Reporting services and back-office integration

Our online reports give you easy access to a comprehensive range of information on clients and accounts. In addition, we offer a number of dedicated client reports. Our platform can also be integrated into a range of third-party software systems to help you manage your business more efficiently.

Accessing your reports

To access reports, simply select 'Firm' from the left-hand menu on the Client Management facility then 'Reporting Services'. Once you've entered your company details, you'll be able to choose the reports you need. Your report will be ready within 24 hours.

|

Report name |

Summary |

Key benefits |

Frequency |

|---|---|---|---|

|

Account Information |

This report details which clients have been migrated to our new product administration system and helps determine what MiFID II information is required. |

Provides time and date of client migration to our new product administration system, as well as an indication of whether additional MiFID II information may be needed, for example if the client holds an exchange traded investment. The report also shows you if the client has registered for online access. |

Daily |

|

Adviser Fee Rates |

This report lists all clients’ accounts set up with an Ongoing Fee, at what rate and where the deductions will come from along with the account valuation. |

Supports the administration of clients on fee agreements as well as calculating fee expectations. |

Daily |

|

Adviser List |

This report details all branches that are linked to the Unique Agency Number (UAN). |

This report is intended for organisations who wish to verify the details of all their UANs set up with Fidelity. |

Daily |

|

Adviser Fee Payments |

This report details all adviser fees earned during the previous month. The report is sent monthly, on or before the 25th of each month following each fee payment run. |

Produced to support the payment and reconciliation of adviser fees. |

Monthly |

| Adviser Transfer Status Report | This report delivers real-time, digital visibility of client transfer progress across all products except Junior SIPP. It includes status updates, action ownership, and dynamic timelines. | All transfer information is conveniently centralised in one location. This enhances transparency, workflow efficiency, and the overall user experience. |

Daily Annually |

|

Annual Distribution Summary |

A report summarising all distributions for non-tax wrapped (OEIC/UT) and pension investments for the previous financial year. This report is produced annually in May/June. |

Provides a summary of your clients’ non-tax wrapped distributions for the previous financial year allowing you to help with their distribution enquiries. |

Annually |

|

Assets Under Management |

This report gives a snapshot of Assets Under Management, broken down by product, fund provider, fund and agency. |

Gives an overview of asset distribution across funds, providers and sub agencies, enabling analysis of any risk concentrations and asset allocation. |

Daily |

|

Cancelled Deals |

This report details all transactions which have been cancelled during the selected period. |

The report is intended for advisers who wish to track any deals which are cancelled after they have been priced. |

Daily |

|

Cash Report |

This report shows cash within an account in addition to details on regular transactions set up, such as income, fees, and withdrawals |

It shows available cash and any regular transactions which could impact cash |

Daily, Weekly, Monthly, Quarterly |

|

Client List* |

This report details all current clients and the number of active accounts currently held, as well as listing those clients paying the Investor Fee and any remuneration model they are under. It now includes details of adviser consultant IDs linked to the attributed pension account. |

It can be used to update your client database or in order to produce a mailing list for your clients. The report also includes clients’ e-mail addresses. |

Daily |

|

DFM Fee Payments |

A statement showing all DFM payments your clients have paid |

This report will be used to review how much your clients have paid in DFM fees, additionally it is used to calculate any manual payments still required. |

Monthly |

|

Fund List |

This report details all funds currently available. |

This report allows you to maintain an accurate list of funds that can be purchased or re-registered. |

Daily |

|

Holdings |

This report details all client holdings by fund and will include the number of units or shares held and the latest fund values. Any zero balances are excluded. |

Full reporting of all clients’ holdings – allowing you to keep track of assets on the platform at both product and client level. |

Daily |

|

Income Distributions |

This report details any income distributions on non-tax wrapped (SICAV/OEIC/UT) clients’ accounts during the period. It provides the same information that is provided in a tax voucher. It now includes details of SICAV income payments as well. |

Allows you to keep up-to-date with clients’ income and tax position. |

Daily |

|

Investor Fee Collections* |

This report details collections of the Investor Fee from your clients, including where the fee was collected from or if it was unsuccessful, and on what date the fee was collected within the period the report covers. |

Allows you to keep track of the deductions for the Investor Fee and ensure they are coming from the designated holding. |

Daily |

|

ISA Contribution Report |

A two part report detailing clients who have opened an ISA but have not utilised their full allowance, as well as clients linked to your agency that have yet to open an ISA in the current tax year. Now includes any unwrapped collectives and cash holdings which could be moved into an ISA. |

Suitable for generating marketing mailings to your customers in the run up to the end of the tax year, to ensure ISA allowances are being effectively used. |

