Model portfolios and DFM services

With the increased use of model portfolios and Discretionary Fund Management (DFM) services, we are continually improving the services we provide to both advice and DFMs firms.

Here you’ll find out all you need to know about:

- How advice firms can set up and manage model portfolios and use defined models from DFMs.

- How DFMs can create, amend, publish and transact across their portfolios within our secure online portal.

We do not charge for this service, although the DFM may do so.

Our service offers DFMs the ability to create, amend, publish and transact across their portfolios within our secure online portal.

Interested in partnering with us? If you are considering becoming a DFM partner on our platform, please get in touch by sending us an

email.

Skip to section

Using our model portfolio service

Our service allows DFM firms to perform the following actions:

- Create and manage models.

- Publish models to multiple contracted adviser firms.

- Rebalance client accounts in bulk across multiple adviser firms and align other account attributes such as regular savings plans.

- Report on all client accounts associated with models and the related adviser firm.

- Download version history for the DFM model.

Access to our model portfolio centre is through a log in and DFM firms can manage which users use the site.

Full details on creating, editing, publishing and rebalancing models can be found within our guide.

The following videos are also available to DFM firms:

Recent enhancements to the service

- To increase efficiencies and reduce administration, we now offer split fees to advisers and DFMs.

- With recent industry changes to DFM fees, fees can now be set up with or without VAT.

- Along with previous improvements to MI, we now offer an optional client quarterly portfolio statement which allows DFMs to add their own commentary.

- DFMs can opt into a service that automatically notifies clients of a 10% depreciation in the value of their account(s) in a reporting period (calendar quarter).

Other changes to be aware of

- We can now pay fees directly to you for accounts that are on the latest version of client management.

- Your fee will be paid monthly on the same date as adviser fees, which is on or around 25th of each month.

- Some advisers may not have added a separate DFM fee to client accounts, as they may have included this within their own fee (as previously everything was paid to them directly). Advisers may need to audit their existing accounts on DFM models and ensure a separate DFM fee has been set against each one in order to allow us to pay you directly.

- Going forward, if an adviser adds one of your models to an account, entering your fee will become mandatory even if they enter zero. Similarly, your fee can only be entered if the account is linked to one of your models.

Important Note

Corporate Accounts, Pension Trustee Accounts and Trusts that remain on our old platform administration systems are not eligible for direct DFM fee payments. A separate DFM fee can be entered online but this will be added to the adviser fee and all paid to the adviser. You will need to continue collecting your fees manually from the adviser for these account types.

Setting up and deducting the fees

- Your fee rates continue to be set by the adviser firms for each underlying account. You are not able to set up or amend fees on client accounts. Any changes must be made by the adviser.

- The fees are calculated by taking a daily average of the account value and then working out a monthly average – the fee is based on this. This is deducted from the client account in the week following the month end and paid to you on or around the 25th of the month (same as the adviser fees).

- Your fee is deducted in the same way as Advisers Ongoing Fees. The default is for the fee to come from cash within the account. If there is no cash or insufficient cash available, then it will move to unit deduction. The adviser can choose if this is from the largest asset holding or they can nominate a specific holding within the account. Alternatively, they can choose for fees to come from the client’s Cash Management Account.

- Modal portfolio and cash management: There are 3 options when running models on our platform — Download now

Discretionary Fund Manager Report

This report provides clients with a full breakdown of each account managed by a Discretionary Fund Manager. We have produced a guide to this report, which can also be used with clients. It covers:

