Adviser fees service

We understand an efficient and easy-to-use fee management service is vitally important to your business. We’ve therefore designed our Adviser Fees service to be as simple and straightforward as possible.

About the service

Our Adviser fees service provides you with the flexibility you need to manage fee arrangements with your clients:

- You can set up Adviser Fees on ISAs, Investment Accounts and our Pension

- Initial, ongoing and specified (one-off) fees can be deducted from clients’ accounts

- For maximum flexibility, you can apply different fees to each client account and to different segments within each account

- A single consolidated fee payment is made to you each month.

The service is not available on products provided by Standard Life, such as the SIPP and International Bond.

You’ll need client consent when setting up fees, and so we provide Client Authority forms as part of the set-up process. This form needs to be signed by the client before setting up or amending the fees, even if you have your own paperwork for fee arrangements. You do not need to send this form to us, but we may ask for this at a future date for regulatory purposes.

Regular Adviser Fee payment reports will give you details of all the fees you have received in the previous month, along with all the information you need to reconcile payments with your client records. For information on how to set this up, please visit Reporting services.

Useful forms

Guides

Your guide to our charges and adviser fee service

Client guide to fees and charges

FAQs – setting up adviser fees

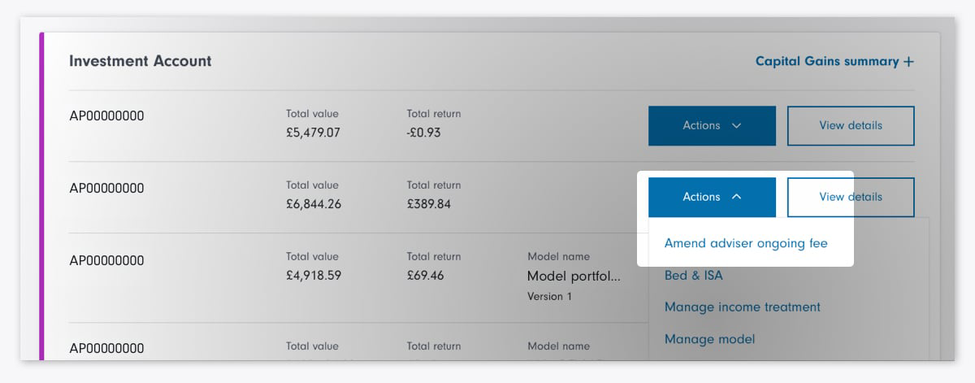

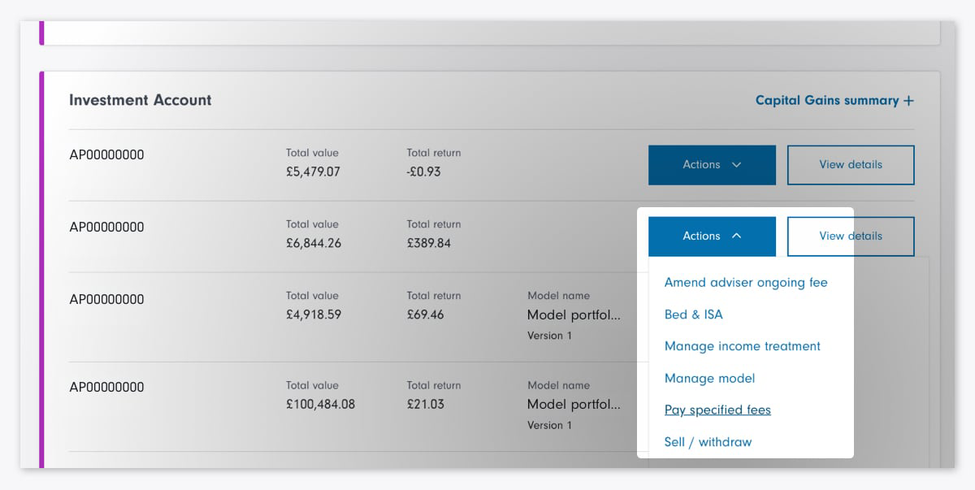

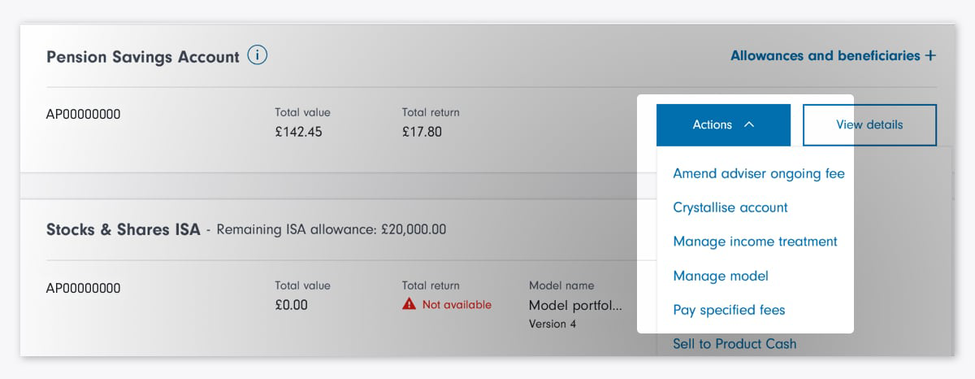

You can set up Adviser Fees either when you submit new business or in the Client Summary page (click on the ‘Actions’ tab, then select ‘Amend adviser ongoing fee’).

Adviser Fees can be set up online for all business, except for the following, where you should include them in the relevant paper application:

- Junior Pension

- Pension re-registration

- Partial uncrystallised transfer

- Trust applications

- Inherited ISA transfer.

