Investing for children

In this section, you’ll find all the information you need about investing for children within a Junior ISA or Junior Pension on behalf of clients. You’ll also find Q&As where we answer common queries, such as who may contribute and the rules around making withdrawals.

Opening a Junior ISA

The following conditions apply when opening a Junior ISA on behalf of a client:

- Junior ISA accounts can only be opened by someone with parental responsibility for the child (parent or legal guardian), but other family members and friends can then make contributions

- The account will be held in the name of the child and the parent or legal guardian will be the registered contact on the account

- The child must be under the age of 18 and a UK resident

- The registered contact must not be a US Person

- A new Junior ISA account can be opened with a £1,000 lump sum investment or from just £50 per month as part of a regular savings plan

- The maximum amount that can be invested into a Junior ISA in the current tax year is £9,000

- You can also transfer existing Junior ISAs held with other providers to our platform via an online application. This can be through a re-registration or cash transfer.

How to Create and Manage a Junior ISA is covered in this video.

Useful links

Frequently asked questions

Lump sums

Account opening for lump sum investments is conducted online through client servicing:

- Select “Servicing” from the main menu followed by “Create a prospect” (you are able to add both the child and the parent/legal guardian as prospect clients)

- Through the profile of the parent or legal guardian, open a new account and select “JISA”, “Lump Sum” and then “Continue”

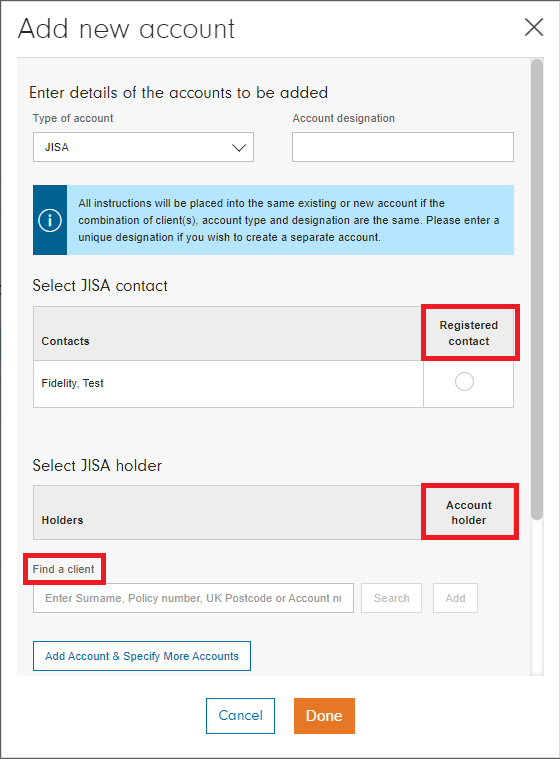

- Add a new account and from the “Type of account” drop down box select “JISA”

- Ensure you select the registered contact (parent or legal guardian)

- Search for the child within the “Find a client” box and then add them

- Tick the box next to their name to ensure they are selected as the account holder

- Click “Add Account & Specify More Accounts” to continue through to the investment.

Payments can be made by cheque or debit card only – please note we do not currently accept payments by bank transfer for Junior ISAs.

Regular savings plans

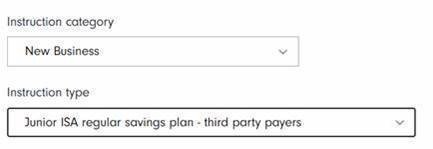

A regular savings account can be completed online if the payment is made by the registered contact (parent or legal guardian). If the payment is being made by a third party, then a Junior ISA regular saving form (third party payments) will need to be completed.

This form can be sent to us using our Upload & Send service. Please select “Firm” from the main menu, followed by “Upload & Send Documents” and then “Upload documents”. Please select the following categories:

Re-registration or transfer

A Junior ISA account can be opened by transferring or re-registering from an existing Junior ISA account held with another provider. Please note, we do not accept partial transfers/re-registrations.

