Doing business with us

Here you’ll find all the information you need in order to do business with Fidelity, including due diligence materials to support you decision-making process and disclosure material for using with your clients.

There are two scenarios in which clients can be moved between firms:

- Linking an existing Fidelity client (e.g., someone who is linked to another advisory firm, a different Unique Agency Number (UAN) of the same firm or is a client of Fidelity Personal Investing.)

- Bulk transferring clients from one advisory firm to another

Further information on each of these scenarios appears below. Our service for information-only advisers is also covered below.

Skip to section

Useful forms

- Your guide to the Transferring clients between firms

- Transfer of Business application form*: Please complete this form if you wish to complete a transfer of business from one agency to another of more than 10 clients.

- For less than 10 clients please use our online Link a Client functionality.

-

Transfer of Business excel data capture form* : (For partial novations only): Please complete this document to go alongside the form above, if carrying out a partial novation.

-

Letter of Authority - Information Only*: This document is to provide account information to a regulated third party for an Information Only client.

*Once completed, this can be sent to us using our Upload and Send service. -

Online Letter of Authority capture form : This form is available for use between advisers/intermediaries and their clients. It is not an application form and should not be sent to Fidelity Adviser Solutions.

Frequently asked questions

Existing Fidelity clients (those currently linked to an adviser firm or a client of Fidelity Personal Investing), can be linked to your firm through our online ‘Link a client’ service.

Once a client has been moved to your agency from a different firm, please link a model portfolio (if required) and activate any ongoing adviser or DFM fee (if required) once the client has been moved.

If you are moving your client(s) between unique agency numbers (UANs) within the same firm, the existing fee agreement will remain in place. You may need to relink any model portfolio once the client has been moved to the new agency and set up a DFM fee as appropriate.

Any specific client platform fee agreements will not be carried over and clients will adopt the platform fees set up on the unique agency number they have been moved to.

To link a client to a new unique agency number:

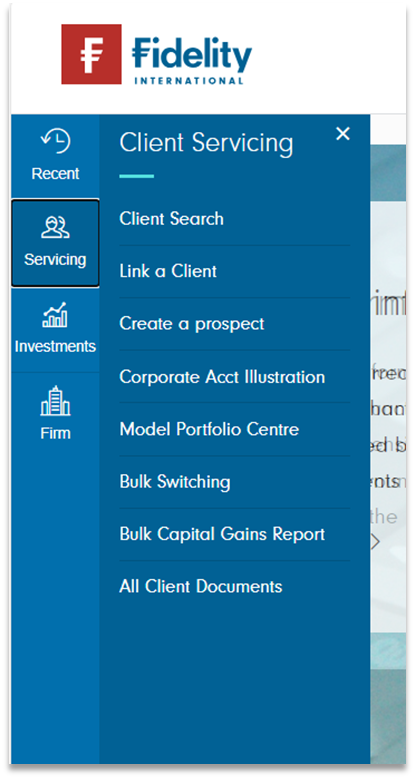

- Log in and select ‘Servicing’

- Select ‘Link a client’ from the left hand toolbar

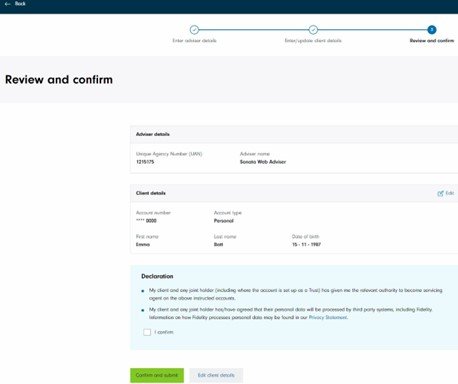

- Enter details into the 3 step process detailed in the images below.

- A letter will be sent to your client to confirm they have been linked, and a copy will be added to the vault for your reference.

Please Note: If you are moving your client(s) between UANs of the same firm, no additional paperwork will be sent to your client and no change will be made to the client’s adviser fee agreement.