Daily |

|

ISA Income |

This report details any income distributions within clients’ ISA accounts during the period chosen. It provides the same information as the paper ISA income statements sent to clients. |

Allows you to keep up-to-date with clients’ ISA income; including reinvested units. |

Weekly |

|

Model Portfolio and Assigned Clients |

This report lists all clients linked to Model Portfolios. |

Provides details of clients linked to different models, the client’s current valuation and date last rebalanced. |

Daily |

|

Monthly Sales |

A report giving you a concise overview of the last six months sales figures, containing net sales, gross sales and redemptions. |

Allows you to have a quick overview of the business conducted over a rolling six month period. |

Monthly |

|

Pension Summary |

A report providing a detailed overview of all pension accounts. |

This report shows full details of all clients' pension accounts. It provides key details such as withdrawals, contributions and tax positions. |

Weekly |

|

Pension Transfer Status |

This report gives you a snapshot of clients’ pension transfers so you can see how they are progressing. |

Allows you to view and track the status of all your clients’ in-bound pension transfers from other providers. The report also identifies whether any documentation is still required to complete the transfer. |

Daily |

|

Portfolio Valuations & ISA Allowances |

This report details total portfolio holdings by client and lists the remaining current year ISA allowance. |

Provides a high level overview of your clients’ total holdings and remaining ISA allowance, helping with client segmentation and targeting those who have not fully utilised their ISA allowance. |

Daily |

|

Product Costs |

A report at account level detailing all MiFID II related product costs and charges per month for the last 18 months. |

Provides a full breakdown of product charges including Investment Charges (OCF, Entry/Exit, Transaction and Incidental costs). |

Daily |

|

Re-registration Status Report |

This report shows the detailed status and updates on all outstanding re-registration in cases |

Provides an overview of all outstanding or recently closed re-registration in cases. At asset and account level it shows the status, provides rejection reasons and any conversion activities. |

Daily, Weekly, Monthly, Quarterly |

|

Regular Savings Plan |

This report details all the regular savings plans (previously known as monthly savings plans) which are set up for your clients and their current status. |

Enables you to track how many payments have been made, the current amount and when the next payment is due. |

Daily |

|

Regular Savings Plan Fee Rates |

This report lists all clients set up for regular savings plans where an initial fee rate has been applied. |

Supports the ongoing administration of clients on fee agreements and allows you to check key details such as initial fee type, rate and monthly collection amounts. |

Daily |

|

Sales Report |

A report detailing all major transactions (such as purchases, redemptions, switches, transfers and re-registrations) but excluding administrative transactions (such as reinvested units, tax credits and interest accruals). |

Allows you to concentrate on the most important account activity and monitor actual business transactions placed by you and your clients. |

Daily |

|

Service Costs |

A report at account level detailing all MiFID II related full costs and charges per month for the last 18 months. |

Provides a full breakdown of MiFID II costs and charges including all Fidelity Fees and Adviser Fees. The report also shows a rolling 12-month aggregate of all costs and charges each month. |

Daily |

|

Transactions |

This report details all transactions during the selected period. |

Provides details of recent transactions to enable you to check key details such as charges, fees and other deal information. |

Daily |

|

Web Access |

Shows individuals set up under an agency number with a consultant ID for web access. Details all the permissions the individual is set up with such as dealing, viewing accounts and reporting services. |

Enables you to keep track of users and ensure that they have the correct permissions set up. |

Weekly |

*Please note that details regarding the Investor Fee for accounts held by two or more clients are not displayed on this report.

Dedicated client reports

We offer enhanced reporting for the following three areas:

- Client reporting

- Capital gains reporting

- Income reporting

More details on each report appears below.

