Data to support your business needs

Data is key to every business. It allows trends to be identified and can help with auditing your book of business and support your clients.

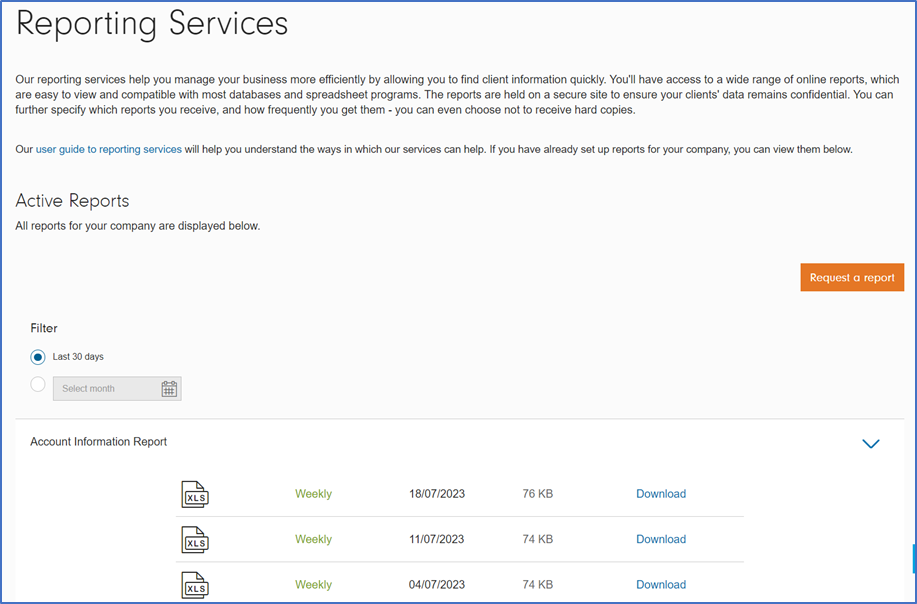

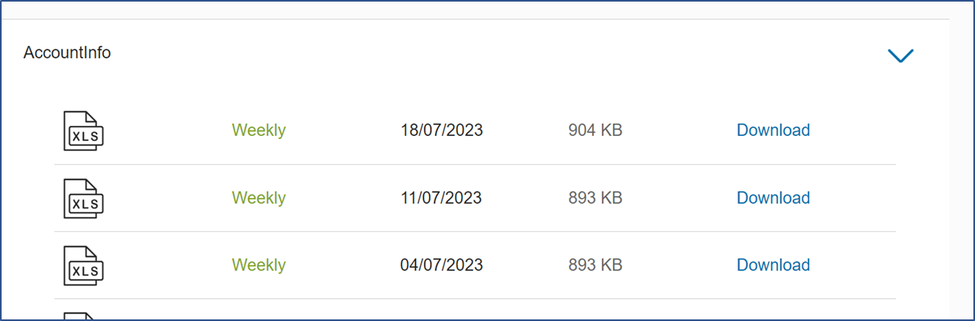

Did you know we can provide comprehensive management information to help you monitor your business and your clients’ accounts? The ‘Reporting Services’ area of our website has numerous reports available which can assist in managing your business more efficiently.

Click here to find out more about our Reporting Services.

Benefits to you and your business

Solving your business problems/needs

As we have numerous reports available, we’ve highlighted some examples of specific business needs that our reporting can help you solve.

Our online service offers clients many benefits, including opting for online documents, as well as performing some basic administrative tasks themselves. This saves time for you as well.

Clients can:

- View the latest valuation of their investments and accounts whenever they wish

- Download all their important documents, such as their latest Statement & Valuation

- Complete simple tasks online, such as updating their personal details when these change

- Manage their investments (we recommend they speak with you before making any adjustments)

Watch this interactive video to view the benefits of the online client portal.

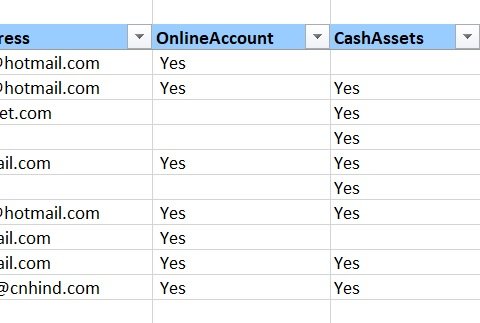

How can I see if my clients have online access?