Frequently asked questions

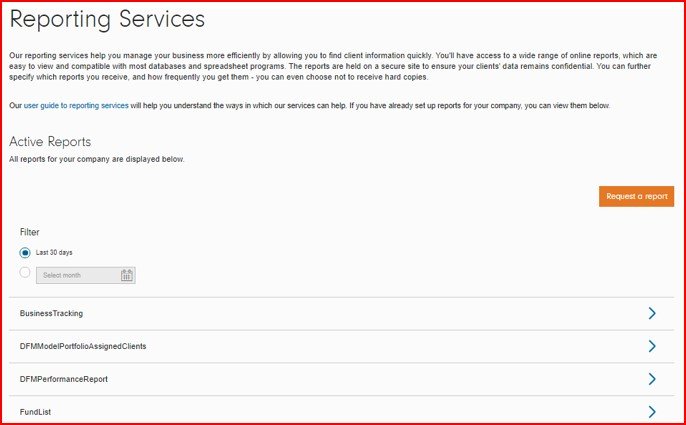

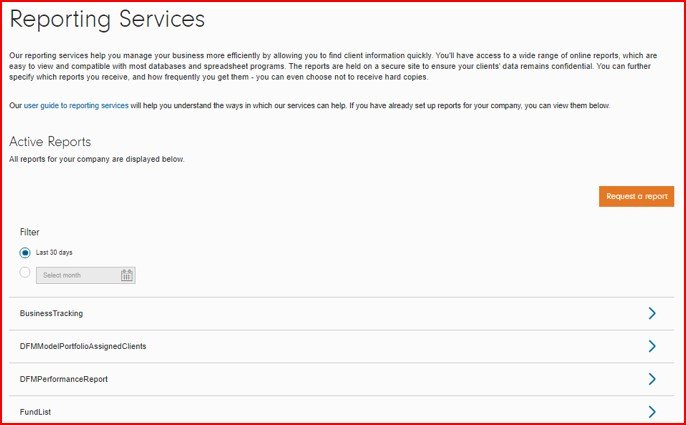

Adviser firms can use the ‘Portfolio & Assigned Clients’ report (available in the ‘Reporting Services’ area of our website) to review all accounts on their models and update any DFM fee rates that are missing or incorrect.

If your fee rate is updated mid-month then the fees will be pro-rata for that month. For example, if the fee is updated on 15th November, the adjusted rate will only be paid from the 15th November.

Both you and the adviser firm can use the ‘Portfolio & assigned clients’ report to regularly audit if the fees have been entered correctly.

Within ‘Reporting Services’, there will be a monthly fee statement generated that you will be able to download. This statement will help you with reconciling the payment that has been credited to your bank account.

Overview

Yes, the 10% depreciation reporting service is an optional facility for DFMs whereby notifications can be sent to clients when a portfolio depreciates by 10% (or multiples of 10%) or more over a reporting period.

The service, where enabled, provides the following facilities:

- It detects when a threshold is exceeded in a calendar reporting period for a client account.

- Advisers and DFM consultants can opt into receiving an alert if any account they manage exceeds a threshold on any given day.

- Clients can be contacted directly via email if they are web registered. A letter will also be placed in the client’s and adviser’s electronic vaults, detailing the accounts and performance.

- MI is available on accounts showing where a threshold has been exceeded and whether affected clients have been contacted. Reports are available to both advisers and DFMs.

- Advisers can view client letters through the Client Management facility.

Once enabled, the service will cover all accounts linked to your model portfolios. However, end clients must be web-registered to receive a notification of a 10% depreciation event.

The reporting periods for the service run on calendar quarters, starting on 1st January, April, July, and October. The performance assessment uses a money-weighted return calculation. The evaluation includes the effect of fees and charges directly deducted from the account.

Read more about this service in our Intermediary Terms of Business.

