Adviser fees service

We understand an efficient and easy-to-use fee management service is vitally important to your business. We’ve therefore designed our Adviser Fees service to be as simple and straightforward as possible.

About the service

Our Adviser fees service provides you with the flexibility you need to manage fee arrangements with your clients:

- You can set up Adviser Fees on ISAs, Investment Accounts and our Pension

- Initial, ongoing and specified (one-off) fees can be deducted from clients’ accounts

- For maximum flexibility, you can apply different fees to each client account and to different segments within each account

- A single consolidated fee payment is made to you each month.

Please note that our fee service is not available on the Standard Life International Bond, Canada Life International Bond or Utmost Offshore Bonds.

Regular Adviser Fee payment reports will give you details of all the fees you have received in the previous month, along with all the information you need to reconcile payments with your client records. For information on how to set this up, please visit Reporting services.

Client consent and fee agreements

You’ll need client consent when setting up fees, you have three options for obtaining client fee authority:

| 1. | Use the Fidelity Client Authority Form | This is available for advisers who prefer to use our own Fidelity form. The form can be downloaded from the section below. |

| 2. | Use your firm’s own bespoke client fee agreement | Ensure it meets regulatory requirements and clearly authorises the agreed fees. |

| 3. | Create a bespoke client fee agreement using wording extracted from the Fidelity Client Authority Form | You’ll find suggested wording below to help ensure it meets regulatory requirements. |

You can also use a combination of the above options, for example, using our form for some clients and your own agreement for others.

Important information

- Ensure your client has signed either a Fidelity Client Authority or your own client fee agreement before setting up or amending any fees.

- Do not send Fidelity the signed agreement. It should be retained for your records only.

- As part of our ongoing checks and monitoring to meet regulatory obligations, Fidelity may periodically request a copy of the signed agreement that was in place at the time the investment was made.

Suggested wording for your own client fee agreement

Your firm may already have its own client fee agreement in place. However, if you’ve been using Fidelity’s Client Authority form and are now planning to create your own, here are the two points from our form that you should consider incorporating:

- By signing, I agree to pay my adviser the Adviser Fee(s) outlined in this agreement and in accordance with the Fidelity Adviser Solutions Client Terms.

- I authorise Fidelity to deduct cash from my accounts to pay these fees. If there is not enough available cash, I authorise Fidelity to sell units/shares from my nominated investment, or if none is specified, from my largest investment holding.

Other Considerations

- When creating a Client Fee Agreement for your firm, it’s important to consider the below points:

- Initial & Ongoing Fees: Does your agreement capture both initial and ongoing fee instructions?

- Fee Structure: Does it allow for both monetary and percentage-based fee amounts?

- Variable Initial Fees: Do you charge different initial fee rates for lump sums, transfers, regular contributions, or crystallisations?

- Account-Level Fees: Are fee rates consistent across all accounts, or do they vary by account number?

- DFM Fees: Does your agreement need to include Discretionary Fund Manager (DFM) fees?

- Specified Fees: Does it capture one-off fees and the frequency of their deduction?

Managing and amending fees

You can amend the fee amount at any time, provided you have obtained a new signed Fidelity Adviser Fees Form or your firm’s own client fee agreement.