To easily identify which clients have not registered for online access, you can use our handy Account Information report. Once you have the report open, scroll to the column entitled ‘Online Account’, where you can filter to show clients who have online access or not.

How can my client register for online access?

Signing up for an online account is quick and easy. Clients should:

- Visit fidelity.co.uk/clients

- Click on ‘Register for online access’ and follow the instructions.

Our step-by-step guide can also take them through this straightforward process.

For further information and to learn how clients can register for online access, please visit our Help clients move online page.

Keeping up with a client’s changing circumstances has always been important to enable the appropriate financial planning for that client, and even more so now with the introduction of Consumer Duty.

The new regulations emphasise avoiding foreseeable harm for clients and therefore, having an up-to-date Expression of Wish is key to ensuring that benefits are passed on to those that your client had intended them for, and importantly that the benefits can be paid out as either a one-off lump sum or as a regular pension withdrawal, whichever suits the beneficiaries and their tax position better in the future.

Our popular ‘Pension Summary report’ can help identify clients with no Expression of Wish in place or those who may not have updated it recently. Watch the video below to find out how.

Further information is also available in our Expression of Wish and Nomination form guide. This guide will help you complete the Expression of Wish and Nomination Form.

We understand the importance of fees to your business and therefore, ensuring that all your clients are set up with the correct adviser ongoing fee is essential. Have you got clients where the ongoing fee hasn’t been set up? Are you losing income to your business?

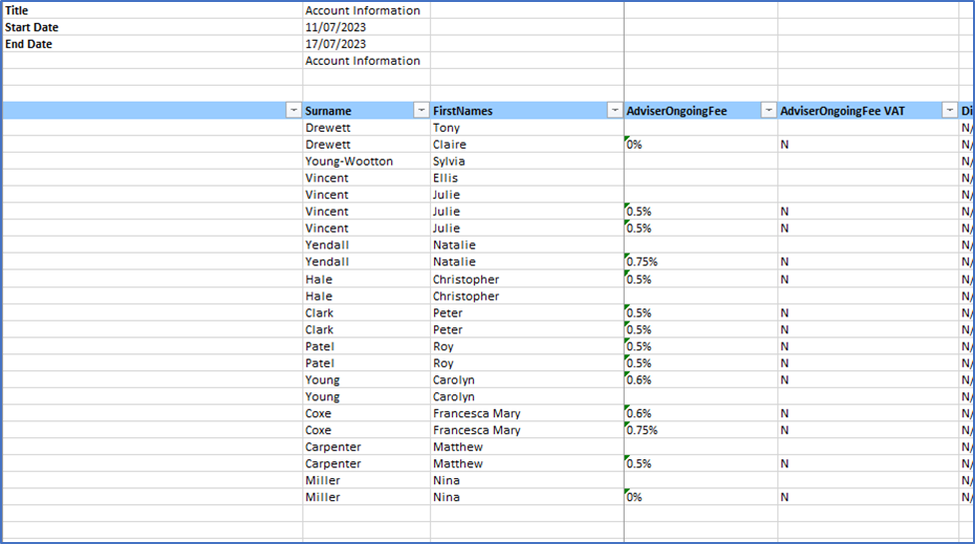

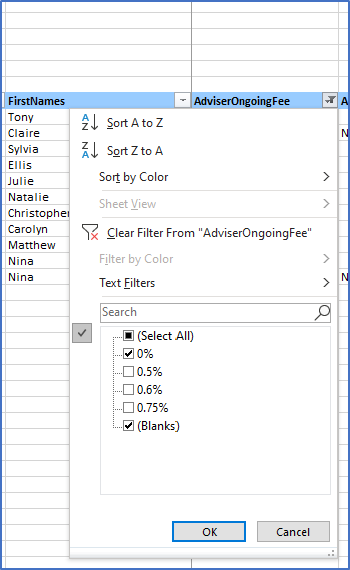

Check now by viewing the ‘Account Information’ report within the Reporting Services area of the platform:

- Once the report is opened, simply scroll across to the column labelled ‘AdviserOngoingFee’

- Click on the arrow on the column heading to open the filter.

- Select only ‘0%’ and ‘£0’ then click ‘Ok’. This will provide you with a list of clients with no ongoing fee set up.

Often clients may not be linked to the right model portfolio. In order to avoid foreseeable harm under Consumer Duty, it is essential to regularly check that clients are in the right version of the model.