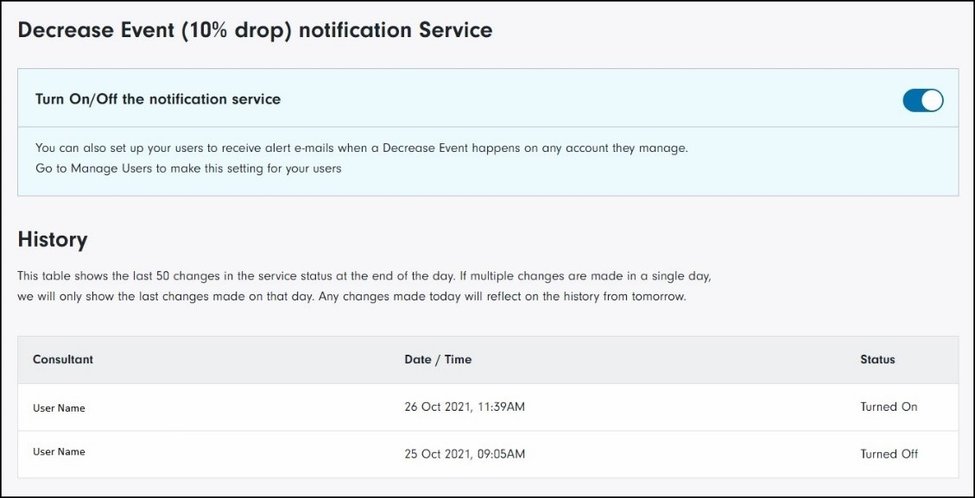

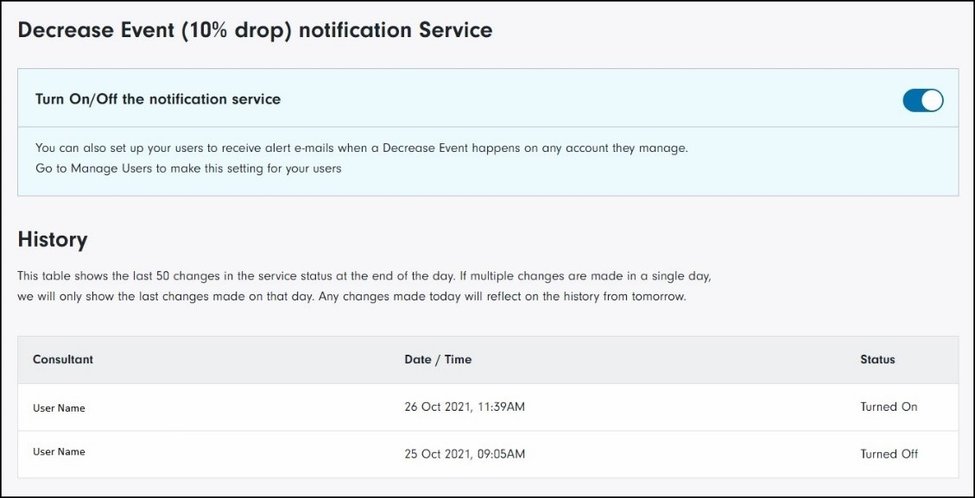

Enabling the service

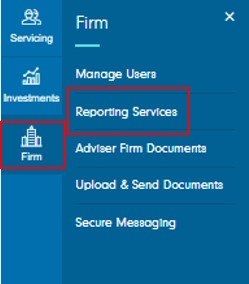

The service can be enabled by clicking ‘10% drop notification’ in the ‘Firm’ menu once you have logged in. Enable the service and click ‘Save’. Once this has been completed, the assessment of returns on the accounts using your model portfolios will begin and the associated alerts will be put in place. Client reporting and management information will also become available.

Please note only Firm Administrators can enable or disable the service. A history of changes to the service is shown on the screen.

