Account dealing

Here we explain different ways you can transact on behalf of your clients – whether it's investing a lump sum, opting for phased investments, creating a Regular Savings Plan or switching from one investment to another. You’ll also find information on using our model portfolio service here.

Application forms

Anti-money laundering (AML) procedures

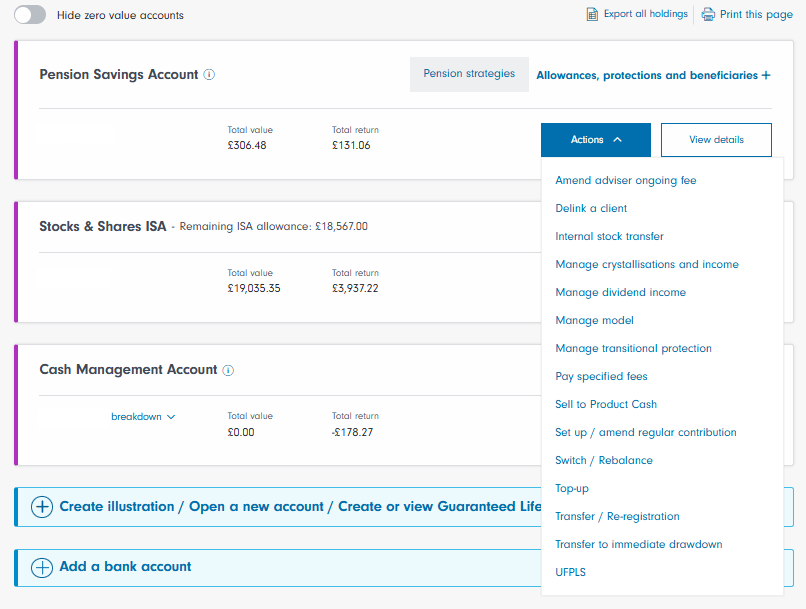

If you no longer wish to serve as an adviser for a particular client, you no longer need to call us and can delink them online via the “actions” menu next to their account.

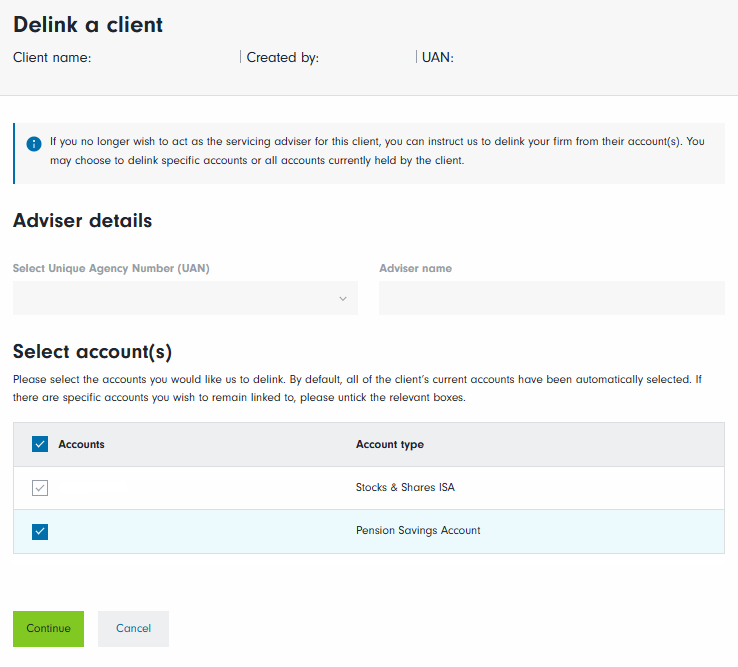

You can select all accounts the client holds or choose specific accounts. By default, all the client’s current accounts will automatically be selected.

If there are specific accounts you wish to remain linked to, please untick the relevant boxes. Once your instruction has been submitted online, you request will be actioned within 24 hours.

Frequently asked questions

If no other adviser firms are linked to the account(s), the client will be moved to Fidelity Personal Investing. The service fee charged will depend on the client’s total investment value.

Yes, we will send written confirmation to both you and the client.

All fees will be stopped, adviser fee payments accrued before the accounts are delinked will still be deducted and paid to your firm.

Yes, the client will retain their existing investments except for any investments in the Standard Life Smoothed Return Pension Fund, which will be sold.

Adviser initial fees from a client’s regular savings plan(s) will be stopped, although the regular savings plans themselves will continue to collect unless instructed otherwise by the client.

Regular tax-free cash payments will stop immediately, and we will send written confirmation of this to the client.

Regular taxable income payments will continue until the pension drawdown account no longer has sufficient funds to make a regular payment.