The maximum that can be taken is either £25,000 or 10% of the gross contribution amount – whichever is lower. If you're not applying a fee please enter '0'.

We pay all Adviser Fees on or around the 25th of the month.

- Ongoing fees are calculated daily and are deducted from the client's account about three weeks before you receive payment

- For an initial fee to be paid on the 25th, the deal it is linked to must settle by the 18th

- If a specified fee is to be paid by selling some of a client's investments or cash, the sale must settle by the 18th of the month for the fee to be paid on the 25th.

Yes, you can do this when you set the plan up.

The fee may be either a percentage of the investment or a fixed amount – we will deduct it from the client's investment. For example, if your client decides to pay £100 a month into their savings plan and you agree an initial fee of 3%, we will take £3 from each monthly payment and invest the remaining £97.

In the case of a pension, we deduct a percentage initial fee on a regular contribution in two parts – the first from the net contribution and the second from the tax relief, which we usually receive between six and eight weeks later. However, if you and your client arrange for the initial fee to be a monetary amount, we will deduct it from the net contribution.

You’ll find more information in our guide.

Yes, after you select a client’s account, choose ‘Pay specified fees’ from the ‘Actions’ dropdown.

You can set up initial and ongoing fees as part of the application process.

Fees can be either a percentage or cash amount. You can make changes or arrange a specified fee online through the ‘Actions’ tab next to the relevant account on the ‘Client Summary’ screen. A percentage initial fee on a regular or one-off contribution is paid in two parts – the first from the net contribution and the second from the tax relief, which we usually receive between six and eight weeks later. However, if you and your client arrange for the initial fee to be a monetary amount, it will come from the net contribution.

FAQs – managing adviser fees

Whenever possible we take fees from the cash in your client's account. If there isn't enough cash available, we will sell some of their investment in line with your instructions.