Enabling alerts

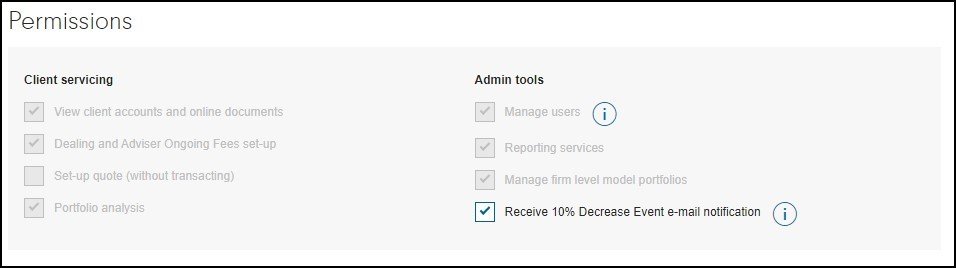

The service can be configured so that each consultant receives an alert when an account using a discretionary model exceeds a 10% threshold for the first time in the reporting period. For each consultant, simply check the ‘Receive 10% Decrease Event e-mail notification’ box within user preferences. To set this up, the consultant needs to be able to administer user preferences.

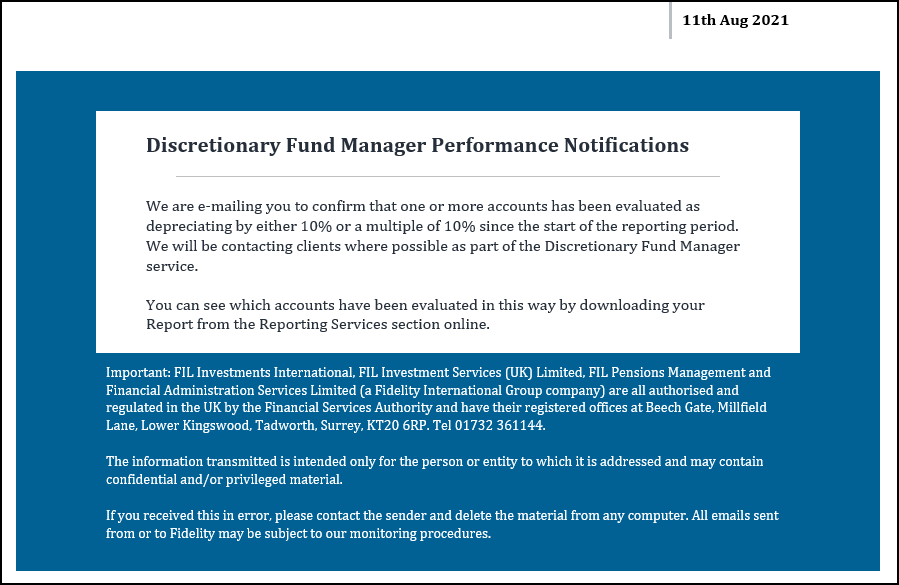

On any day where a threshold is exceeded for the first time by one or more accounts, an e-mail alert will be sent to registered consultants. A sample of the e-mail alert is shown below:

Managing content and client reporting

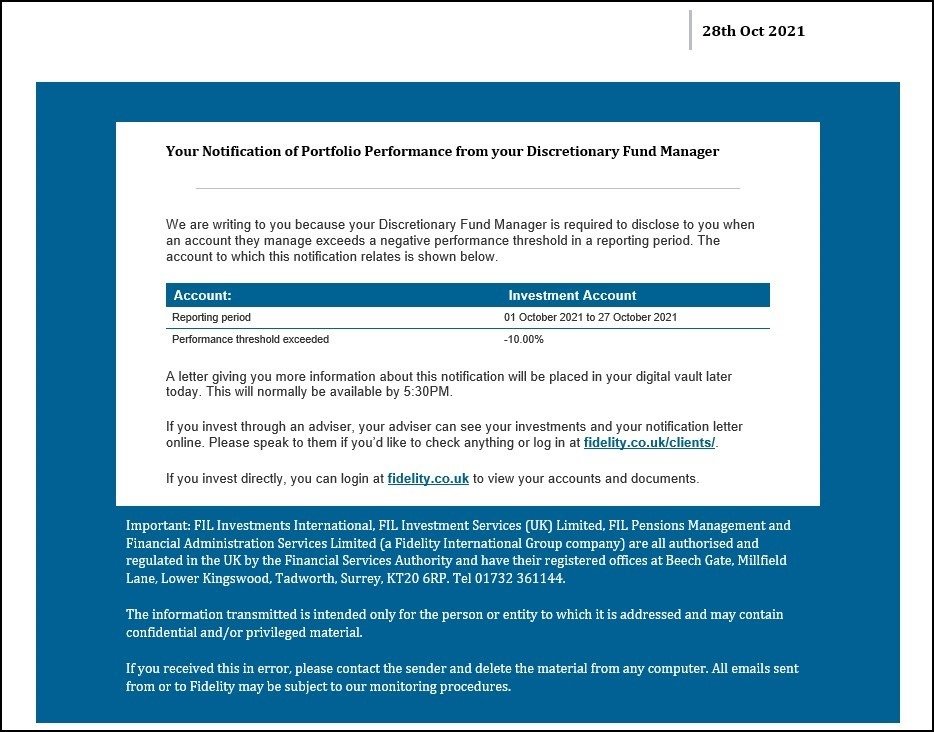

If a client is web-registered, they will receive a notification e-mail and electronic letter when a 10% threshold is exceeded within one of their accounts for the first time. If they are not web-registered, we will not attempt to communicate with the client.

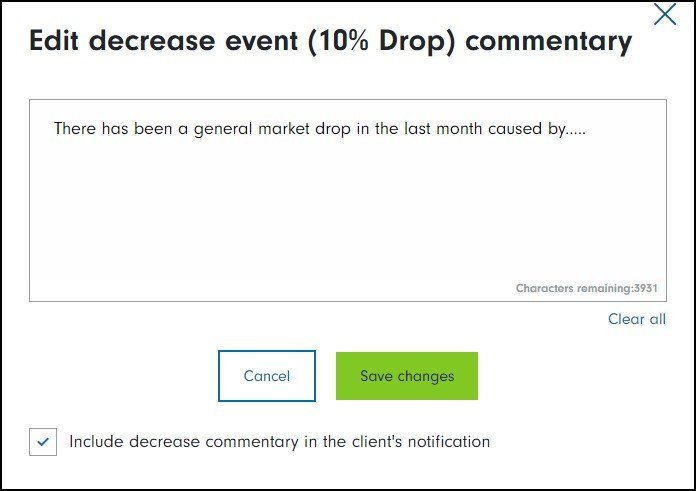

For each model portfolio, you can configure the content to be included in the client’s letter. To set the commentary, edit your model portfolio and click ‘Add decrease commentary’. You can then enter your content and, once completed, check the ‘Include decrease commentary in the client’s notification’ box (as shown below):

Please note this content must be in place prior to the depreciation event occurring.

A sample of the email is shown below and you can view a copy of the electronic letter here.

Management information

Three separate reports are available detailing accounts that have exceeded a 10% threshold:

- Daily 10% pre-notification - DFM

- Daily 10% post-notification - DFM

- Historic 10% notification - DFM

On each day we notify which accounts have been detected as having exceeded a threshold in the pre-notification report at or around 7am. We update the daily data with the outcome of the communication process later in the day and this is shown in the post-notification report. A historic audit of previous events and notifications is available in the historic report.

Reports including client data are available on request.

If you would like any further information, please contact your usual Fidelity Adviser Solutions representative.

Yes, adviser firms can now include or exclude VAT on DFM fees for all new clients added to model portfolios. They should speak to you about whether your fees are VAT applicable or not in order to set this correctly.

If you approach your Account Manager to confirm you are removing VAT from your fees, then we have a process where we can bulk update existing clients on your models to remove the VAT from the fee. Please reach out to your Account Manager to discuss this further.