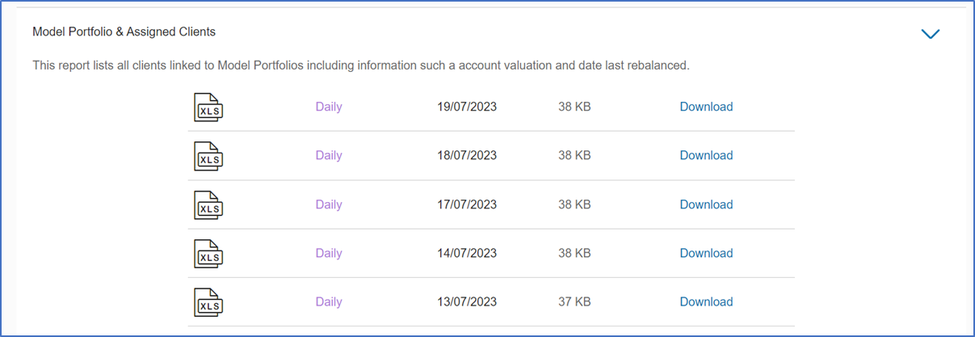

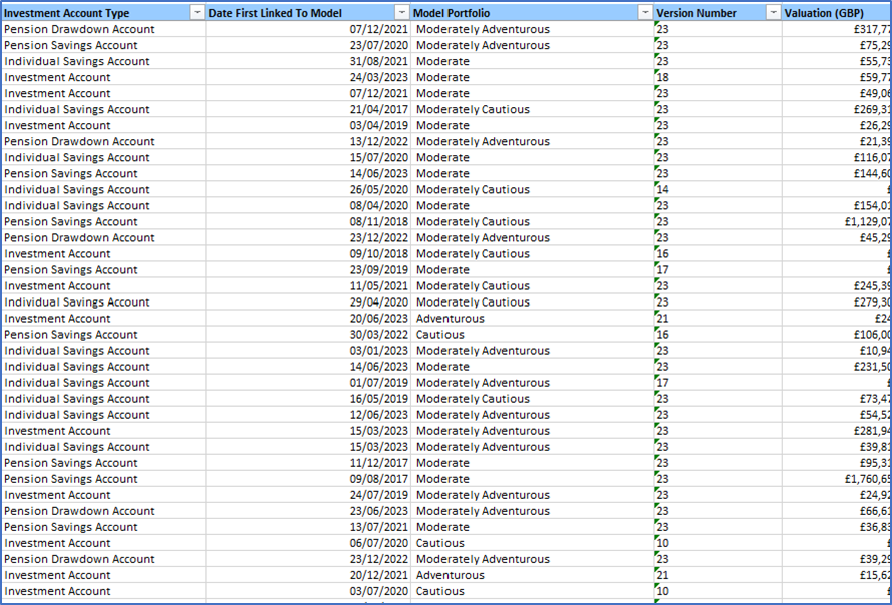

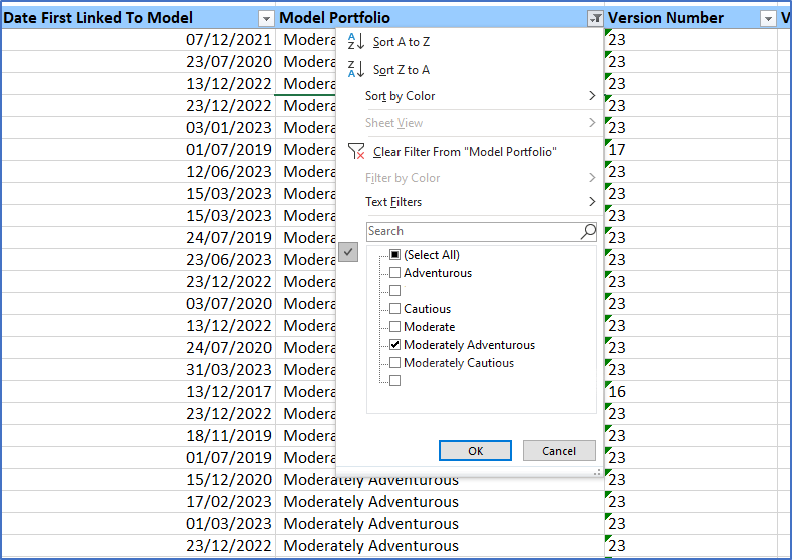

Check now by viewing the ‘Model Portfolio and Assigned Clients’ report within the Reporting Services area of the website:

- Simply open the report and scroll to columns labelled ‘Model Portfolio’ and ‘Version number’. You can also view your clients ‘last rebalance date’.