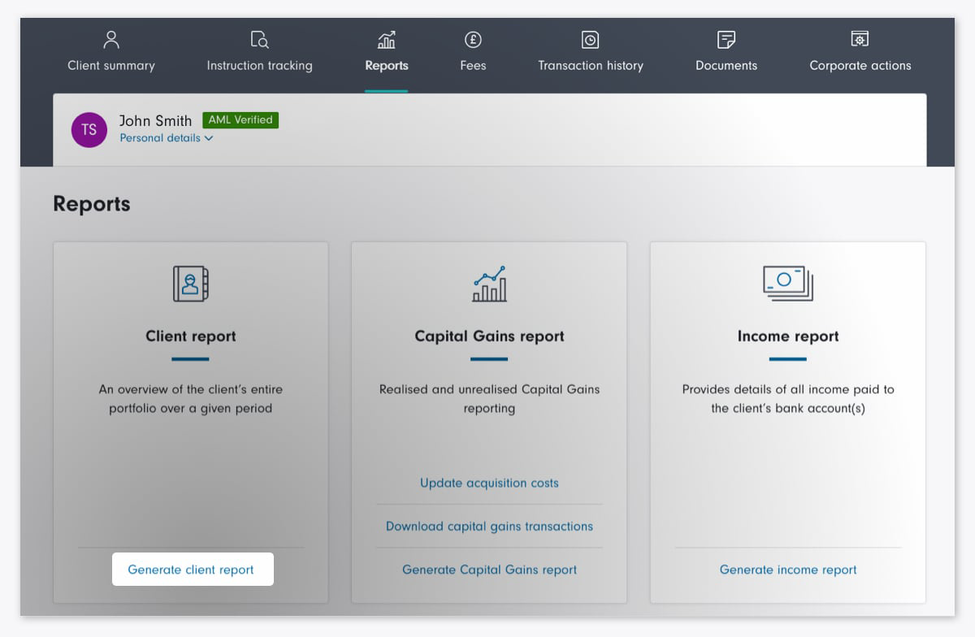

To access these reports, simply locate the client’s account and select ‘Reports’. You will see this screen from which you can make your selection.

Our ‘Client reporting’ facility saves you time by gathering all the information needed for a client review in one convenient place. You can choose the latest tax year or a date range going back to April 2015 for the report and it can be created across single or multiple accounts. Data is available up to the end of the last full business day.

The report shows:

- The total return for the accounts selected

- Valuations at the start and end period of the report

- The total money in and out of the account, including a detailed breakdown

- Performance for the specified period

- Asset allocation

- Account information including regular contributions, dates and amounts, withdrawals, fees and up-to-date expression of wish and protection details.

The benefits to advisers:

- You can obtain all the information you need for a client review in one place, rather than having to view several different pages, therefore saving you time

- Information within the report will allow you to complete a comprehensive review with your client

- The report is simple and clear for your clients to understand

- Your client will be able to clearly see all the platform fees and charges

- You can add commentary throughout the report.

More information on the report can be found in our Guide to client reporting.

This report allows you to view a client’s capital gains position for investments held on the platform. It's the easy way of managing and reporting capital gains positions on behalf of your clients.

Features

- Unrealised and tax-year specific realised gains reports are available on screen or can be downloaded as a PDF or Excel spreadsheet

- Excess Reportable Income (ERI) is calculated in the report

- Entry of acquisition costs for capital gains purposes for re-registered and stock transferred investments

- The consolidated capital gains report allows you to combine both reports into one document

- There’s the ability to deliver bulk and/or single client reports

- The reports account for historic deals with daily updates

- Calculations are made using up-to-date prices.

Calculations take into account acquisition date and cost, disposal proceeds, current value, equalisation and notional distributions and corporate actions. Computations follow the general CGT rules of identification and matching.

More information on the report can be found in our Capital gains reporting service user guide.

Our income report provides a comprehensive breakdown of all natural income payments, generated from any income investments held by your client on the platform. The report shows the income treatment for all income payments received; this includes any income that has been:

- Paid out to the client’s bank account or is due to be paid out

- Paid to the Product Cash Account or Cash Management Account

- Reinvested

In addition to natural income payments, the report also includes details of any interest paid on cash held in client accounts. Further details on our cash facilities, including the current interest rates can be found here.

How to generate the report

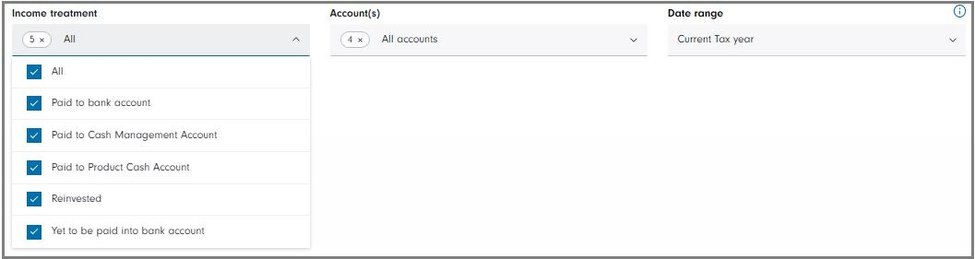

Once you’ve accessed the income report:

- Select the types of income treatment that you’d like to include within the report

- Choose whether to include all the client’s accounts or include/exclude specific accounts

- Pick a reporting period from a fixed timeframe (e.g., a specific tax year) or enter your own custom date range

- Click on “show report”

