Model portfolios and DFM services

With the increased use of model portfolios and Discretionary Fund Management (DFM) services, we are continually improving the services we provide to both advice and DFMs firms.

Here you’ll find out all you need to know about:

- How advice firms can set up and manage model portfolios and use defined models from DFMs.

- How DFMs can create, amend, publish and transact across their portfolios within our secure online portal.

We do not charge for this service, although the DFM may do so.

Our DFM service lets you use defined models from Discretionary Fund Managers for ISAs, Investment Accounts and our Pension. We do not charge for this service, although the DFM may do so.

A full list of available DFMs can be found here.

Skip to section

Benefits of using a DFM on our platform

- You can focus on financial planning while outsourcing investment decisions, helping you to manage risk within your business.

- Your clients benefit from the investment expertise provided by the DFM.

- You retain full visibility and ownership of your client accounts.

- You can access downloadable investment portfolio x-ray reports, providing transparency for both you and your clients.

- For ISAs, Investment Accounts and the Pension, we facilitate payment of any DFM fees directly to the DFM, reducing administration and costs for your business.

New enhancements

- You can now allocate client assets to separate pots within the same account and apply different DFMs to each pot

- To increase efficiencies and reduce administration, we now offer split fees to advisers and DFMs.

- With recent industry changes to DFM fees, fees can now be set up with or without VAT.

- DFMs can opt into a service to deliver a quarterly client portfolio statement which also allows them to add their own commentary.

- DFMs can now opt into a service that automatically notifies clients of a 10% depreciation in the value of their account(s) in a reporting period (calendar quarter).

Managing client accounts using a DFM

Our DFM service allows you to perform the following actions:

- Link directly with your chosen DFMs to access and use their models.

- Assign client accounts to those DFM models.

- Purchase a DFM model directly for new business or realign existing client accounts.

- Carry out rebalances to align your client accounts to a DFM model.

- Align other account attributes, such as regular savings plans and withdrawal plans (only available for withdrawal plans if the DFM model does not include cash) to a DFM model.

A DFM can also manage models and realign client accounts directly.

Over 50 different DFMs are available through our service and you may choose more than one DFM, although only one portfolio per account can be used.

For detailed information on our DFM service, please view our webinar.

Frequently asked questions

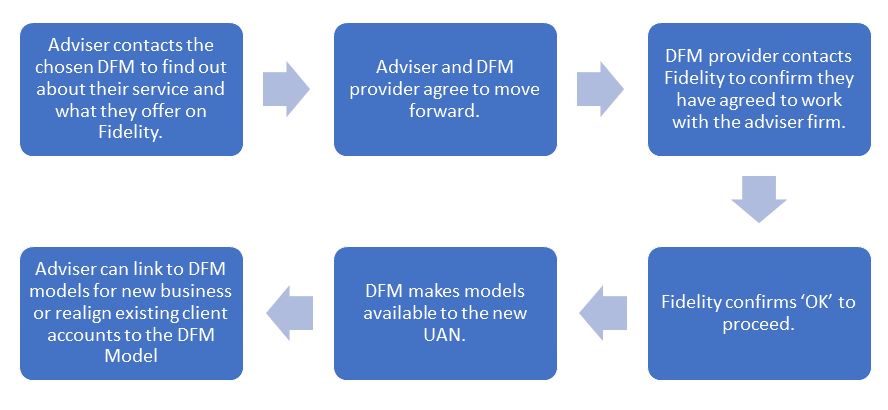

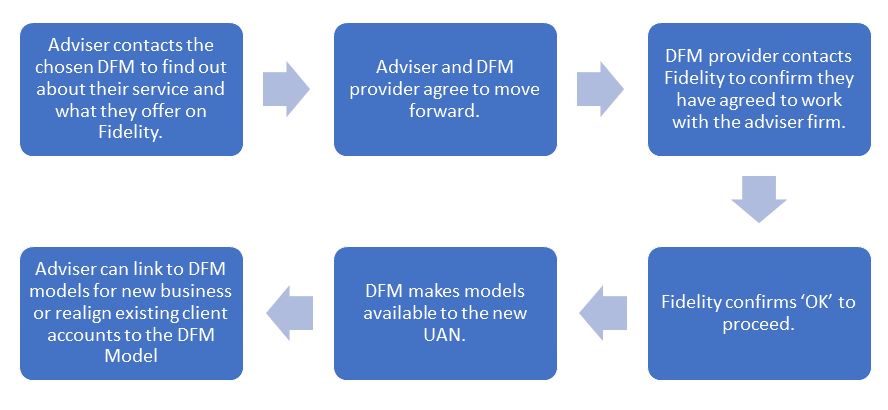

It is very simple and no paperwork is required. The process is illustrated below:

DFM model portfolios can be accessed through the following wrappers:

- Pension

- Investment Account

- ISA

- Junior ISA

- Standard Life SIPP

- Pension trustee accounts

- Offshore bond products (Canada Life & Utmost)

- Trust accounts

- Corporate accounts

- Charity accounts

The service is not available for Junior SIPPs, Standard Life International and Investment Bonds.