Useful forms

Guides

Your guide to our charges and adviser fee service

Client guide to fees and charges

FAQs – setting up adviser fees

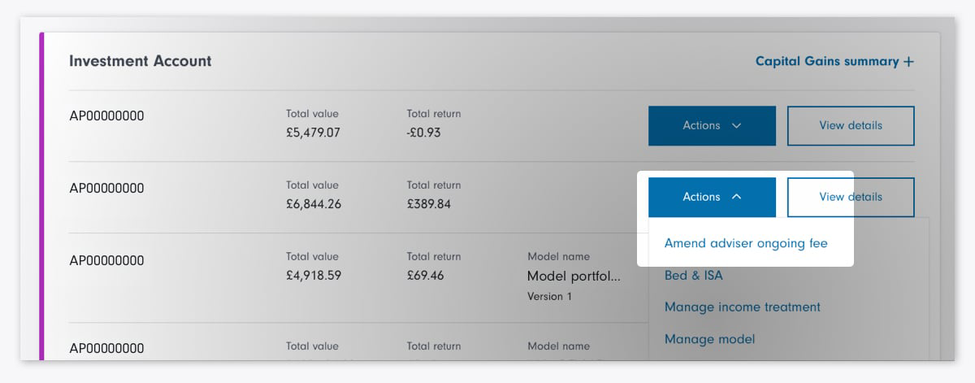

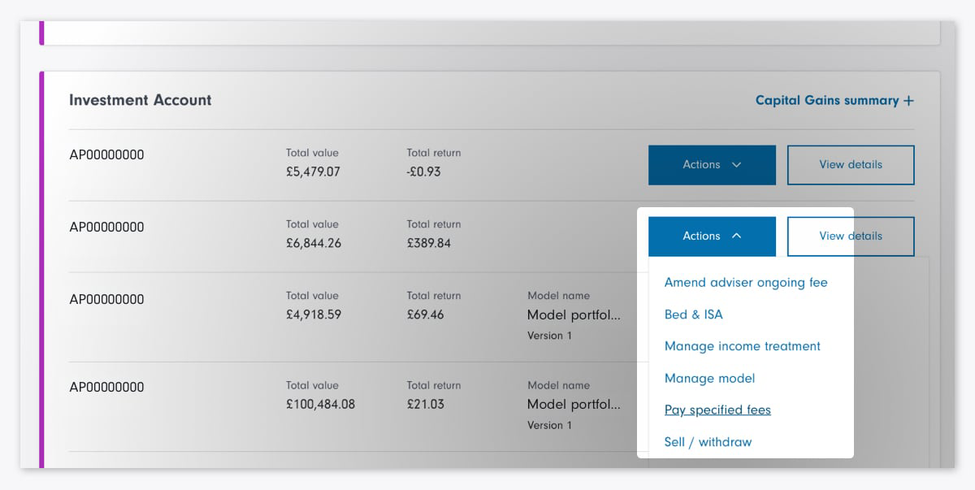

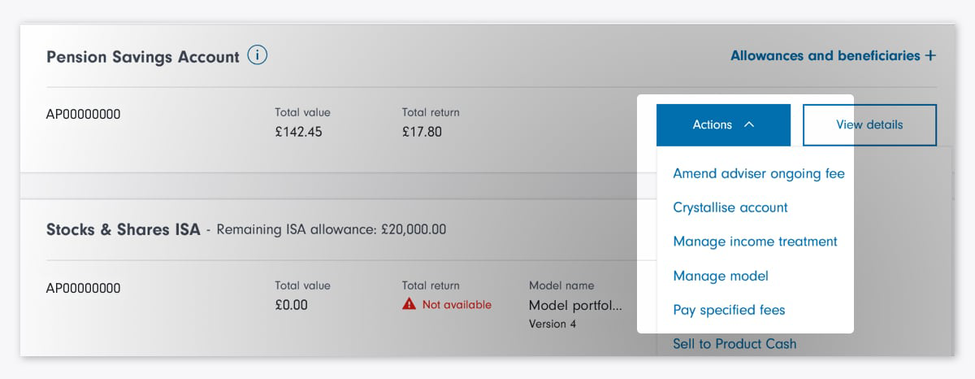

You can set up Adviser Fees either when you submit new business or in the Client Summary page (click on the ‘Actions’ tab, then select ‘Amend adviser ongoing fee’).

Adviser Fees can be set up online for all business, except for the following, where you should include them in the relevant paper application:

- Junior Pension

- Pension re-registration

- Partial uncrystallised transfer

- Trust applications

- Inherited ISA transfer.

The maximum that can be taken is either £25,000 or 10% of the gross contribution amount – whichever is lower. If you're not applying a fee please enter '0'.

We pay all Adviser Fees on or around the 25th of the month.

- Ongoing fees are calculated daily and are deducted from the client's account about three weeks before you receive payment

- For an initial fee to be paid on the 25th, the deal it is linked to must settle by the 18th

- If a specified fee is to be paid by selling some of a client's investments or cash, the sale must settle by the 18th of the month for the fee to be paid on the 25th.

Yes, you can do this when you set the plan up.

The fee may be either a percentage of the investment or a fixed amount – we will deduct it from the client's investment. For example, if your client decides to pay £100 a month into their savings plan and you agree an initial fee of 3%, we will take £3 from each monthly payment and invest the remaining £97.

In the case of a pension, we deduct a percentage initial fee on a regular contribution in two parts – the first from the net contribution and the second from the tax relief, which we usually receive between six and eight weeks later. However, if you and your client arrange for the initial fee to be a monetary amount, we will deduct it from the net contribution.

You’ll find more information in our guide.

Yes, after you select a client’s account, choose ‘Pay specified fees’ from the ‘Actions’ dropdown.

You can set up initial and ongoing fees as part of the application process.

Fees can be either a percentage or cash amount. You can make changes or arrange a specified fee online through the ‘Actions’ tab next to the relevant account on the ‘Client Summary’ screen. A percentage initial fee on a regular or one-off contribution is paid in two parts – the first from the net contribution and the second from the tax relief, which we usually receive between six and eight weeks later. However, if you and your client arrange for the initial fee to be a monetary amount, it will come from the net contribution.

No, you have flexibility. You can use our form, create your own agreement using our suggested wording, or create your own bespoke agreement entirely.

You must ensure that your agreement clearly authorises the agreed fees and complies with all regulatory requirements. A signed copy must be retained in the client’s file. Do not send it to Fidelity. Fidelity does not create or review client fee agreement forms for advisers. If you are unsure whether your own agreement is appropriate, please consult your compliance department or use the Fidelity Client Authority form instead.

