Model portfolios and DFM services

With the increased use of model portfolios and Discretionary Fund Management (DFM) services, we are continually improving the services we provide to both advice and DFMs firms.

Here you’ll find out all you need to know about:

- How advice firms can set up and manage model portfolios and use defined models from DFMs.

- How DFMs can create, amend, publish and transact across their portfolios within our secure online portal.

We do not charge for this service, although the DFM may do so.

Our model portfolio service allows you to create bespoke portfolios of up to 50 funds or Exchange Traded Investments. The portfolios can be set up for your entire firm to use or can be tailored for individual adviser or client requirements. You can also use defined models from DFMs on ISAs, Investment Accounts and our Pension.

Skip to section

About our model portfolio service

Within our model portfolio service, you can:

- Use model portfolios with our Quote and Transact service for ISAs, Investment Accounts and our Pension.

- Link directly with DFMs to access and use their models.

- Invest straight into a model for new business or to realign existing clients.

- Use cash options within portfolios.

- Single or bulk rebalance clients’ accounts to align to DFM models.

- Align other account attributes, such as regular savings plans and regular withdrawal plans.

- Generate x-ray reports and download fund disclosure for DFM models.

- Produce a detailed set of reports, supporting control and audit functions.

What your chosen DFM can do with our service:

- Create and manage model portfolios.

- Publish models to chosen advisory firms.

- Rebalance client accounts in bulk and align other account attributes, such as regular savings plans and regular withdrawal plans.

- Modal portfolio and cash management: There are 3 options when running models on our platform — Download now

Creating and assigning models

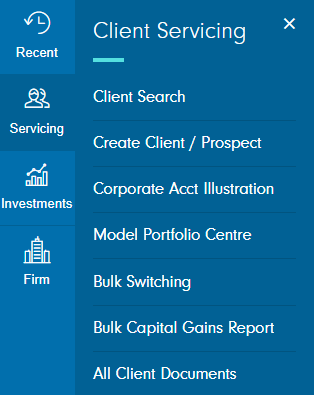

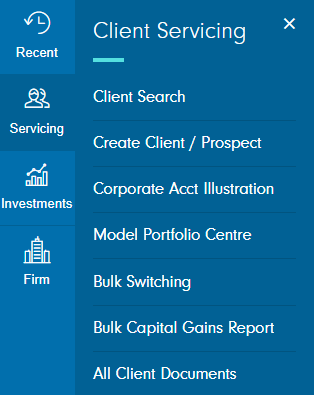

You can find step-by-step instructions on setting up and assigning models by selecting ‘Servicing’ and then 'Model Portfolio Centre' from the Navigation bar on the left-hand side of the Client Management home page.

A number of short instructional videos are also available on creating and managing model portfolios.

You'll need to ensure you have the correct access permissions set within ‘Manage users’ in order to set up or manage firm level portfolios. You may need to contact your Firm Administrator to arrange this.

Please note the model portfolio service cannot be used for pension clients aged under 18.

Model portfolios and rebalancing

We offer two options for rebalancing:

- Single rebalancing is available online via 'Quote and Transact' and this allows you to instruct a rebalance to a model on a client account. These instructions are submitted immediately to be processed.

- Bulk rebalancing is available from the left-hand navigation menu by selecting 'Model Portfolio Centre'. This allows you to select from a list of all client accounts on the same model and rebalance those accounts in one instruction. We process bulk rebalances overnight for submission the following day.

Please note: if you use our automated bulk switching or rebalancing service, deals may be aggregated and placed at different cut-off points. All switch and rebalance instructions require all sell deals to price before the buy deals can be placed. Therefore, any funds which price the day after the dealing cut off will extend the processing time to up to five working days for these types of transactions.

Example:

- Working day 1 - deal received

- Working day 2 - sell deals placed and priced for same-day priced funds

- Working day 3 - sells priced in funds which are priced after cut off

- Working day 4 - buy deals placed and priced for same-day priced funds

- Working day 5 - buy deals priced in funds which price after cut off

Frequently asked questions

For assigning a model portfolio, this is not required.

For a rebalancing, your client’s approval is required. Unless you hold the relevant discretionary portfolio management permissions, you will need approval for every client you rebalance. However, we do not need to see this.

You can assign existing model portfolios when creating a quote, deal on an existing account or open a new account by selecting ‘My Portfolios’ on the ‘Fund Details’ page.

However, you cannot create a new model as part of the quote process.

This is not possible when a model is linked to an account. If you want to do a quote for a client and search for funds during the process, you will first need to remove the model from the account.

We will sell on the first working day and buy on the second working day, unless the fund being sold prices the day after cut-off which could mean the buy takes place on the third working day. The completion date will depend on the settlement period of the asset being switched into.

Deals for a bulk rebalance will be placed for the next day’s dealing cut-off. Deals may be aggregated and placed at different cut-off points depending on the funds included in the rebalance. All rebalance instructions require all sell deals to price before the buy deals can be placed. Therefore, any funds which price the day after the dealing cut-off will extend the processing time to up to five working days for these types of transactions.

Bulk switches deals may be aggregated and placed at different cut-off points depending on the funds included in the bulk switch. All bulk switch instructions require the sell deals to price before the buy deals can be placed. Therefore, any funds which price the day after the dealing cut-off will extend the processing time to up to five working days for these types of transactions.

No, the model portfolio service is online only.

For pension accounts for persons aged under 18, the following services are not available:

- bank transfers

- model portfolios

- re-registrations

- employer contributions

- regular contributions into exchange-traded investments.