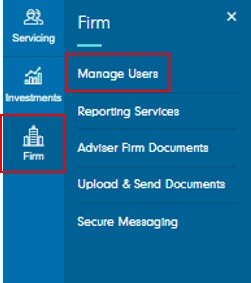

Yes, firms are able to set up new users. Simply login to our secure website and click on ‘Firm’ and then ‘Manage Users’:

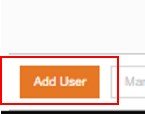

Then click ‘Add User’ at the bottom of the page:

Enter the personal details of the individual and select their appropriate permission levels. When you select submit the individual will receive two emails; one with a Consultant/Login ID and one with a temporary pin which lasts 24 hours.

The individual will need to log in to the website using the Consultant/Login ID and the temporary pin. They will be prompted to set up security details and a permanent pin of their choice.

This is covered in our Model Portfolio Centre guide (pages 3 – 9).

This is covered in our Model Portfolio Centre guide (pages 10 – 12).

Please contact your appointed Account Manager.

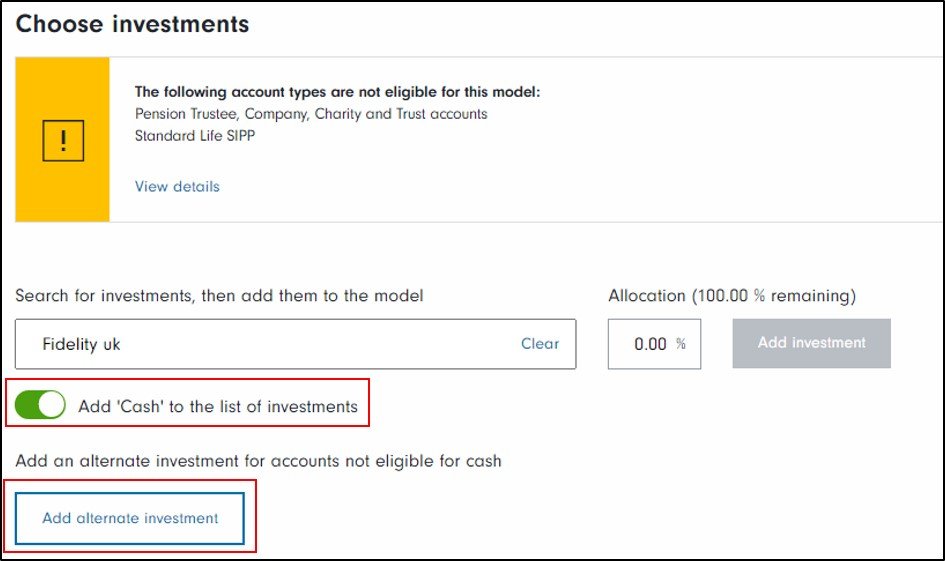

We do not require cash as part of your model portfolios nor is there a minimum cash balance requirement.

If ‘cash’ is part of your model it will be included as part of the rebalance. If ‘cash’ is not part of your model portfolio, you will have the choice to include or exclude client cash balances when you rebalance as part of your instruction. The choice applies to all clients in the model.

For some of our products a cash account is not available. For these you can choose a cash alternative when building/editing your models, such as one of the many cash funds available.

Please send your asset requests to your appointed Account Manager.

If you request a new asset/share class from an existing fund provider, we will initiate the onboarding process as soon as possible. We hope to get these onboard within eight weeks, although this is dependent on the speed of the provider as well.

If we do not currently have a relationship with the provider, this will need to go through a prioritisation process to review the business case. Once approved, onboarding can take between eight to twelve weeks, but again this is dependent on the speed of the provider.

We currently offer a large range of mutual funds, Investment Trusts, exchange-traded products and shares from the FTSE 100, FTSE 250, FTSE all-share index and FTSE AIM 100 with some shares from the ISEQ20.

Yes. We must have your MiFID information before you can trade into these products.

We have applied restrictions for our Junior Pension which includes bank transfers, model portfolios, re-registrations, employer contributions and regular contributions into exchange-traded investments. If there are any Junior Pensions on your client list, they will not be available for rebalances.