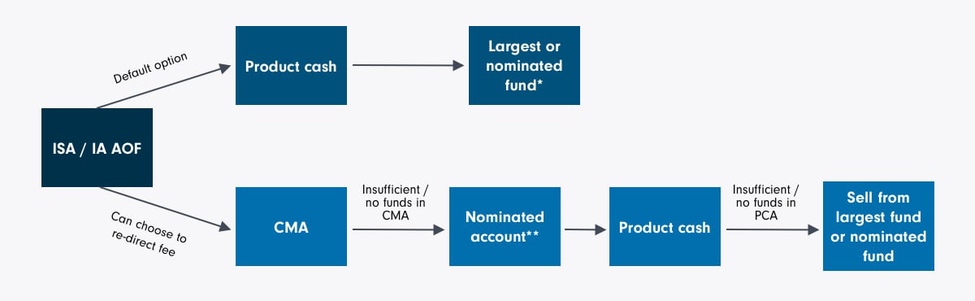

Fees can be paid either from the Cash Management Account (CMA), or from the account on which they are due (Product Cash), as follows.

*When selling investments, we will always try to sell from mutual funds first before moving to exchange traded investments.

**Where no account is nominated or insufficient monies exist in the nominated account, we will move to the next largest Investment Account and lastly to the Client's ISA – looking at cash first and then selling investments. This is not possible for pension accounts.

Note: When selling investments for payment of fees, redemptions are always unit-based. Market movements can lead to a price drop resulting in insufficient cash being raised to pay the fee. In this case, the money disinvested will sit in reserved cash until there is more available cash in the account, at which point the fees will be paid out.

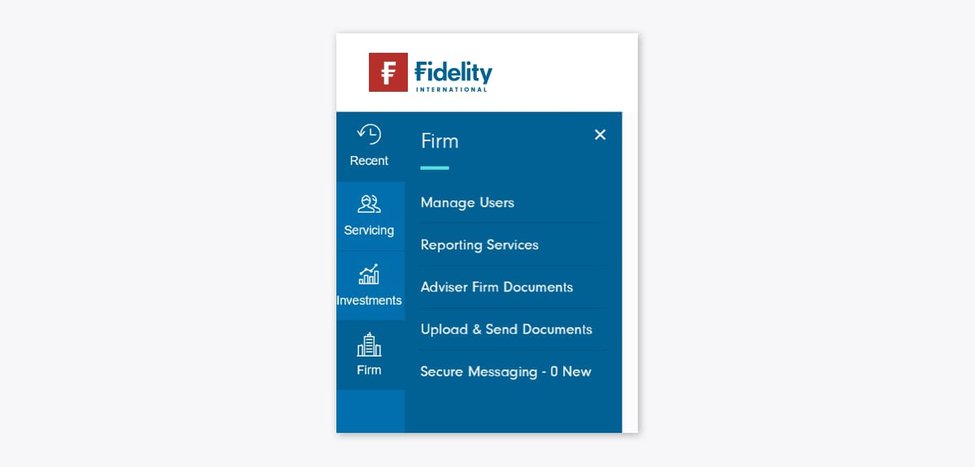

Reports will be uploaded for you on or before the 25th of each month. You can access the reports from within the ‘Firm’ menu and selecting ‘Reporting Services’.

The 'Adviser Fee Payments' report shows all the initial, ongoing and specified fees you have earned in the previous month and gives you the information you need to reconcile payments with your client records.

Client Authority forms allow you to record the fees you have agreed with your client. There are different Client Authority forms for sole, joint and company accounts. You must complete one of these forms for each client, even if you have your own paperwork for the arrangement. You don’t have to send the completed form to us, but you need to keep it on file as we may ask to see it in the future to meet our regulatory obligations. In this case, we will contact you in writing, asking to see forms from one or more of your clients selected at random.

We may ask to see the signed Client Authority form if your client disputes a fee we have taken on your behalf. The form will help us to check we have taken the correct amount.

We stop any ongoing fees as soon as we are told a client has died. This means you will not receive fees for the month in which we hear of the death. You have the option of setting up a new agreement with your client’s executors or administrators, using our Fee & Commission Authority (Deceased) form. In line with FCA guidelines, each person who has legal authority to act for the estate must sign this form. The first payment under this new agreement will cover the whole of the month in which the arrangement is set up.

Please note your client's executors and administrators will not be able to sign for a new agreement on a pension.