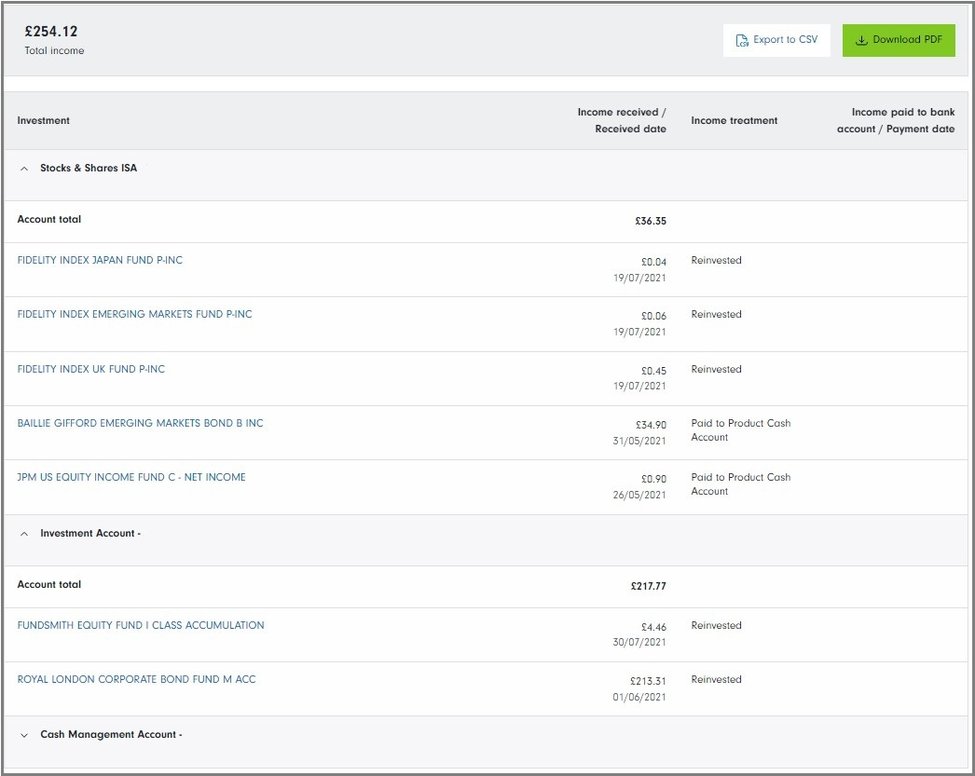

Viewing the report

The income report is generated on screen and provides:

- The total income received across all accounts included within the report

- A breakdown of all income payments at both account level and investment level

- The ability to expanded or collapsed accounts to make viewing the information on screen easier

- The option to exported to a CSV spreadsheet or download as a client friendly PDF file

Please be aware that the report does not include any payments made to your client as part of a fixed withdrawal plan or phased drawdown instruction.

Data is only available from the 1st January 2015. If you require income information prior to this date, please use the ‘Transaction’ tab when you have selected your client.

Helpful guides and links

Frequently asked questions

- Most funds that reside outside of the UK are designated ‘offshore’. For example, Irish domiciled funds and ETFs count as offshore.

- You can also tell the Funds country of origin by the ISIN number. If the code doesn’t start with ‘GB’ then it’s most likely an offshore fund.

- Excess Reportable Income (ERI)

- ERI is the profit from a fund that has not been distributed to investors, either as dividends or interest. ERI is deemed as a distribution of income for UK tax purposes and is treated as if the investor had received on the fund distribution date.

- Excess Reportable Income (ERI) relates to offshore funds that have obtained reporting fund status with HMRC in the UK.

- HMRC maintains an approved list of offshore reporting funds.

- Fund and ETF providers publish excess reportable income in annual documents that can be used to calculate tax liability.

- This will typically include the following information:

- Excess reportable income amount per unit / share

- Fund distribution date

- Start/End Day of the reporting / accounting period

- Equalisation amount / adjustment (if any)

- Currency.

- Excess reportable income is payable even if fund shares were purchased on the final day of the reporting period.

- ERI has a reporting start and end period. The excess reportable income counts as being received on the fund distribution date which is 6 months after the reporting end period. The distribution date also determines the tax year that any tax liability falls due.

- The fund distribution date may be different from other dividend distribution dates. This way, different tax years can apply to excess reportable income versus income paid directly as cash.

- For income funds, tax will be owed on excess reportable income plus any cash distributions that are paid directly to the customer.

- The ERI is added to the base cost of the fund, which in turn reduces the capital gains tax bill when shares are sold.

- Excess reportable income is earned for any shares held on the last day of the fund’s reporting period.