- Click on the arrow on the ‘Model Portfolio’ column to look at a particular model portfolio to identify any clients that may not be in the latest version

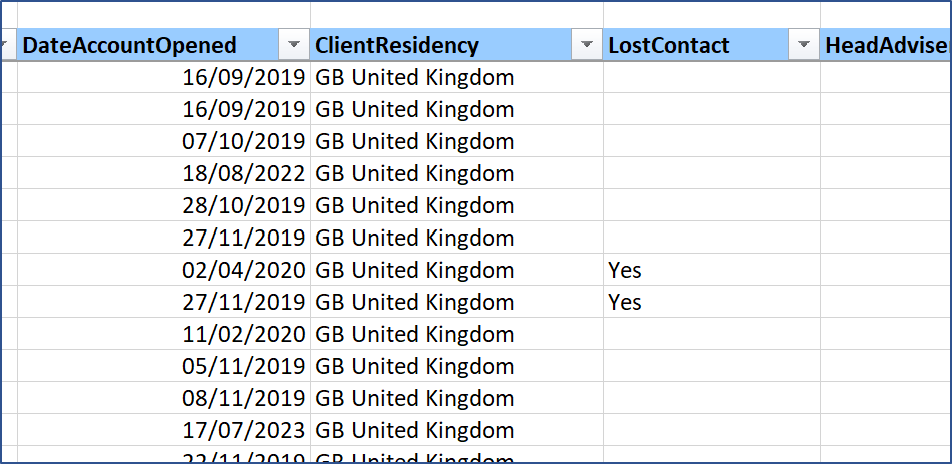

Keeping in touch with clients is really important and occasionally, we have returned mail which means we need to place restrictions on accounts. This means clients will not receive important documents, are unable to redeem from their account and we may also need to turn off your Adviser Fees. So help us avoid ‘foreseeable harm’ and check which of your clients need updating today.

Our ‘Account Information report’ has a ‘Lost Contact’ identifier and once checked, you can update the address online.

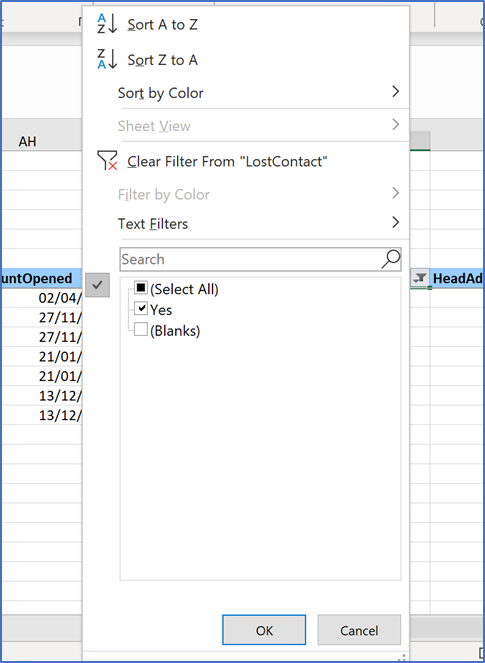

- Simply open the report

- Scroll to column labelled ‘LostContact’

- Click on the arrow on the column heading

- Choose ‘Yes’ and click OK

As you will know, pensions remain one of the most tax-efficient ways for clients to save for the years ahead and there are now higher annual allowances.

Finding out which of your clients have made contributions this year – and the previous three tax years for carry forward purposes – is really easy.

Our handy ‘Pension Summary report’, will quickly provide details of the contributions made by all your clients, allowing you to maximise contributions. Watch the video below to find out more.