For more information on how to do this, please follow the steps outlined above for lump sum investments but select re-registration/transfer instead.

A client can invest a minimum of £1,000 as a lump sum contribution, while a regular savings plan must be for a minimum of £50 per month.

The maximum that can be invested for the current tax year is £9,000.

All lump sum payments can be made online. If the payment is coming from a third party, such as a grandparent, this person should be added as a prospect which will enable you to select them as a payee on the submission page.

Payments can be made by cheque or debit card – please note we do not currently accept payments by bank transfer for Junior ISAs.

Yes, a third-party lump sum contribution can be made online. You will need to set the third party up as a prospect, which will allow you to select them as a payee when making the investment. To set up a third-party regular savings plan, you will need to complete and submit this application form.

Our annual Service Fee of 0.25% on assets held applies, although no Investor Fee is charged on Junior ISAs.

Ongoing management charges on the funds held within the Junior ISA also apply as do dealing charges for exchange-traded investments.

Yes, provided they are from two different payees (for example, from a parent and the other from a grandparent). All lump sum payments can be made online.

If a payment is coming from a third party, you will need to set them up as a prospect, which will allow you to select them as a payee when making the investment. To set up a third party regular savings plan, you will need to complete and submit this application form.

Yes, we can accept cash transfers and re-registrations of Junior ISAs to the platform through the online journey, which will allow you to save and retrieve an instruction, produce an illustration and set up adviser fees on the account. Please note this does not include Child Trust Funds, and we do not accept partial transfer/re-registration into the platform.

These cases can be tracked online via instruction tracking.

Yes, although you must place the instruction through the new provider. We can only accommodate full transfers away.

No, a child cannot have both a Child Trust Fund (CTF) and a Junior ISA with Fidelity. If they have a CTF, this will need to be transferred into Fidelity’s Junior ISA. Fidelity accepts cash transfers from CTFs into our Junior ISA by application form.

Yes, you will need to complete and submit this application.

Please note, if a child was born between 1 September 2002 and 2 January 2011, the Government would have automatically opened a Child Trust Fund on their behalf. A child cannot have both a Child Trust Fund (CTF) and a Junior ISA.

The account is held in the child’s name.

When setting up a Junior ISA account, the client will need to include a 'registered contact' who must be an individual with parental responsibility for the child. The registered contact must not be a U.S. person and will receive all correspondence from the account until the child reaches age 18. The child will then receive correspondence once the Junior ISA is converted into an ISA. You can change the registered contact by completing this form.

The client will receive a welcome pack, an ISA declaration form, and an anti-money laundering verification form.

Yes, you can add a model portfolio to a Junior ISA account in the same way you would for an adult ISA.

More information on Model Portfolios.

Income from a Junior ISA can be either reinvested or kept as cash within the Fidelity cash account.

An Adviser Ongoing Fee can be set up for a Junior ISA in the same way as an ISA. However, when the child reaches 18 years of age and a new ISA account is opened for them, an ongoing fee will not automatically be set up. A new client authority form will be required (signed by the adult) before the fee can be set up online.

More information on our adviser fees service.

When the child turns age 18, the Junior ISA will convert to an adult ISA (the funds will remain invested). From this point, the child (now an adult) will be the only person able to act on the investment. The client will still be linked to your firm but any ongoing fees will be switched off. A client authority form will need to be signed by the adult before a new fee can be set up online.

Once a Junior ISA matures into an adult ISA, we will stop collecting any regular savings payments. Only the account holder will be able to pay into the new adult ISA.

Withdrawals from a Junior ISA can only be made after the child reaches 18 years of age. If a child becomes terminally ill, a request can be made to access the money by completing the HM Revenue & Customs (HMRC) terminal illness early access form.

If a child passes away, the Junior ISA will be paid to whoever inherits their estate (usually a parent or legal guardian).