Re-registration and transfers

If you are considering transferring assets to Fidelity Adviser Solutions, we are here to support you all the way. We’ll help you manage the whole process from start to finish.

Moving clients to a new platform has historically been perceived as a time-consuming, labour-intensive task. So, we’ve completely reviewed our re-registration and transfer proposition to help make the process as simple and efficient as possible. Here you’ll find all the support you’ll need prior to, during and upon completion of any applications on behalf of your clients.

Benefits of working with us

Process

- A fully compliant process supporting the requirements of the FCA’s Platform Market Study

- We only ask for client signatures if the existing provider requires a letter of authority

- We provide automated electronic transfers between fund managers and other platforms, allowing for a smoother process

- Our re-registration and transfer process is fully online.

People

- Support from our experienced and skilled transfer specialists

- Consultative engagement to help design and implement your bespoke transfer plan

- Continuous point of contact throughout your transfer project.

Tools

- Online illustrations are available, if required

- You can enter the acquisition costs once assets are re-registered to an Investment Account in order to receive capital gains reporting

- Re-registration and transfer tracking tool provided as an integral part of your clients' accounts.

Technology

- We support you by determining whether the fund/share class held by your clients are available on the platform and available for re-registration

- A bulk re-registration/transfer service, should you wish to move a book of business altogether.

Please email us if you would like to discuss new business opportunities or anything related to re-registrations or transfers.

Pension transfers can be requested by re-registration or cash transfer.

- Most cash transfers are processed more quickly than re-registrations, which can take considerably longer. However, the client is out of the market with a cash transfer. Therefore, where a greater transfer time is not an issue, re-registration can be a good option if you would prefer to keep the client invested.

- When submitting a re-registration, we will request that all funds are transferred in specie, where possible, avoiding time out of the market.

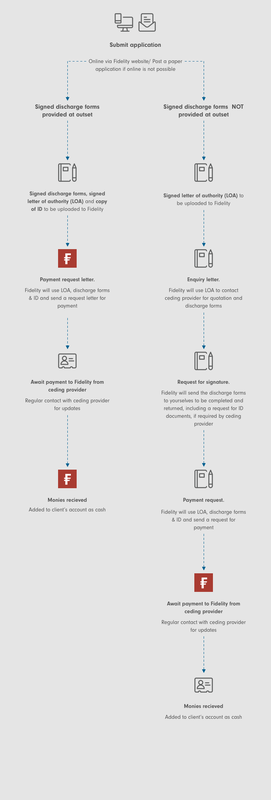

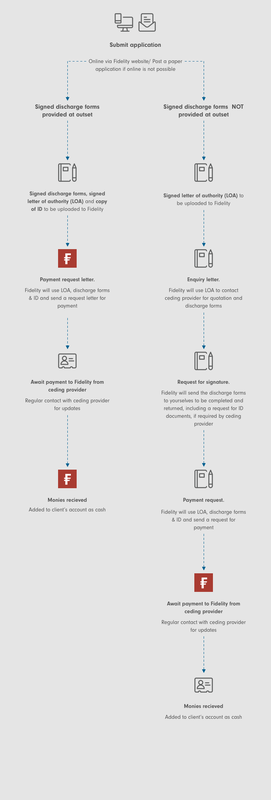

Here we provide an overview of the pension re-registration process, and the various steps involved, so that you can manage your clients' expectations.

Skip to section

Fund eligibility

One of the key aspects of re-registration is understanding which funds/share classes can be re-registered. Where a fund/share class is not available on our platform, we'll ask the existing provider to sell that fund and transfer the proceeds as cash. Once received, we will hold this money in the product cash account.

Some platforms hold share classes which are only available on their platform, so in order to arrange a re-registration we will need to identify a common share class held on both platforms and arrange for a share class conversion to be made.

Once we receive the re-registered fund, if we have a cheaper share class available, we'll automatically convert it. However, within the online application you have the option to opt out of the post-re-registration conversion.

It's important to know in advance any funds that are not available for re-registration within our pension. These generally fall into the following areas:

How the process works

The length of time it takes to complete your transfer will depend on several factors, including:

- We always require a transfer letter of authority (LOA) to be signed and returned to us before we can request the re-registration.

- The number of individual funds you are transferring.

- How quickly your current pension provider responds to our requests for information.

- If a share class conversion needs to be completed by the ceding scheme.

- Whether your current provider and individual fund providers use electronic transfer systems.

Manual schemes

The following providers do not require a wet signature and therefore you can use our 'Upload and Send' service to submit these to us rather than sending via post:

- Standard Life Pensions

- Hargreaves Lansdown Nominees Ltd

- Ascentric

- Nucleus Financial Services Nominees Ltd

- Aviva Wrap

- Advance by Embark.

How you can help speed up the process

Ask the ceding provider if they require any signed discharge forms or any additional requirements – these will need to be signed and sent to us once you have submitted the online application.

Please see our Discharge forms checklist for further information.

Keeping track of your transfers

Re-registrations for Pension Savings Accounts will appear in instruction tracking. There will only update as completed once all the re-registered assets have been received –there will be no interim status updates due to the manual nature of the instruction.

Transfer tracking is not currently available for pension re-registration into drawdown.