DFMs have access to all asset classes on the platform, including:

- Funds (OEICs and Unit Trusts)

- ETFs

- Investment Trusts

- Shares

- Offshore Funds

Please note, not all exchange-traded investments will be available for the following wrappers. In addition, Product Cash will not be available for these wrappers and so a DFM would be required to hold a cash alternative, e.g., a cash fund.

- Standard Life SIPP

- Pension trustee accounts

- Offshore bond products (Canada Life & Utmost)

- Trust accounts

- Corporate accounts

- Charity accounts

There are no additional charges for using a DFM through our platform, although the DFM may charge for their services.

Normal platform charges apply – an Investor Fee of £45pa plus a Service Fee of 0.25%.

Charges for trading Exchange Traded Investments also apply – buy/sell £3, switch £1.50, rebalance £1.50 (these charges are per trade, per client).

You can enter the DFM fee and your own (adviser) fee online and these will be shown separately in the illustrations. DFM fees can be entered on the system with or without VAT.

With regards to the payment of fees for ISAs, Investment Accounts and our Pension, one payment is made to you and one to the DFM. Monthly statements are provided to you showing the payment to the DFM.

For the following accounts, fees will be paid directly to the adviser firm. The amount to be paid to the DFM will be shown on the adviser fee statement, and it will be the responsibility of the adviser to forward this on to the DFM:

- Standard Life SIPP

- Pension trustee accounts

- Offshore bond products (Canada Life & Utmost)

- Trust accounts

- Corporate accounts

- Charity accounts

Advisers

- Portfolio x-ray reports.

- Fund disclosure documents, e.g., KIIDs and fund factsheets.

- Reports to help identify which client accounts are linked to a DFM model.

DFMs

DFMs are required to send out quarterly reports to clients. As part of our service, DFMs can elect for a quarterly report to be sent to clients on their behalf (a DFM may do this themselves). Reports are sent in January, April, July and October for the previous quarter, e.g., reports sent in April will cover the months of January, February and March.

Advisers and DFMs:

A daily report is available to you and the DFM whereby performance calculations on client accounts linked to DFM models can be viewed. It is between your firm and the DFM as to who takes responsibility for notifying the underlying client of any falls of 10% or more (we will not notify the client).

Overview

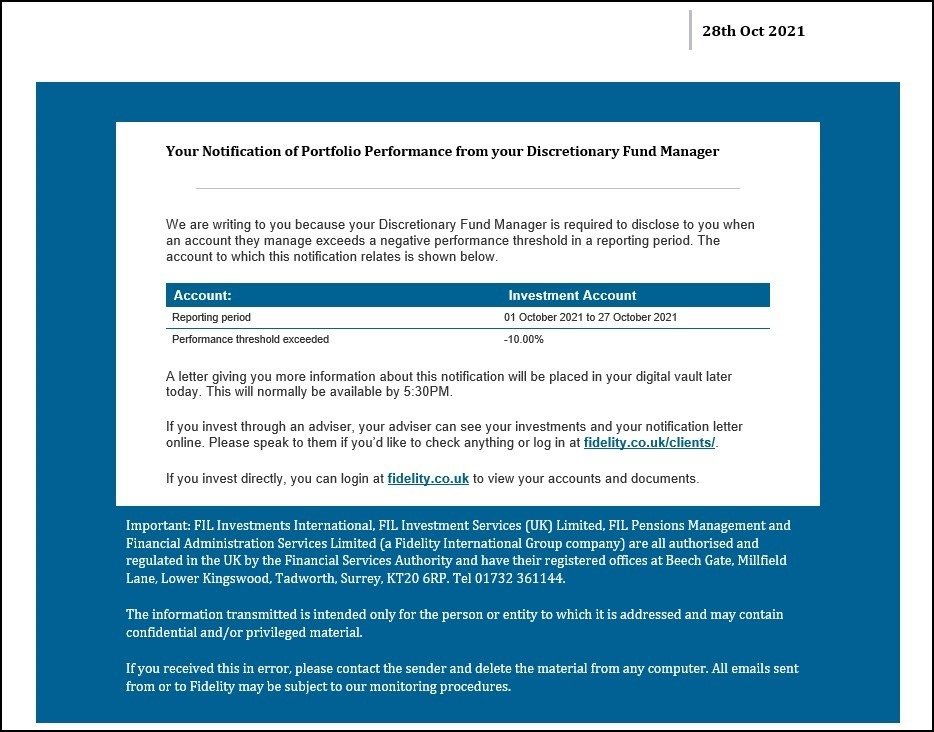

Yes, the 10% depreciation reporting service is an optional facility for DFMs whereby notifications can be sent to clients when a portfolio depreciates by 10% (or multiples of 10%) or more over a reporting period. Your DFM will be able to tell you if they have opted into this service or not.

