Model portfolios & rebalancing

Our Model Portfolio service allows you to create bespoke portfolios of up to 50 funds or Exchange Traded Investments.

The portfolios can be set up for your entire firm to use or can be tailored for individual adviser or client requirements. You can also use defined models from DFMs on ISAs, Investment Accounts and our Pension. We do not charge for the use of this service, however the DFM may do so.

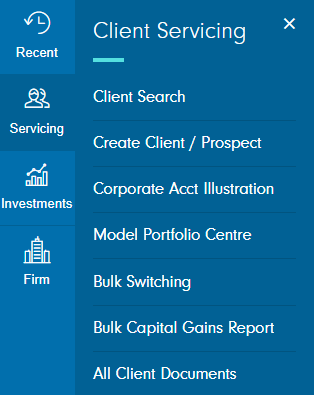

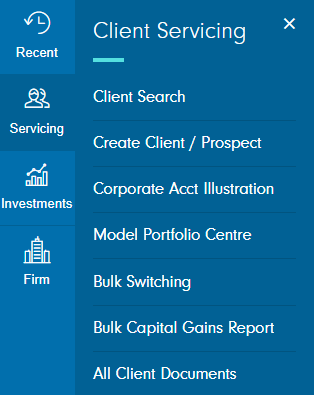

You can find step-by-step instructions on setting up and assigning models by selecting ‘Servicing’ and then 'Model Portfolio Centre' from the Navigation bar on the left-hand side of the Client Management home page.

You'll need to ensure you have the correct access permissions set within ‘Manage users’ in order to set up or manage firm level portfolios. You may need to contact your Firm Administrator to arrange this.

Please note the Model Portfolio service cannot be used for clients aged under 18 who hold a Pension.

Model portfolio rebalancing

We offer two options for rebalancing:

- Single rebalancing is available online via 'Quote and Transact' and this allows you to instruct a rebalance to a model on a client account. These instructions are submitted immediately to be processed.

- Bulk rebalancing is available from the left-hand navigation menu by selecting 'Model Portfolio Centre'. This allows you to select from a list of all client accounts on the same model and rebalance those accounts in one instruction. We process bulk rebalances overnight for submission the following day.

Please note: if you use our switching or rebalancing service, deals may be aggregated and placed at different cut-off points. All switch and rebalance instructions require all sell deals to price before the buy deals can be placed. Buy deals will be timed to settle after the last sell deal has settled to allow the proceeds of the sell to be received so that we can settle buy deals. Additionally, trading and settlement of investments may be delayed due to a public holiday in the UK or in the country in which the investment is based or trades, which can lead to longer periods of time required to complete switches and rebalances.

Please note any funds which price the day after the dealing cut-off will extend the processing time for these types of transactions.

Fund suspensions, model portfolios and rebalancing

List of DFMs available

How to video: Creating and managing client portfolios

FAQs

For assigning a model portfolio, this is not required.

For a rebalancing, your client’s approval is required. Unless you hold the relevant discretionary portfolio management permissions, you will need approval for every client you rebalance. However, we do not need to see this.

You can assign existing model portfolios when creating a quote, dealing on an existing account or opening a new account by selecting ‘My Portfolios’ on the ‘Fund Details’ page.

However, you cannot create a new model as part of the quote process.

This is not possible when a model is linked to an account. If you want to do a quote for a client and search for funds during the process, you will first need to remove the model from the account.

The length of time taken to complete a switch / rebalance depends on the investments being bought and sold and the times taken for these transactions to price and settle, which may be different for each investment bought and sold.

No, the model portfolio service is online only.

For pension accounts for persons under 18, the following services are not available:

- bank transfers

- model portfolios

- re-registrations

- employer contributions

- regular contributions into exchange-traded investments.