount will be calculated proportionally across the other assets

- Define the value of cash and assets. This allows you to enter the cash values for each investment and we use these values to calculate the number of units/shares to transfer

- All proportional (cash and assets). The transfer value will be calculated proportionally across Product Cash and your client’s investments.

Once an option has been selected and any data required entered, the number of units to be transferred will be calculated and shown on the screen.

This option allows you to define the number of units to be transferred. We will show you the value of the units calculated at current market prices.

This option allows you to define what percentage of each asset (including Product Cash) will be transferred. We will show you the value of the cash and units/shares calculated at current market prices.

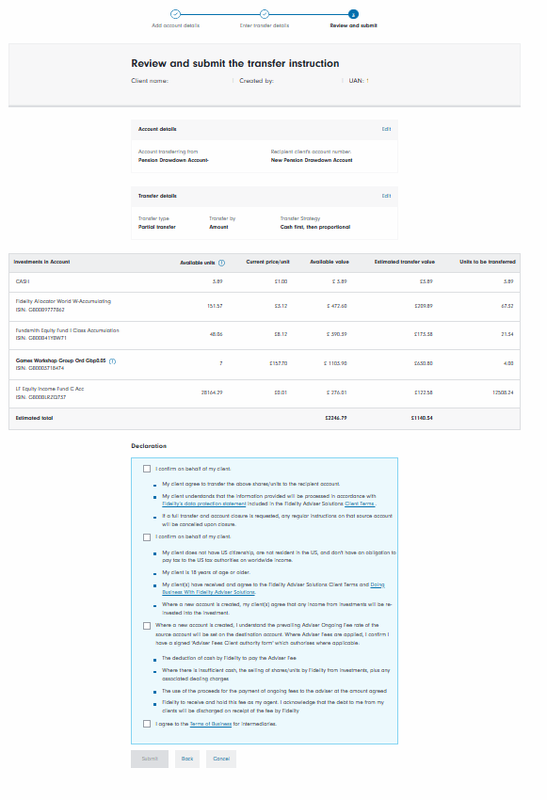

Step 3: Review and submit

Once your instruction is complete, the next screen shows a summary of the source account, target account, and number of units/shares to be transferred.

If all is in order, please read and agree to the Declarations and then click ‘Submit’.

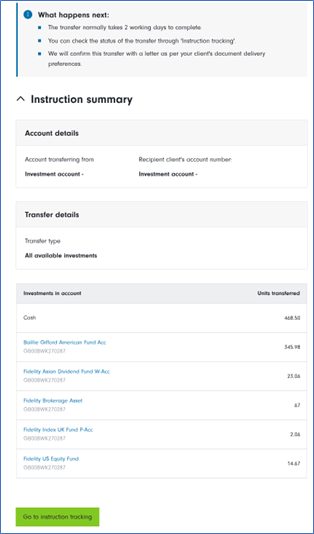

Step 4: Confirmation

Once processed, a confirmation screen will be displayed. The units/shares transferred will be shown. The status of the transfer can be viewed from the instruction tracking screen for your records.

Transfers between accounts are normally performed immediately.

Following the transfer, trades can be executed, model portfolios can be set up, and other account settings can be completed.