The service, where enabled, provides the following facilities:

- It detects when a threshold is exceeded in a calendar reporting period for a client account.

- Advisers can opt into receiving an alert if any of their accounts that the DFM manages exceeds a threshold on any given day.

- Clients can be contacted directly via email if they are web registered. A letter will also be placed in their electronic vault detailing the accounts and performance.

- MI is available on accounts showing where a threshold has been exceeded and whether affected clients have been contacted. Reports are available to advisers and DFMs.

- Advisers can view client letters through the Client Management facility.

Once enabled, the service will cover all accounts linked to the DFM’s model portfolios. However, your clients must be web-registered to receive a notification of a 10% depreciation event.

The reporting periods for the service run on calendar quarters, starting on 1st January, April, July, and October. The performance assessment uses a money-weighted return calculation. The evaluation includes the effect of fees and charges directly deducted from the account.

Read more about this service in our Intermediary Terms of Business.

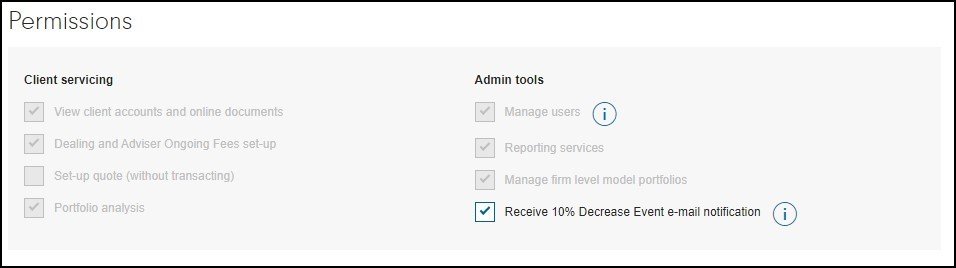

Enabling alerts

The service can be configured so that each consultant receives an alert when an account using a discretionary model exceeds a 10% threshold for the first time in the reporting period. For each consultant, simply check the ‘Receive 10% Decrease Event e-mail notification’ box under user preferences. To set this up, the consultant needs to be able to administer user preferences.

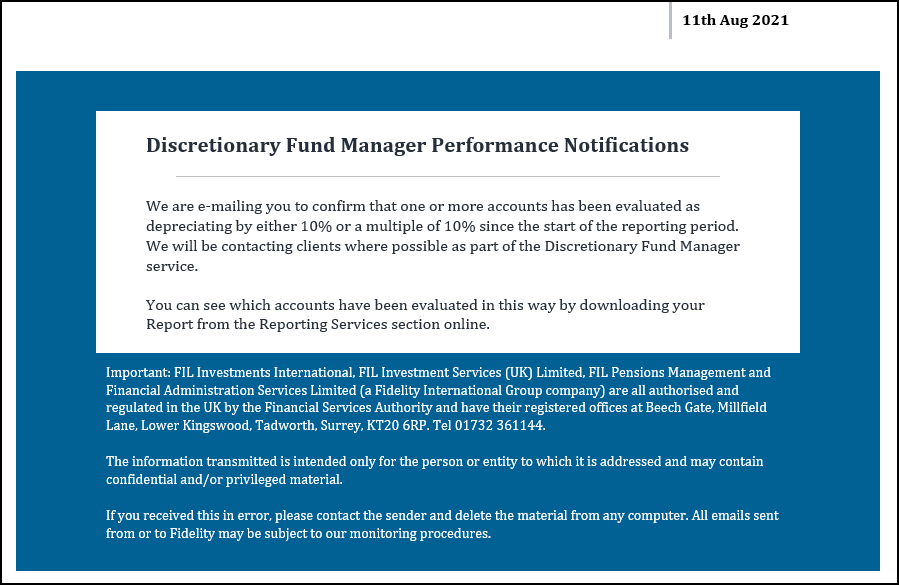

On any day where a threshold is exceeded for the first time by one or more accounts, an e-mail alert will be sent to registered consultants. A sample of the e-mail is shown below:

Viewing letters

If a client is web-registered, they will receive a notification e-mail and electronic letter when a 10% threshold is exceeded within one of their accounts for the first time. If they are not web-registered, we will not attempt to communicate with the client.

A sample of the email is shown below and you can view a copy of the electronic letter here. Your DFM may include additional content in the letter (this is optional facility for the DFM):

No, a DFM cannot view client accounts but they do have access to MI on the accounts linked to their models. For data protection purposes, a DFM does not have access to the same level of information as the adviser.