Benefits of using this service:

- Quick and easy to link a personal, corporate or trust client account online - visible within 24hours

- No additional paperwork required

- Enables easy ongoing management of the account and ability to activate any adviser fees

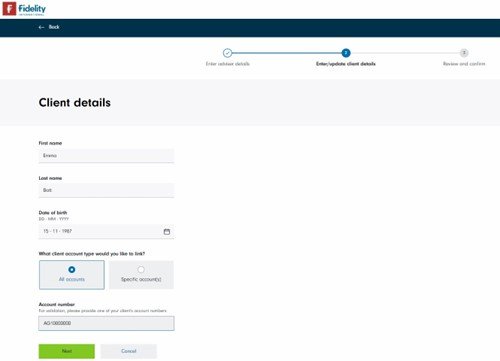

- Ability to specify whether all the client’s existing accounts are to be linked or specific ones

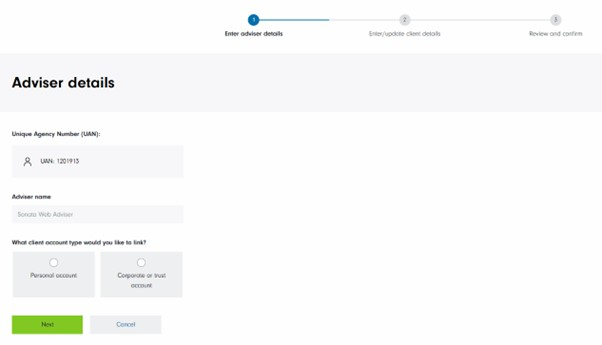

Step 1 - Adviser details

Step 2 - Client Details

Personal Account

Corporate Account

Step 3 - Review and Confirm

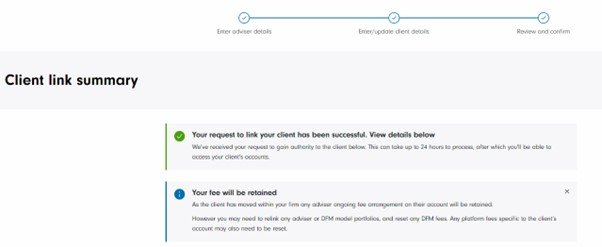

The confirmation screen below appears when a client moves from one agency to another within the same firm. When a client is moving from another firm, the message will advise that no fee has been retained and a confirmation letter will be sent to the client.

Actions you need to take

Once your client is linked to your agency:

|

Moving client(s) to a new firm |

Moving client(s) within existing firm |

|---|---|

|

|

|

There are two ways of bulk transferring a client from one firm to another:

1. The most efficient method is to complete the relevant Fidelity forms for:

- Full novation/transfer: complete the Transfer of Business application form

- Partial novation/transfer: complete the Transfer of Business application form and Transfer of Business excel data capture form . These can both be sent to us via your ‘Upload and Send’ service.

2. Alternatively, if you do not wish to complete this form, then you can send us the relevant industry standard permission documents, the most efficient way of doing this is via your ‘Upload and Send’ service. These must include the following information:

- Please ensure that all Fidelity Unique Agency Numbers are up to date for your agency

- For the previous agency, we require:

- Firm name

- FCA number

- Fidelity Unique Adviser Number (UAN)

- Signed confirmation that they consent to this transfer of business (Please note this is not required if you are transferring business from an agency that is part of the same entity as yours. If the previous agency was an appointed representative, we require signed authorisation from the previous network to proceed).

- For the new agency, we require:

- Firm name

- FCA number

- Fidelity Unique Adviser Number (UAN)

- Address

- Contact details

- Bank details

- Confirmation that the client consents to this transfer of business

- State whether it is a Full Transfer or Partial Transfer (a partial transfer is where only some of the clients are being transferred to the new agency. Please fill in our Transfer of Business excel data capture form if selecting this option).

- Important: Please inform us which Fidelity Unique Agency Number (UAN) we should transfer the clients to:

|

Transfer options |

|||

|---|---|---|---|

|

1. Link all clients to your existing Fidelity UAN |

2. Re-use existing Fidelity Head UAN**(Only applicable for a full transfer) |

3. Link all clients to a new sub UAN, under the existing Head UAN |

4. Create a new Fidelity Head UAN |

** This option is only applicable for full transfer of all clients linked to the previous head UAN. We will update the FCA Number and all agency details. Please note we can stop or transfer an existing adviser ongoing fee, but we cannot change it.

The Client Authority Form needs to be signed by the client before setting up, amending or taking over fees following the transfer, even if you have your own paperwork for fee arrangements. You do not need to send this form to us, but you should retain this on your client files as we may ask for this at a future date for regulatory purposes.

Actions you need to take: |

|---|

|

Once the clients have been moved to your agency:

|

Please note we do not process requests from overseas advisers as these firms are not FCA regulated. If we do receive such a request, we won’t action this but we will inform the client who can manage their relationship with the adviser directly off platform.

Please go online to establish any adviser ongoing fee

Please go online to establish any adviser ongoing fee