- Calculation is: Net proceeds – (Base cost + ERI) = Capital gain

- Here’s an example of how to apply it to disposals:

- Base cost (aka acquisition cost) of fund £10,000

- ERI calculated as £500

- Base cost plus ERI = £10,500

- Net proceeds: £20,000

- Less base cost & ERI of £10,500

- Capital gain = £9,500

The existing Capital Gains Transaction report (accessible to advisers through the FAS website) has been enhanced to include Excess Reportable Income (ERI) information.

ERI data is needed by investors so that they can add this information to their annual Tax return for onward transmission to HMRC. This information is not available in the CGT realised and unrealised gain reports.

In addition to the existing 11 data points contained within the Capital Gains Transactions report, the report has been enhanced to include a further 12 data points. Please see below for a full list of additional data points and definitions.

These changes are live to advisers only, with effect from 21 April

ERI Reporting Start Date | The reporting period start date marks the beginning of the reporting period for which the Excess Reportable Income (ERI) is calculated. |

ERI Reporting End Date | The reporting end date is the final date of the reporting period for which the offshore fund calculates its (ERI). This is the ex-date for the accumulation. |

Units Held at The Reporting End Date | This relates to the total number of fund units that an investor owns in the offshore funds as of the ERI reporting period end date. |

Units Acquired in Reporting Period | This relates to the total number of fund units purchased by the investor within the specified ERI reporting period. |

ERI Income Rate | This is the amount of extra income earned by each unit in an offshore reporting fund during a specific period that wasn’t paid out to investors. This is expressed as a value per unit and helps you figure out how much taxable income you need to report based on the number of units the investor owns at the end of the reporting period. |

Total ERI Income at The End of The Period | This is calculated by multiplying the excess reportable income rate by the number of shares held by the investor on the last day of the reporting period. |

Equalisation Rate | The equalisation rate is an adjustment that accounts for when the investor bought the units in the fund during the reporting period. It ensures that the investor only pays tax on the income earned while the investor owned the units, not on income earned before investing. |

ERI Equalisation Amount | This is the total adjustment applied to the investor’s investment based on the number of units bought during the reporting period. It reduces the amount of ERI that needs reporting for tax purposes. |

Fund Distribution Date | This refers to the date on which the ERI is deemed to be distributed for UK tax purposes, typically 6 months after the end of the reporting period. |

HMRC Reportable for Next Period | This indicates whether for its next Financial Year the fund will retain UK reporting status. If it chooses to surrender the status then the investor’s tax position changes with effect from the start of the next reporting period and capital gains treatment is lost from that date. |

Tax Year | This is the tax year in which the ERI is reportable. |

ERI Income Type | This will show either ‘dividend’ or ‘interest’. |

Other changes are being made

- The ‘Taxing Calculations Capital Gains Tax’ document has been updated to reflect these changes.

- The FAS website has been updated to reflect that ERI information is now available for offshore funds.

Coverage

- A list of offshore ISINs for which ERI data is not available can be found here. This list will be updated on a monthly basis.

- Fidelity has Capital Gains reporting which can help advisers to quickly identify both unrealised and realised gains or losses within client portfolios on the platform.

- The report uses data from all the historic transactions conducted on the platform, and calculations are produced both at an account level and for individual fund holdings.

- Advisers can see a client’s overall Capital Gains position and view which investments the gains and losses arise from.

- Transactions used to perform the calculations can also be viewed within the Capital Gains reports.

- Fidelity has partnered with a 3rd party vendor to source ERI data from fund providers for all eligible funds.

- Where offshore funds are held and where FIL has access to information regarding the ERI for the fund and the equalisation, this will be included within the calculation of any gain or loss.

From 14 March 2025 Excess Reportable Income for offshore funds will be incorporated into the calculation of both realised and unrealised gains and losses.

- The existing Capital Gains Transaction report (accessible to advisers through the FAS website) will be enhanced to include ERI information including; ERI reporting period, the ERI distribution date, the ERI income rate, equalisation rate and tax year.

- Existing reports and web pages will be updated to reflect these changes.

- These changes will be live 21 April 2025.

- Our third-party vendor has assured us that periodic checks are completed against the HMRC register ensuring all offshore reportable funds are included within our CGT reporting.

- Where the fund manager has reported a ‘nil rate’ for ERI purposes, this will not appear within our reporting.

- FIL cannot guarantee that it will always have access to this information, and where it is not available, the Capital Gains reports may over or understate a gain or loss on a fund in this category.

- These changes will only be visible to advisers. Therefore, any client accessing information through EI (including advised clients) will not see the same information.