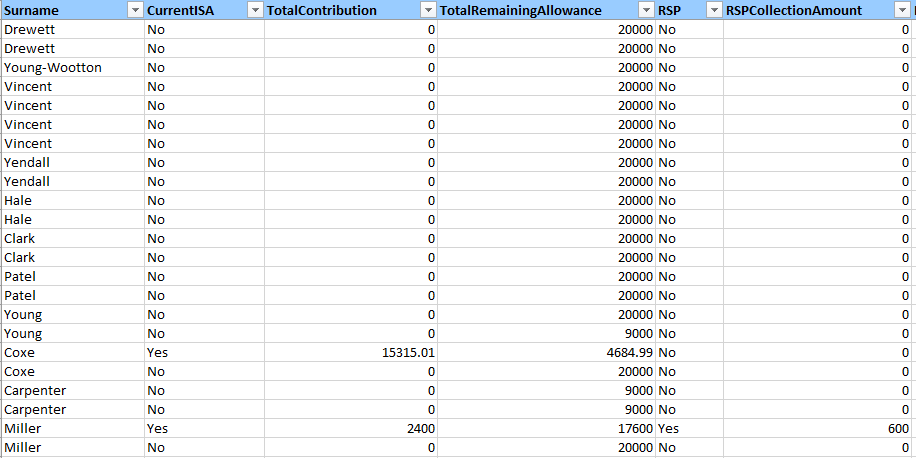

Another tax efficient method of saving is through the ISA.

It’s simple to identify which clients have ISA allowances remaining and whether they have an Investment Account which may allow for a Bed & ISA to be done should it be appropriate for the client.

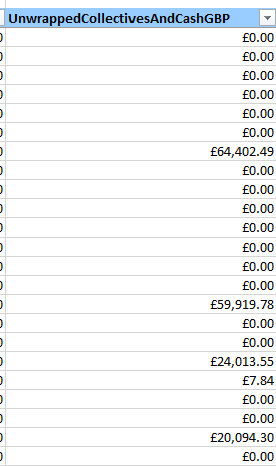

The ISA Contribution Report shows all clients under your agency with an ISA and the total remaining allowance. It will also show whether they have a regular savings plan (RSP) in place and how much is being collected.

It will also show whether the client has any money in an Investment Account (Unwrapped Collective) should you want to consider a bed & ISA.

You may be aware that the FCA has recently published rules which require us to provide a warning to clients who hold certain levels of cash or cash-like funds for a sustained period of time, warning that their savings could be eroded by inflation. For more information and a list of cash and cash-like funds, click here.

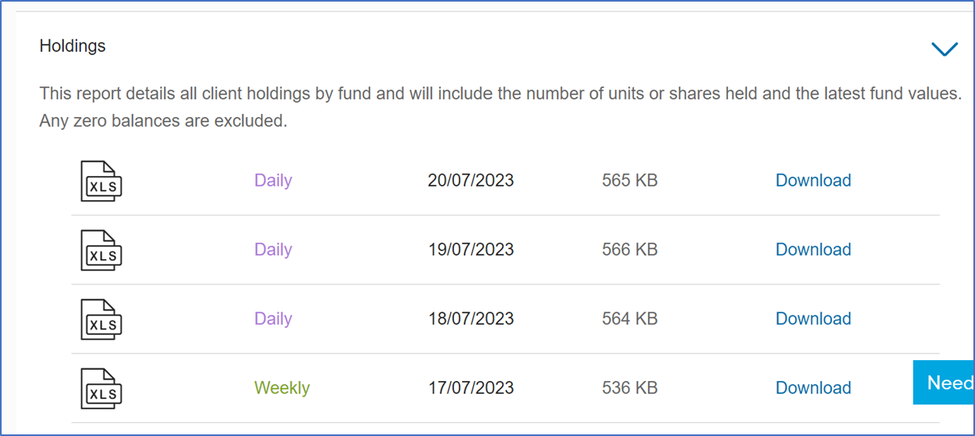

We can help you identify which clients have these types of holdings through the ‘Holdings’ report available through the Reporting Services area of the website.

- Simply download the report

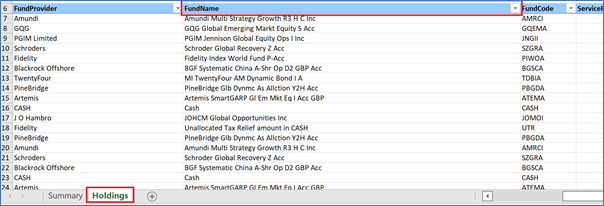

- Click on the second tab labelled ‘Holdings’

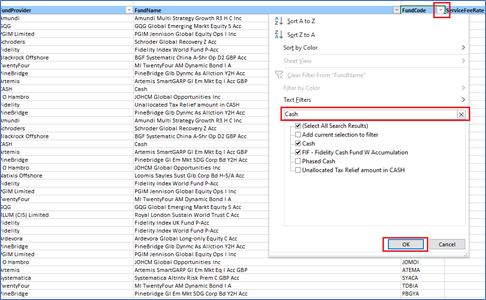

- Scroll to the column labelled ‘FundName’.

- Click arrow on column heading and search for fund name or key word, click OK.