Yes, you can use a combination of our Fidelity Adviser Fees Form and your own agreements, depending on your preference and client needs.

We will periodically request sight of the signed agreement as part of our regulatory obligations. Please ensure you can provide this promptly if requested.

FAQs – managing adviser fees

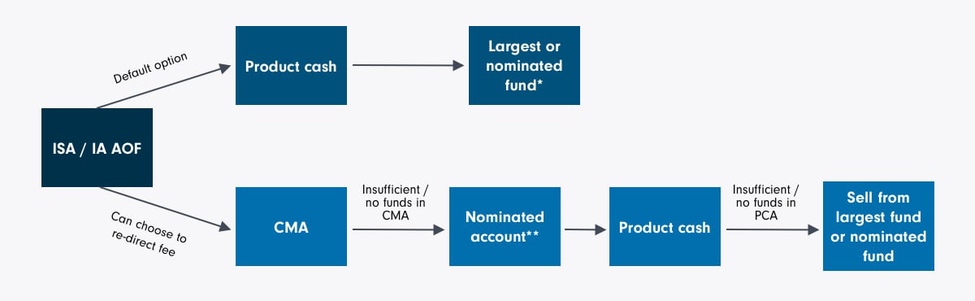

Whenever possible we take fees from the cash in your client's account. If there isn't enough cash available, we will sell some of their investment in line with your instructions.

Fees can be paid either from the Cash Management Account (CMA), or from the account on which they are due (Product Cash), as follows.

*When selling investments, we will always try to sell from mutual funds first before moving to exchange traded investments.

**Where no account is nominated or insufficient monies exist in the nominated account, we will move to the next largest Investment Account and lastly to the Client's ISA – looking at cash first and then selling investments. This is not possible for pension accounts.

Note: When selling investments for payment of fees, redemptions are always unit-based. Market movements can lead to a price drop resulting in insufficient cash being raised to pay the fee. In this case, the money disinvested will sit in reserved cash until there is more available cash in the account, at which point the fees will be paid out.

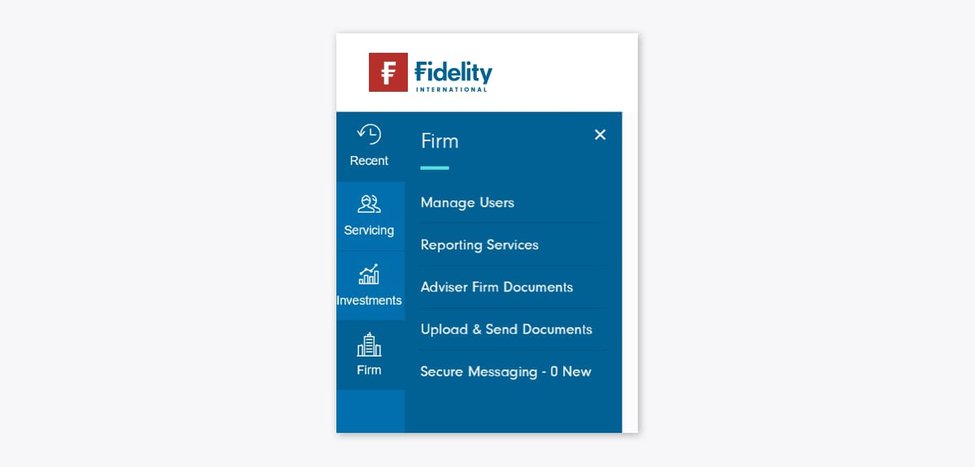

Reports will be uploaded for you on or before the 25th of each month. You can access the reports from within the ‘Firm’ menu and selecting ‘Reporting Services’.

The 'Adviser Fee Payments' report shows all the initial, ongoing and specified fees you have earned in the previous month and gives you the information you need to reconcile payments with your client records.

Fidelity’s Client Authority form allows you to record the fees you have agreed with your client. There are different Client Authority forms for sole, joint and company accounts.

You don’t have to use our form. You can either create your own bespoke client fee agreement using wording from our form or use your own bespoke client fee agreement entirely.

You do not need to send these forms/agreements to Fidelity. However, you must keep them on file, as we may request to review them in the future to meet our own regulatory obligations. If this happens, we will contact you in writing and ask for forms from one or more randomly selected clients. Additionally, we may request a signed Client Authority form if a client disputes a fee taken on your behalf. This helps us verify that the correct amount was charged.

We stop any ongoing fees as soon as we are told a client has died. This means you will not receive fees for the month in which we hear of the death. You have the option of setting up a new agreement with your client’s executors or administrators, using our Fee & Commission Authority (Deceased) form. In line with FCA guidelines, each person who has legal authority to act for the estate must sign this form. The first payment under this new agreement will cover the whole of the month in which the arrangement is set up.

Please note your client's executors and administrators will not be able to sign for a new agreement on a pension.