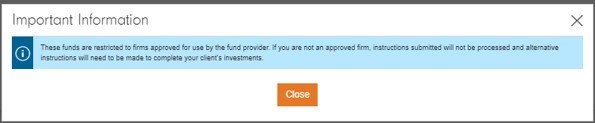

Yes, we can ringfence assets/share classes; we call these restricted funds. If you wish to request access to a restricted fund or need clarification around access, please contact your appointed Account Manager.

If an asset is restricted, it will have ‘restricted fund’ quoted in the name and a warning message will be displayed. This message will still appear even if you have been approved access to the asset.

The adviser is responsible for setting any ongoing fees (including their own ongoing fee and the DFM ongoing fee), specified fees (ad-hoc) or initial fees from their client’s portfolio. We also deduct Investor and Service Fees from the client’s portfolio. The adviser can choose if this is from the largest asset holding or nominate a specific holding within the account. Alternatively, they can choose for fees to come from the client’s Cash Management Account.

Adviser fees – these are agreed between the adviser and the client and paid to the adviser.

Our fees – these are made up of a Service Fee and an Investor Fee:

- Service Fee – this fee covers the cost of maintaining our platform, administering accounts, providing custodian services and other support activities. It is typically 0.25% a year of the value of the client’s investments. This is calculated on the first of each month and deducted on the first of the following month, so it is paid in arrears.

- Investor Fee – the Investor Fee is £45.00 per year. From 1 September 2020, this is a monthly collection of £3.75, which will cover the month it is deducted in. There is no Investor Fee for a child who has a Junior ISA or Junior Pension, or for any client who only has a SIPP and/or bond administered by Standard Life.

Ongoing management charges for each investment company

Dealing charges for exchange-traded investments (ETIs).

This is covered in our Model Portfolio Centre guide (pages 13 – 14).

If an asset within your model is suspended for new buys it will drop out of the model and need to be replaced or reallocated.

If a client holds a suspended asset within their account, you have an option when creating a bulk rebalance instruction to include or exclude the suspended/soft closed asset. If included, it will be sold and swept into the rebalance. If excluded, the asset will remain within the account and the portfolio will operate around it.

If the asset is suspended for ‘buys’ and ‘sells’, it will be automatically excluded and the rebalance will operate around it.

It is not possible for you to place a single switch from one fund to another.

All buys and sells are aggregated and submitted at one or two dealing points in a trading day.

All deals placed will be ‘aggregated’. This means we will combine each of your trades with similar orders and place a single trade at certain times of the day – once in the morning and once in the afternoon – when we will trade at the best price available on the market.

There will be charges levied for exchange-traded investments. The charge for a buy, sell or switch deal placed online will be £3. This includes both sides of a switch transaction, which are charged at £1.50 each (sell and buy), or a total of £3. For regular transactions carried out automatically by us, including dividend reinvestments, the charge will be £1.50.

When an adviser sets up a regular savings plan or regular withdrawal plan, they can choose for this to be aligned to the model portfolio. When you instruct a bulk rebalance you can choose to realign regular savings plans and regular withdrawal plans to the updated model portfolio.

Please note: this does not apply to pension withdrawals.

If a regular contribution is currently going through, the rebalance will only trade on available/settled units at that point, so if any in-flight trades have not settled, they will be excluded from the rebalance.

There are no set periods when rebalances cannot be processed.

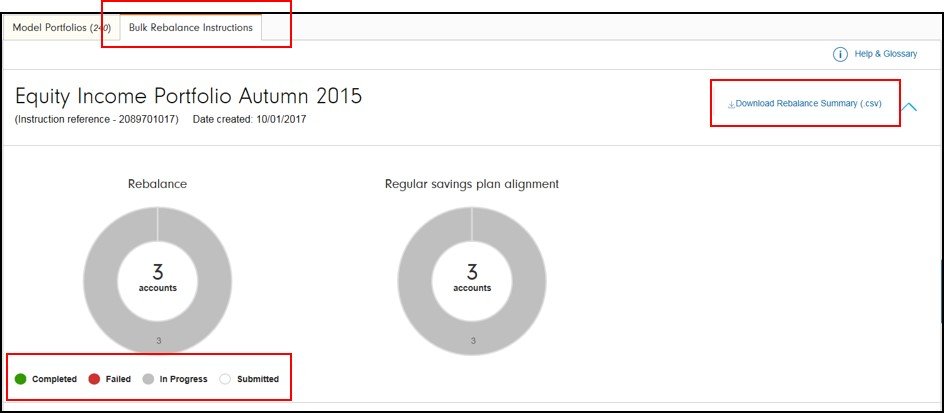

After a bulk rebalance instruction is submitted, this will go through an overnight run and will be placed at the next available trading point on the following day (i.e., a rebalance instruction submitted online on Monday will begin trading on Tuesday). We place all sell deals at the first available trading point for each asset; for most of these it will be day one but some funds on a different trading cycle may not be sold until day two. Deals may be aggregated and placed at different cut-off points depending on the funds included in the rebalance. All rebalance instructions require all sell deals to price before the buy deals can be placed (i.e., if all sell deals can be priced on day one then the buys will begin on day two. If some of the sell deals are not priced until day two then the buys will be day three). Therefore, any funds which price the day after the dealing cut-off will extend the processing time to up to five working days for these types of transactions.

You can obtain this information from several places:

- In our ‘Reporting Services’ area of the website. Use the ‘Portfolio & assigned clients’ report to see what model client accounts are assigned to and what version number of the model they are.

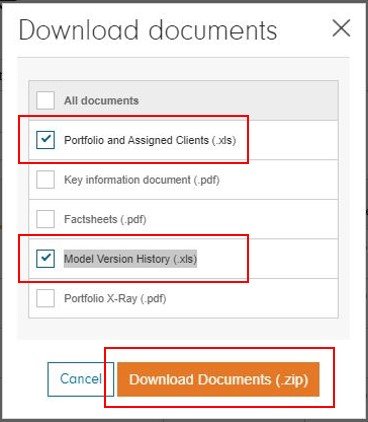

In the ‘Model Portfolio Centre’ select alongside the model then select ‘Download Documents’.

- ‘Portfolio & assigned clients’ report: this is a model level report showing what client accounts are assigned to the model and what version number they are on.

- ‘Model Version History’ report: shows the history of the model changes and gives a high-level number of any account linked to historic model versions.

Yes.

Yes, we provide online quarterly valuation statements to end clients and these support the Discretionary Fund Manager’s regulatory responsibility. Clients will receive one statement covering all their accounts that the DFM manages through each adviser relationship.

Please note: The DFM Statement Service is an optional facility allowing you to request that a separate statement is sent to clients using your models for their account(s) that are held with us. Please see our guide for additional details.

A daily report is posted to the website for you, and for the adviser(s) using your services, to view performance calculations on client accounts linked to your models. It is between you and the adviser who takes responsibility for notifying the underlying client of any 10% drops. We do not notify the end client.

We do not queue trades on the platform. All rebalances will be placed at the next available dealing point on all available units. Post submission tracking is available online via the secure website, confirming which client rebalances have been completed, failed or are still in progress.

The current list of reports available to Discretionary Fund Managers are:

Download documents (via the ‘Model Portfolio Centre’):

- Portfolio & Assigned Clients (.xls)

- Key information document (.pdf)

- Factsheets (.pdf)

- Model Version History (.xls)

- Portfolio X-Ray (.pdf)

Reporting Services (via the ‘Firm’ option within the left-hand side menu):

- DFM Performance Report (.xls)

- DFM Model Portfolio Assigned clients (.xls)

- DFM holdings

- DFM fee statement

- Business tracking

- Fund list (.xls)